Shorter-term fixed-rate mortgages are increasingly popular among Canadian homeowners and house hunters seeking the certainty of a steady rate but looking for more flexibility in their financing, experts say.

With the Bank of Canada seemingly getting close to the peak of its interest rate tightening cycle, mortgage professionals who spoke to Global News said the urge to time the market and try to lock in a lower rate on the way down can be a tempting but risky endeavour.

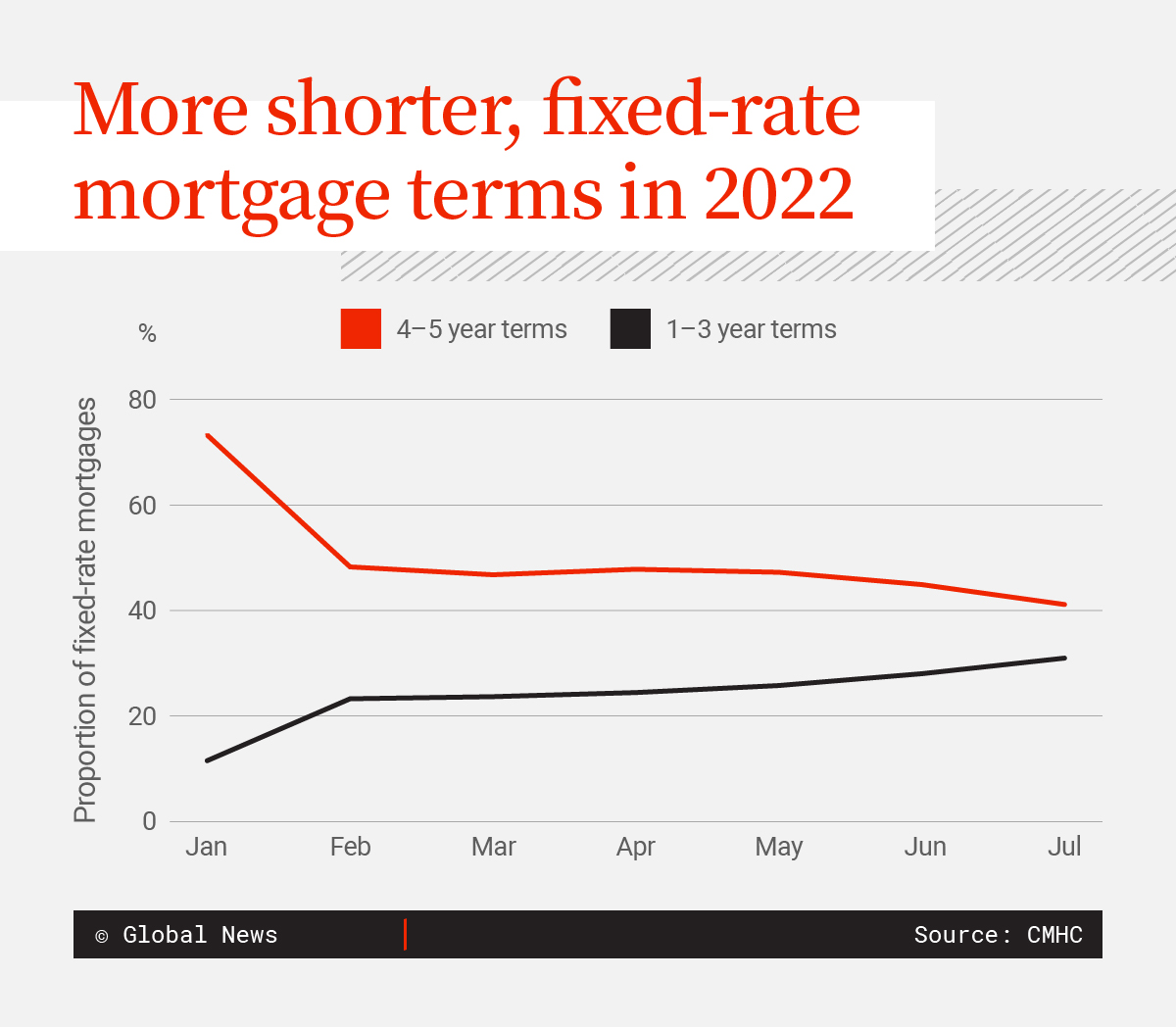

Canada Mortgage and Housing Corp. (CMHC) said in its fall residential real estate report this past week that the proportion of fixed-rate mortgage holders opting for terms shorter than the standard five years has been growing through 2022.

