With stocks taking a beating amid surging inflation rates and ongoing uncertainty tied to the war in Ukraine, market watchers say there are a few ways to prep your portfolio to withstand the current downturn.

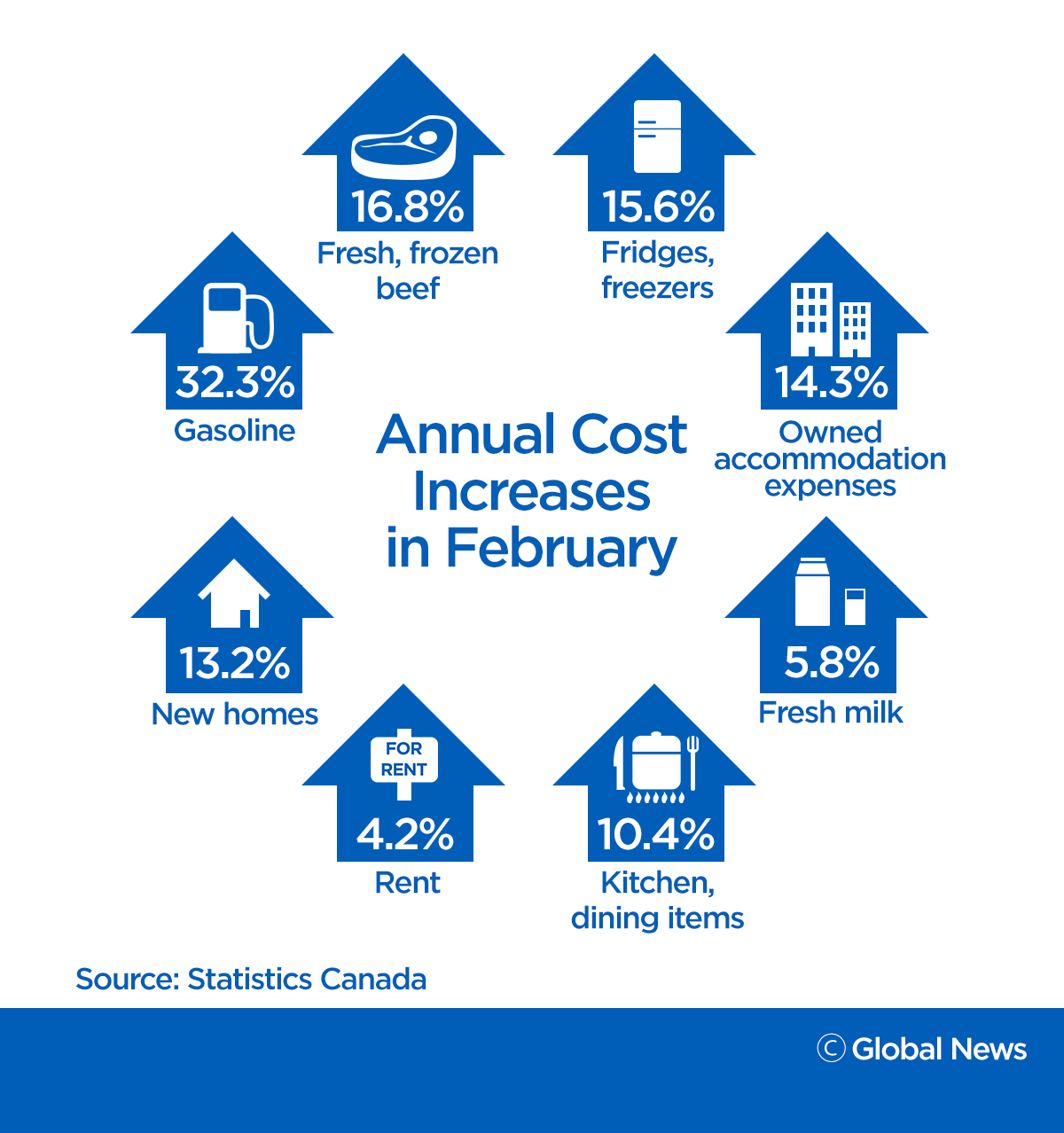

The latest inflation numbers show prices accelerating across the board in Canada at rates not seen in more than 30 years. Economists say February’s headline inflation rate of 5.7 per cent is not the ceiling, citing the ongoing war in Ukraine as putting major pressure on goods of all kinds.

