For new mom Sandy Yong, bills and expenses have been piling up as quickly as dirty diapers in recent months.

Yong’s maternity leave stipend, which gives her roughly 70 per cent of what she’d make in her day job, has been stretched even further lately as her Toronto household grapples with the new daily expenses for her 11-month-old son and high one-time costs like a crib and stroller.

But Canada’s decades-high inflation levels — hitting 6.7 per cent in April — are a dominant factor pushing Yong and her family to re-imagine their budget in search of new ways to save.

“Our family definitely has been feeling the pinch with inflation and the rising costs of gas and groceries,” she says.

“I have been trying to stretch my dollar even more for the last couple months of my mat leave.”

With one month left before she returns to work but surging prices already pushing down the bottom line, Yong tells Global News she’s been changing her approach to feeding her growing family and saving for the future to keep costs manageable in the short and long term.

Canadians cutting back on dining out, entertainment — even medication

Yong is not alone in struggling to make ends meet and looking for workarounds to beat inflation, according to polling from Ipsos conducted exclusively for Global News.

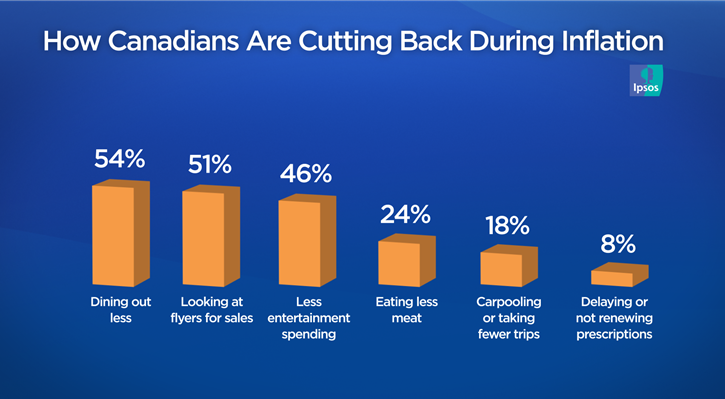

Asked about their strategies for fighting inflation in a mid-April poll, some 54 per cent of respondents said they were dining out less. Other common tactics included putting off new purchases like clothes (47 per cent) and cutting back on entertainment spending (46 per cent).

Other changes affect how Canadians get around, with some 18 per cent saying they were carpooling more or taking fewer trips as gas prices hit all-time records.

Others are in the grocery aisle: one in four (26 per cent) respondents said they were switching to a grocery store they think is cheaper, while 24 per cent said they were eating less meat and 22 per cent said they’re buying fewer fresh fruits and vegetables.

More than half of Canadians said they were looking for sales in flyers while 31 per cent said they’re looking to use coupons or sales apps to save more on consumer staples.

Yong’s trips to the grocery store have her trying to reduce costs in the baby aisle. For instance, she says she has increasingly been offsetting the costs of premium diapers with discount brands.

Get weekly money news

“One of the ways we’ve been able to be more cost-effective was to buy store-brand or generic-brand diapers and formulas, which saves us almost half of what the name brands would be,” she says.

Parents like Yong are also increasingly finding they have to play bad cop as costs rise. Nearly one in three parents surveyed said they’ve been saying “no” to their children more often.

Roughly 17 per cent of parents are cutting back on their kids’ organized sports.

Rising costs and limited budgets are pushing some Canadians to take more drastic actions, however.

Eight per cent of those surveyed said they deleted or did not renew a medical prescription in order to offset inflation — that figure rose to 14 per cent among those aged 18 to 34. Twelve per cent of parents said they’ve done this as well.

One in eight respondents said they’ve dipped into money they were saving for retirement to cover costs.

‘Spring cleaning’ your budget

Myron Genyk, CEO of Evermore Capital, says now is a good time for people to do a bit of “spring cleaning” in their finances to find ways to trim expenses.

Taking a look at credit card statements can show recurring charges that might not be worth the monthly fees, such as a streaming subscription that is no longer being watched. Cutting out these passive charges can be easier sources to find savings than overhauling one’s lifestyle and cutting out habits such as fast food, Genyk says.

In his household, he says apps his kids signed up for that might have recurring payments tied to them are budget drains that can quickly be nipped in the bud.

“I think you’d be surprised how much stuff is on your credit card statement that you don’t need to be spending money on anymore,” he says. “Even if you’re saving ten bucks a month or 20 bucks a month there, that can add up.”

In addition to her day job, Yong works as a personal finance author offering tips to save and grow money during tight times. She’s applied some of those lessons to her own situation.

One of the solutions she’s found is Facebook Marketplace, both as a source for gently used items her baby needs but also as a channel to get rid of the household items her family no longer needs and earn a bit of income on the side.

With the inevitable impact of inflation, Yong and her husband have had to raise their weekly grocery budget from $115 to $130.

But they’ve changed up their approach in a few ways to help them plan their purchases ahead of time.

One of those approaches has been to grocery shop online, which gives Yong a view of the final cart price before hitting the checkout.

“That way we can plan out nutritious and healthy meals for the week, as well as staying on budget,” she says.

She also likes to use rewards points. Though it ties the household to a few name-brand grocery stores, she’s been able to stretch the value of those points by watching for events that let shoppers cash out more rewards at a time and save money.

Where to put your money during inflation

While it’s not as easy to put away money with the cost of living on the rise, there are strategies to help people save or invest their cash in the current inflationary period.

Genyk says it’s a great time to ask for a raise at work to boost the size of your paycheck. Most employers will be anticipating these kinds of requests with inflation running hot.

Holding money in cash or Guaranteed Investment Certificates (GICs) might be the right choice for those who need their money in the next 12 months or so, but Genyk says these holdings are not likely to keep pace with rampant inflation.

He says it’s as good a time as any to get whatever money one has on the sidelines into the market.

Though the market has been down for much of 2022, those with a long-term investing horizon are likely to see gains when the current inflationary period and rising interest rate environment pass.

And while interest rates are indeed on the rise, Genyk says those renewing their mortgage today might consider a longer amortization period to offset the short-term impact of inflation. While they might end up owing more on their mortgage by extending the life of the loan, it might be worth it to offset the temporary inflationary pressures on their monthly budget.

“Should you be thinking short-term or long-term, that has to do with your goals,” Genyk says. “Everybody has different goals. Some people are saving for a down payment, some for their children’s tuition, some are saving for retirement or all of the above.”

For Yong, her family’s savings goals are geared towards reducing the impact of inflation in the long term.

She and her husband have a separate savings account to put money aside to buy an electric vehicle — a move that could mitigate the impact of future fluctuations in the price of gasoline on their household budget.

“That way, in the future, we don’t have to rely on pumping gas,” she says.

— with files from Global News’ Anne Gaviola

Included in this story are some of the findings of an Ipsos poll conducted between April 14 to 19, 2022, on behalf of Global News. For this survey, a sample of 1,001 Canadians aged 18-plus were interviewed. Quotas and weighting were employed to ensure that the sample’s composition reflects that of the Canadian population according to census parameters.

The precision of Ipsos online polls is measured using a credibility interval. In this case, the poll is accurate to within ± 3.5 percentage points, 19 times out of 20, had all Canadians aged 18+ been polled. The credibility interval will be wider among subsets of the population. All sample surveys and polls may be subject to other sources of error, including, but not limited to coverage error, and measurement error.

Comments

Want to discuss? Please read our Commenting Policy first.