In January, roughly 73 per cent of all fixed-rate mortgages initiated or refinanced in Canada went with terms of four or five years, while only 11 per cent had terms shorter than that.

Since then, the popularity of shorter-term fixed-rate mortgages has grown steadily, it said.

The latest CMHC data available for July shows 28 per cent of fixed mortgages had terms of one to three years, while 45 per cent opted for four to five years.

Shubha Dasgupta, CEO of Toronto-based mortgage brokerage Pineapple, says clients have been inquiring more often about the possibility of a shorter-term mortgage product.

With many economists forecasting the peak of interest rates could be near, Dasgupta says some homeowners are hoping to catch an eventual drop in borrowing costs.

“We’re seeing more Canadians looking to the future of what the interest rate landscape could be and trying to find a timing … when interest rates could possibly come down in the years ahead,” he says.

Get weekly money news

James Laird, co-CEO of comparator site Ratehub.ca, says there is historical precedent that a slowing economy will be met by lower rates, and locking in today for two years, as an example, would potentially let a homeowner renew at a lower rate when their term is up.

But that being said, trusting history or even expert advice can set some mortgage holders up for disappointment when looking out on a multi-year horizon, he notes.

“We can try to predict where rates are going, but nobody knows,” Laird says.

Flexibility as big a consideration as lower rates

Normally, shorter-term mortgages offer better rates than the traditional five-year model, Laird and Dasgupta note.

Fears of a looming recession are among today’s factors putting rates for the shorter-term products either on par or even slightly above their five-year counterparts, they say.

Dasgupta says this can set you up for a miscalculation: if you lock in a short-term mortgage at a higher fixed rate and then end up renewing into an even higher-rate environment in one, two or three years, all you’ve done is pay more with more uncertainty.

“Timing the market is near impossible and has more to do with luck than planning,” he says.

The stability of the five-year fixed-rate mortgage is the key factor to its popularity throughout most of Canadian housing history, both mortgage professionals tell Global News.

“Canadians, generally speaking, like the stability of knowing exactly what their monthly mortgage payment will be every month for the next five years. It allows them to budget precisely and they can forget about their mortgage for a period of time,” Laird says.

Variable-rate mortgages, which automatically see rates rise and fall with the Bank of Canada’s policy decisions, briefly overtook fixed-rate products in the second half of 2021 as homebuyers and refinancers took advantage of the option’s cheaper rates.

Variable rates and shorter-term mortgages share similar benefits as they provide more flexibility to homeowners than the long-term fixed products, Dasgupta says.

For homeowners who might be nearing a major life change that warrants a major renovation or relocation — a marriage, new kid or retirement and downsizing — he says these products can allow a change in mortgage product without necessarily bumping up against the costly penalties to get out of a longer-term fixed-rate product.

Variable-rate mortgages, meanwhile, are typically the most flexible products that come with the least costly penalties to break.

Laird says that even though the spread has narrowed between variable and fixed rates, there’s still a compelling reason to go with a variable product today for mortgage holders comfortable with the high upfront rate.

“The penalty to break a variable is lower, and if rate decreases do occur, a variable automatically adjusts your rate downwards,” he says. “That’s still a common strategy. People are still considering the variable rate even in today’s inflated rate situation.”

Despite the popularity of more flexible models, Dasgupta says not to expect five-year fixed-rate products to lose their status as the go-to mortgage for Canadians. The combination of “stability” and “general good market rates” on the five-year fixed rate gives the option an enduring popularity in the hearts of homeowners, he argues.

“When it comes to mitigating risk versus reward, you get a lot of bang for your buck out of a five-year fixed.”

Comments

Want to discuss? Please read our Commenting Policy first.