It will take “years” of work to tackle the challenges making Canada’s housing market so unaffordable, Finance Minister Chrystia Freeland warned on Tuesday.

That’s the latest from the government’s fiscal update, which provides a peek into the country’s finances and looks ahead to the coming months.

“In addition to rising inflationary pressures, strong housing demand throughout the pandemic combined with limited supply has led to significantly higher house prices across the country,” the update explained.

While those prices are expected to normalize “some” when the pandemic subsides, many of the “acute” challenges that are driving up housing prices will take time to address, it added.

“It will take years of strong supply growth to address the acute affordability challenges Canadians are facing in some regions of the country,” according to the update.

Canada has seen a record spike in home price appreciation during the COVID-19 pandemic, with national average home prices up 18 per cent in October compared with the same month in 2020, according to Canada Real Estate Association (CREA) data.

In Vancouver, benchmark home prices recorded a one per cent increase in November compared with October, according to the Real Estate Board of Greater Vancouver. In Toronto, its real estate board found average home prices climbed 2.5 per cent higher in November, reaching $1,163,323, an almost 22 per cent jump from $955,889 in November 2020.

Mostafa Askari, chief economist with the Institute of Fiscal Studies and Democracy at the University of Ottawa, acknowledged housing affordability is a “major challenge.”

“I’m not sure if there is an easy solution for this,” he said.

The government said it’s working with the provinces, territories and municipalities to “unlock and create” more housing supply.

“The government has invested over $70 billion through the National Housing Strategy that will support the construction of up to 125,000 affordable homes and increase Canada’s housing supply,” the fiscal update said.

“Addressing the issues of housing affordability is a priority for the government.”

Askari explained that any steps the government takes to tackle this problem won’t have “an immediate impact,” but the focus on boosting Canada’s affordable housing stock is a good one.

“Supply is the only part of this that they can do something about,” Askari said of the federal government.

To fix this, the government could provide more funding to build affordable housing, and make it easier for the private sector to “access crown lands” that they can use to build more affordable housing, Askari said.

“But I’m not suggesting that any of them is actually an easy thing to do,” Askari added.

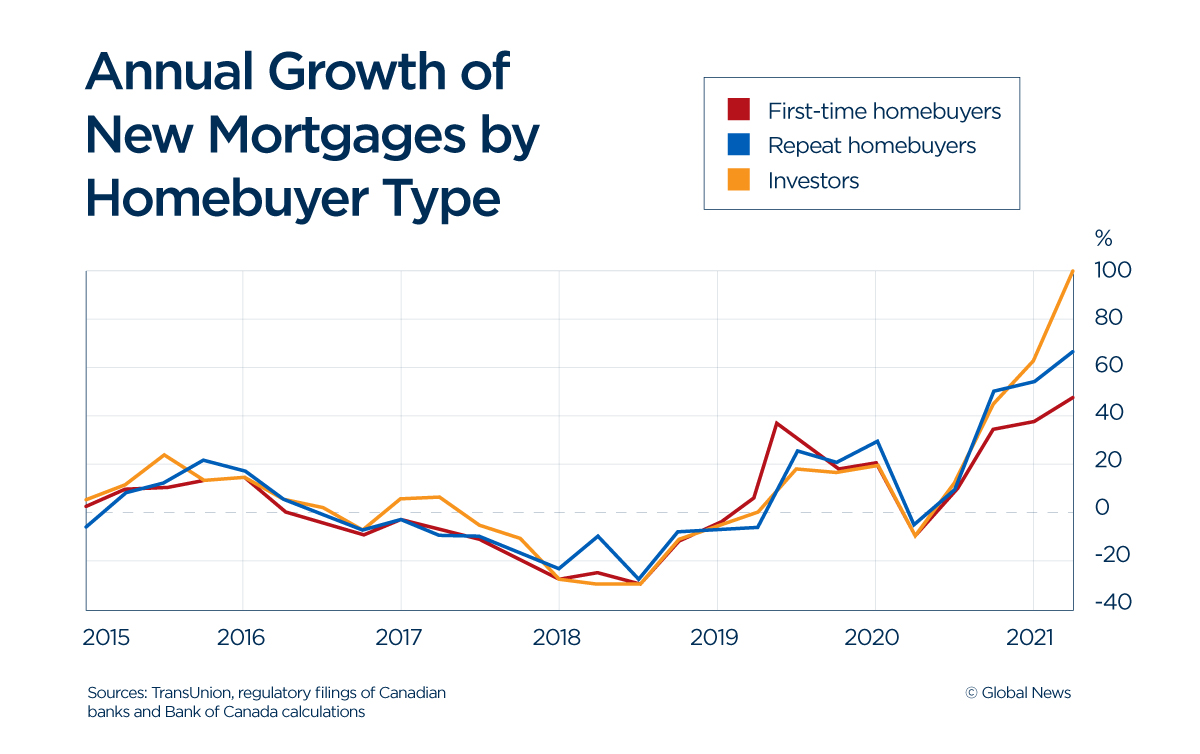

On top of the supply issues, there’s another problem that’s chewing up the stock of available, affordable housing: investors.

In Ontario, homeowners who already have one or more homes made up 25 per cent of property title changes between January and August of 2021, according to a recent analysis by Teranet.

That’s up from around 16 per cent in 2011.

The fiscal update nodded at a previously announced measure from Budget 2021 that hopes to curb this phenomenon – at least for non-resident homebuyers.

“Budget 2021 announced the government’s intention to implement a national, annual 1-per-cent tax on the value of non-resident, non-Canadian owned residential real estate in Canada that is considered to be vacant or underused,” the fiscal update said.

This Underused Housing Tax is supposed to be in effect for the 2022 calendar year, it added, and is projected to rake in about $200 million in tax revenues during the 2022-23 fiscal year.

Askari was skeptical about whether this will have any substantive impact on the housing market.

“People have been talking about taxing the foreign owners … I’m not sure those things actually are going to help in any significant way,” he said.

It’s possible the tax could have a small impact on the price of “expensive homes” in places like Toronto or Vancouver, Askari added, but overall, it won’t address the key issue: supply.

“I can’t see that reducing the access of foreign investors to the Canadian real estate market is going to actually help increase our supply of housing,” he said.

Overall, Askari said the fiscal update doesn’t do much beyond signalling the federal government “wants to tackle” the housing issue.

Conservative Leader Erin O’Toole was also unimpressed by the government’s housing commitments.

“Conservatives, Mr. Speaker, believe in a Canada where everyone has the chance to work hard, everyone has the chance to own a home,” O’Toole said, speaking in the House of Commons on Tuesday.

“But half of Canadians under 30 are giving up on owning a home. That is a failure of leadership of epic proportions…Do we really want to be the country, Mr. Speaker, where young people, a generation of them, are giving up on the idea of owning a home?”

Just over 10 per cent of Ontarians aged 18-34 own their homes, according to data published on the RE/MAX website in November, which cited Statistics Canada. That’s compared to 40 per cent of those between ages 35 and 54, and just shy of 48 per cent of those aged 55 and older.

Canadians looking for more details on what will be done to pour some water on the scorching hot housing market might have to wait until the spring, according to the fiscal update.

“We know housing prices are a real concern, especially for those in the middle class looking to buy their first home,” it said.

“Addressing housing affordability remains a priority for our government. Our work is ongoing. We will take further action in the upcoming budget.”

– with files from Global News’ Erica Alini

Comments