Shares in Enbridge Inc. were down Monday morning after the Canada Energy Regulator ordered it to suspend an open season it was holding for service on its Canadian Mainline oil pipeline system.

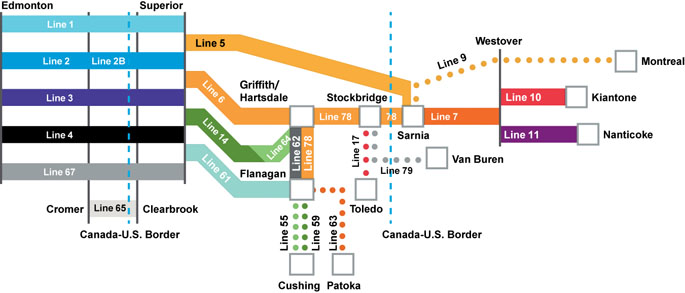

Enbridge says the CER decision Friday after markets closed changes the timing, but it still intends to proceed with signing firm contracts with shippers on the system that moves about 70 per cent of Canada’s crude exports into the United States.

The pipeline system’s current operating model, which makes space open to all bidders on a monthly basis, expires in June 2021.

Watch below: Some Global News videos about pipelines.

The regulator says it shut down the open season after reviewing submissions from more than 30 parties, including complaints from producers Canadian Natural Resources Ltd., Suncor Energy Inc. and Shell Canada Ltd. that the process was unfair.

Get weekly money news

READ MORE: Enbridge says oil producer complaints won’t alter Mainline pipeline open season plan

Analysts rate the CER decision as slightly negative for Enbridge because it means the Calgary-based company must now apply to the CER to approve the tolls, terms and conditions of the proposed service change before another open season can proceed.

In a report, analysts at Tudor Pickering Holt & Co. say that could mean it will have to settle for lower tolls than it expected.

“Friday’s decision by the CER is a departure from the decades of precedent and commercial practice in our industry,” Guy Jarvis, executive vice-president of liquids pipelines for Enbridge, said in a statement published Sunday.

“Although the CER decision results in a change to the process of securing commercial support through an open season in advance of the regulatory application, it does not change our plans to respond to the desires of our customers for priority access to Mainline capacity, toll certainty and access to the best markets that contract carriage offers.”

Enbridge shares were down $1.28 at $46.50 in early afternoon trading on the Toronto Stock Exchange.

Comments

Want to discuss? Please read our Commenting Policy first.