Residents of Highway 8 near Spences Bridge have been displaced since the Nicola River flood on Nov. 15.

The devastated area had no cell or internet service for almost five weeks — but when Steven Rice got his Telus bill recently, he was charged for that period.

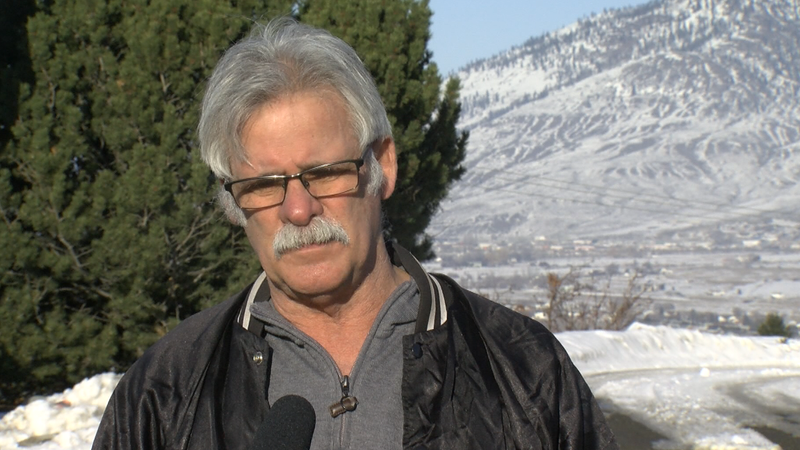

“Just imagine, you open a bill and you’re scheduled for disconnection for something that they can’t disconnect anyways — they might as well because you haven’t had it — but they also want you to pay them some money. If that doesn’t go from anxiety to anger, I don’t know what does,” said Rice, a Highway 8 resident.

Rice is one of many being charged for service. He says during that time, no one in Spences Bridge or its surrounding areas could get any reception unless they drove 18 kilometres out of town.

But many evacuees didn’t have a car, so they couldn’t check their emails or see any bills coming in.

Rice says with three phone lines and two internet lines, his credit score has already been impacted.

“One of the most important tools in your financial toolbox is your credit score — and if that’s damaged it not only doesn’t do you any good, it does you harm,” Rice says.

In an email, Telus says they are currently investigating the situation.

Get daily National news

But it’s not the only bill that keeps coming in for residents of Highway 8.

BC Hydro also sent out bills to properties that had no power.

The corporation says it has a bill block for long-term evacuees which stops them from receiving a bill. However, it came to their attention last week that they had missed a few customers.

“They’re not expected to pay these bills,” BC Hydro Community Relations personnel Mary Ann Coules says. “For folks that have their payments come out of their account automatically, if they’ve missed this and now seen that there’s been a charge from BC Hydro, we will reimburse them for those funds as well as for any charges that they may have incurred.”

However, Rice is still waiting for a solution from Telus. Until then, he worries about other evacuees who might be caught off guard when they’re trying to get back on their feet.

“They’re going to be surprised with their credit score,” he says.

“They may not be able to buy that couch or get that rental or even certainly not buy a house, so I would really urge them to check their credit scores.”

Comments

Want to discuss? Please read our Commenting Policy first.