While Canadians are finally seeing a decline in the high prices they pay for using their mobile devices, the cost of the devices themselves is shooting through the roof.

That’s the picture painted by Statistics Canada’s latest inflation bulletin, which reported two significant price swings in the telecom sector.

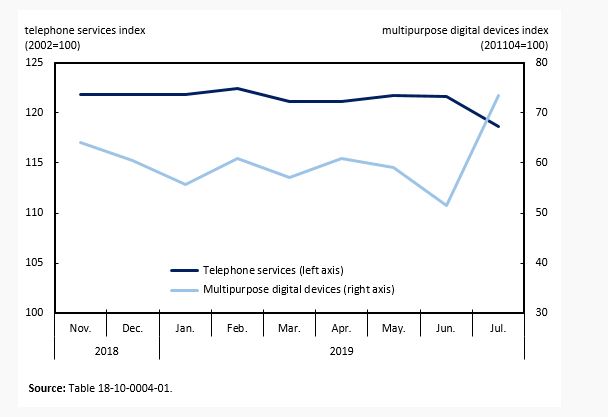

While the cost of phone services dipped by 2.5 per cent in July compared to June, the cost of digital devices like smartphones rose by 42.5 per cent, a movement BMO economist Douglas Porter described as an “off-the-charts” jump in a note to clients.

The decline in phone service costs follows the June introduction by Rogers, Bell and Telus of unlimited data plans that eliminate overage charges and instead throttle speeds when users surpass their monthly data limit. The move follows the adoption of unlimited plans by smaller competitors like SaskTel and Shaw Communications’ Freedom Mobile. (The Shaw family controls both Shaw Communications and Corus Entertainment, the parent company of Global News.)

WATCH: Major wireless carrier offering new unlimited plans

The price of cellphone services alone declined by more than three per cent in July, dragging down the overall cost of phone services, which includes landline use, according to data provided by StatsCan to Global News.

Get weekly money news

The spike in device costs, on the other hand, comes as the Big Three also ushered in financing options that allow customers to pay for their mobile devices through monthly installments with zero down and no interest charges. The offering is an alternative to traditional two-year plans in which customers usually pay a subsidized device price that’s split between an upfront payment and a charge baked into their monthly rate plan.

WATCH: Canadians can pay off their mobile phones, but their bills might not drop. Here’s why

The new financing plans do away with device subsidies.

“That’s the movement you’re seeing in telephone services,” according to Nikola Milutinovic, an analyst at StatsCan’s consumer prices division. Consumers, he said, “are paying less for the plan itself but more for the hardware portion.”

READ MORE: Rogers, Bell, Telus launch beefed up wireless data plans – but there’s a catch

Still, the agency observed “increases in device prices across plans and carriers,” Milutinovic added via email.

The price of mobile devices has been steadily climbing, said Laura Tribe, executive director of Open Media.

“You’re getting something as powerful as your home computer that was built with the technology small enough to fit in your hand,” she said.

Canadian prices for the latest smartphone models easily reach $1,500 and above.

READ MORE: Canada’s new low-cost cell phone plans? ‘A joke,’ expert says

While telecom analysts expect the broad move to unlimited plans to slow down revenue growth for the industry, they see the introduction of financing plans as an offsetting measure that will cut carriers’ spending on device subsidies.

Data overage charges cost Canadians more than $1 billion in 2017, accounting for five per cent of the wireless industry’s $24.5 billion in revenues for the year, according to data from the Canadian Radio-television and Telecommunications Commission (CRTC). That was down from six per cent in 2016.

Overall, the average price of four key mobile plans decreased by 28 per cent between 2016 and 2018, the telecoms regulator said in a report published Aug. 9. The study, however, did not look at device costs.

The regulator recently asked wireless providers to stop offering device financing plans longer than 24 months as it investigates whether they violate the wireless code.

The CRTC said that while the longer financing plans could make device purchases more affordable, the plans may carry cancellation fees or other clauses that would lock customers in for longer than the two-year limit set in the code.

READ MORE: Regulator asks Canadian telecoms to stop 36-month phone financing

The regulator said the limit was set to make it easier for customers to switch providers for better offers, something the longer financing plans could hinder.

The warning came soon after Telus confirmed it planned to roll out a 36-month payment plan for phones, while Rogers launched 36-month financing in early July.

Rogers maintains that option is acceptable because consumers are paying month to month and don’t pay interest or a cancellation fee, although outstanding balances may become due if the customer drops the service.

Telus CEO Darren Entwistle said on a conference call Friday that the longer financing plans were about making access more affordable.

“Where you can finance the device over 36 months, that really supports the affordability pieces that we’ve been articulating.”

READ MORE: The best, cheapest cellphone plans in Canada in 2019

Bell chief executive George Cope said on a conference call Thursday that the company would likely extend its financing plans from their current 24 months.

“To have that financing over three years is an intelligent move for the consumer market and one that you’ll probably ultimately see us roll out with as well as we’re currently at the 24 months.”

Freedom Mobile, for its part, reacted to the introduction of financing plans by the Big Three with a limited offer that promises a device for free along with its unlimited plans.

Such limited-time promotions are a mainstay of the industry’s marketing, as carriers compete to sign subscribers during the busy back-to-school period and the seasonal gift-buying period before Christmas.

— With files from the Canadian Press

Comments

Want to discuss? Please read our Commenting Policy first.