A $1.6 billion draft budget, including a 9.3 per cent combined hike in taxes and fees, is under the microscope at Vancouver City Hall this week.

Councillors are hearing from city staff and the public ahead of a planned vote on the document next week.

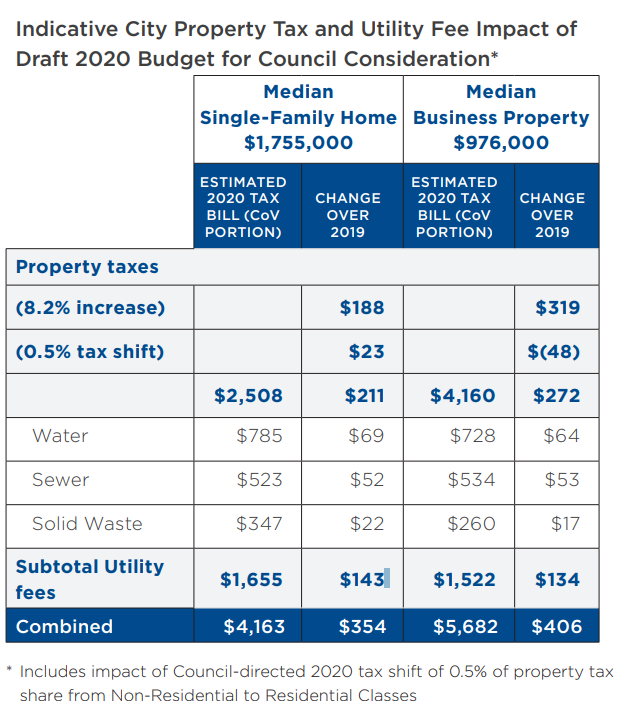

The 9.3 per cent figure is a combination of an 8.2 per cent property tax hike and a 9.5 per cent utility fee hike. It also includes a 0.5 per cent tax shift from business to residential properties.

Vancouver’s chief financial officer Patrice Impey said Vancouver’s tax rate, expressed as a percentage, is actually lower than the city’s neighbours but acknowledged the total bill is, in fact, higher than most.

“When we look together at a medium single family home, utilities and taxes, Vancouver still sits slightly below the average for all of Metro Vancouver,” Impey told council Tuesday.

“When we compare the total tax bill, you’ll see that the City of Vancouver is the second highest in Metro Vancouver, and that’s largely because those provincial taxes come to us based on assessed value, and Vancouver has one of the highest assessed values overall.”

According to the city, the hike would mean a $211 tax hike for the median detached home, and a $143 increase in utility fees.

Get weekly money news

For the median condo unit, the tax hike would be about $89.

The new funds are meant to cover increased costs for existing services, as well as hiring 25 new police officers and 30 new firefighters.

Vancouver police Chief Adam Palmer said those officers are needed, as the force has seen a net reduction in recent years due to budget reductions.

He said the new officers will be tasked to the Downtown Eastside, as well as investigative and child exploitation units.

Robert Weeks, president of the Vancouver firefighters’ union, said firefighters are struggling under surging call volume, many related to overdoses.

“What I can tell you is our call volume has gone from 23,000 in 1986 to 60,000 now, and growing,” said Weeks.

But services aren’t the only part of the budget set to climb.

An estimated $23.8 million has been earmarked for new council priorities including social housing and Vancouver’s declaration of a climate emergency.

In July, city staff warned councillors that property taxes could climb as high as 10 per cent to fund the new priorities.

Now, in December, the prospect of a hike nearly that high has divided councillors.

“The proposed property tax increase of 8.2 per cent by the City of Vancouver is OUTRAGEOUS. It is the largest in a decade and must be reduced,” wrote the Non-Partisan Association’s (NPA) Rebecca Bligh, who said the new council has simply layered its priorities on top of the work of the previous government.

“I’ve been a renter for over 20 years in our city and have raised two children. I’m concerned about how the property tax rate increase will impact homeowners and renters. It’s critical that we keep the property tax rate below five per cent.”

COPE Coun. Jean Swanson, however, took to social media to imply property taxes in the city may, in fact, be too low.

“We have climate, housing and opioid emergencies that need funding,” wrote Swanson.

“Tackling climate change will cost money,” added One City Coun. Christine Boyle. “Not tackling climate change will cost way more.”

READ MORE: Vancouver council approves 2% tax shift from businesses to homeowners

Retired City of Vancouver employee Bernie Burnett was one of dozens of people who came to speak to council about the draft budget.

“Prior to Vision coming in in 1999, the city’s mandate was not to provide housing, nor transportation,” she said.

“I’m not sure why affordable housing has suddenly become such a priority for the City of Vancouver when in fact it is the provincial government’s responsibility and I have in fact paid a surtax for them to build housing,” she added, saying housing should be approved but built on the province’s dime.

Council is expected to continue hearing from speakers Tuesday and Wednesday.

Comments

Want to discuss? Please read our Commenting Policy first.