Rising interest rates gave a boost to RBC’s earnings in the third quarter, but the benefits were outweighed by a significant pullback in capital markets and the deteriorating economic outlook that higher borrowing costs have also triggered.

The bank, Canada’s largest, reported a net income of $3.6 billion for the quarter ended July 31, down from a profit of $4.3 billion in the same quarter last year, as it booked provisions for potential loan losses ahead and took a hit on a loan underwriting markdown because of market conditions.

“Our market-sensitive businesses reported a challenging set of results, against the backdrop of one of the toughest environments for financial markets,” said chief executive Dave McKay on an earnings call Wednesday.

“This was underpinned by increased uncertainty, heightened volatility, lower asset valuations and widening credit spreads impacting client sentiment and activity.”

McKay pointed to the now familiar challenges of inflation, supply chain constraints, geopolitical tension, tight labour markets. He added that droughts related to climate change are becoming an additional constraint.

RBC also said during its earnings call that about 80,000 of its variable-rate mortgage customers will reach a “trigger point” where their mortgage payments will rise to the point where it is no longer covering any principal in the “next couple of” Bank of Canada rate hikes.

The bank’s earnings were affected by provisions for credit losses totalling $340 million for the quarter compared with a release of provisions for credit losses of $540 million in the same quarter last year.

McKay said the provisions were prudent given the weaker macroeconomic forecast, including the likelihood of a recession across North America, while rising central bank rates push the economy even closer towards the end of a cycle.

Earnings also took a hit from its capital markets division, where net income of $479 million was down 58 per cent from a year ago as it took a $385 million loan underwriting markdown caused by market conditions, while the provisions and lower debt, equity and loan activity also weighed.

Personal and commercial banking saw earnings dip $90 million, or four per cent, to $2 billion, on loan provisions, while the division saw a 14 per cent jump in net interest income as it recorded 10 per cent loan growth, including double-digit mortgage loan growth. Credit card spending was 30 per cent above pre-pandemic levels.

McKay said that while mortgage growth was strong he doesn’t expect it to last as interest rates hit the housing market.

“We expect mortgage growth to slow over the coming quarters given the decline in housing activity and prices, and a return to a more balanced sales-to-listing ratio.”

He said that given the economic challenges there will likely be fewer people qualifying for loans ahead as the bank stays disciplined with its risk appetite.

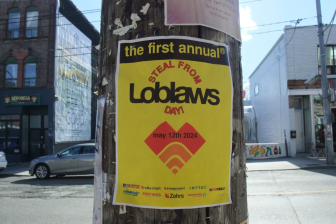

- Posters promoting ‘Steal From Loblaws Day’ are circulating. How did we get here?

- Canadian food banks are on the brink: ‘This is not a sustainable situation’

- Video shows Ontario police sharing Trudeau’s location with protester, investigation launched

- Solar eclipse eye damage: More than 160 cases reported in Ontario, Quebec

“You can expect that with inflation, with challenges to consumers, with potential job loss coming at us, that more and more customers will fall out of that risk appetite.”

Chief risk officer Graeme Hepworth said rising rates and declining home prices is increasing the risks of the bank’s mortgage portfolio, but that the most leveraged borrowers, who originated mortgages in the heady housing market of the pandemic don’t renew until 2025 or beyond.

“This puts our clients in a strong position to deal with rising rates and declining home prices … clients will also have time to adjust behaviour and benefit from wage and income inflation to moderate the impact of higher payments.”

He said the bank has also seen credit card delinquency rates start to increase towards pre-pandemic levels, but the bank noted that deposit rates were still 30 per cent higher than pre-pandemic levels.

While risks have increased from rising rates, RBC has also seen benefits to its interest income. The bank reported an overall 17 per cent increase in net interest income to $5.9 billion, while its net interest margin was up 12 basis points from the previous year.

Overall, the bank reported total revenue of $12.1 billion, from $12.8 billion a year ago. On an adjusted basis, RBC said it earned $2.55 per diluted share for the quarter compared with an adjusted profit of $3.00 per diluted share a year earlier.

Analysts on average had expected an adjusted profit of $2.66 per share, according to financial markets data firm Refinitiv.

National Bank analyst Gabriel Dechaine said in a note that capital markets fell more than expected, with trading revenue of $480 million below his $790 million estimate, largely because of the loan writedown.

He said that while the losses from the underwriting book were disappointment, the bank’s gains on net interest margins, with similar gains of 10 to 15 basis points of net interest margins gains over the next couple of quarters, was encouraging.

“While capital markets’ weakness could be viewed as transitory, 1/8RBC’s 3/8 surprisingly strong NIM expansion should yield more sustainable benefits.”

With files from Global News

Comments