Russia’s invasion of Ukraine is about to enter its fourth week. Sanctions against Russia, supply chain disruptions and uncertainty surrounding the catastrophic conflict in eastern Europe — and the possibility it spreads beyond Ukraine’s borders — have sent global stock markets tumbling, worsening an already brutal start to 2022 for investors.

The S&P 500 is down more than 500 points, or 10 per cent, so far in 2022. The Dow Jones Industrial Average is also down more than eight per cent year-to-date.

Senior investment advisor Allan Small, who runs his own financial group under the iAP Private Wealth banner, says he’s gotten a flurry of questions from his clients since the attacks in Ukraine began.

He tells Global News the humanitarian concerns of Russia’s aggression are paramount, but says the financial ripple effects have become impossible to ignore.

“There’s a lot of uncertainty, a lot of scared individual investors out there,” he says. “I think everyone’s wondering, you know, how low these markets can go?”

Some companies can withstand inflation impacts

Surging inflation levels in Canada, the United States and beyond are raising costs not only for individual consumers, but for the companies underpinning global stock markets.

Inflation raises the bottom-line concerns for these companies, Small explains, making the cost of business more expensive and hurting their growth prospects in the long run.

“The demand for products and services, the top line growth, is doing very well. Unfortunately, it’s the expense side of things that is increasing,” he says.

Get weekly money news

Not all companies are primed to suffer as a result of high inflation.

Tu Nguyen, economist with RSM Canada, notes that Canada has a number of commodity producers that make the same exports that commonly flow out of Russia and Ukraine, such as grains and oil.

This makeup of Canada’s economy puts it in a “unique position” globally, she says, and could help the country stave off threats of recession should the war persist.

The S&P/TSX Composite Index has largely rebounded from late February dips tied to Russia’s invasion, while other major North American indices continue to show losses.

“We know that the Toronto Stock Exchange is doing better than just about any other market in the world right now,” Nguyen tells Global News.

“So if it’s a consolation prize is something that we can take comfort in, then maybe we take that as a sign that the Canadian economy might prove quite resilient in this case.”

‘Physical things’ the place to be?

Surging inflation around the globe has also spurred the world’s richest man to weigh in on Twitter.

Tesla and SpaceX founder Elon Musk tweeted on Monday that he recommends investors buy “physical things” such as homes or “companies you think make good products” when inflation is high.

Asked about Musk’s musings, Small didn’t disagree that conventional wisdom has sometimes seen investors hedge their money in commodities such as gold when inflation is soaring.

“When you feel as though the U.S. dollar may not be worth the paper it’s written on, you look for things such as gold,” he says.

But Small also said the tumbling stock market does not change the value proposition behind companies with solid fundamentals — it might even make them smarter bets.

He says there’s an opportunity during any downturn to “upgrade” your portfolio and increase exposure to companies with discounted stocks.

Small differentiates “A name” companies — top-line firms that usually have shares priced at a premium — from B and C names, or those companies that have strong value but don’t deliver as quality returns.

The current downturn could see opportunities to sell off B and C names and go for the As, he argues.

Small also notes that having “pricing power” — the ability to pass on inflationary impacts to the end buyer — increases a company’s ability to withstand the current high-cost environment. He cites Google and Amazon, as well as retailers such as dollar stores, as a few such companies.

“We’re looking at companies that have pricing power, companies that are showing good top line growth, as well as bottom line growth — companies that are controlling their expenses. And these are the names that I think will do well going forward,” Small says.

Though he says high-growth prospects like tech stocks shouldn’t be discarded just because they’re currently in a downturn, he also says the balanced approach remains king in the stock market.

“Having a diverse portfolio will insulate an investor on the downside,” he says.

“I’m still looking towards … owning shares of good quality companies versus owning physical assets. To me, these companies are the future, and that’s not going to change whether inflation is five per cent, four per cent or three and a half per cent.”

Small is confident the war in Ukraine and inflation will both eventually settle, and like other world crises before them, the stock markets will rebound and possibly surpass their previous highs after the fact.

Joining the sell-off or taking other drastic actions to overcompensate will take investors out before markets have a chance to bounce back from the current economic crisis, he argues.

— with files from Global’s Anne Gaviola

Comments

Want to discuss? Please read our Commenting Policy first.