The federal agency in charge of Canadian housing issues says Vancouver’s white-hot housing market is finally starting to moderate into safer territory.

For three years, the Canada Mortgage and Housing Corporation (CMHC) has given Vancouver a “high vulnerability” rating.

That rating is developed from an index of market factors, including overheating, price acceleration, overvaluation and overbuilding.

But after 12 consecutive quarters, the agency has downgraded the city to “moderate vulnerability.”

WATCH: The trickle-down effect of Vancouver cooling housing market

The CMHC said that while overvaluation continues to be a problem, price acceleration has eased and the imbalance between home prices and things like income and population has narrowed.

“While home price growth over the past few years significantly outpaced levels supported by fundamentals, these imbalances have narrowed through growth in fundamentals and lower home prices in different segments of the resale market,” said the CMHC in its latest Housing Market Assessment.

Get weekly money news

“Moderate sales and a greater availability of listings on the resale market continue to signal low evidence of overheating, while low inventories of completed and unsold new homes and a low vacancy rate in the rental market suggest that there is low evidence of overbuilding.”

READ MORE: Metro Vancouver home sales up ‘modestly’ in May — Real Estate Board of Greater Vancouver

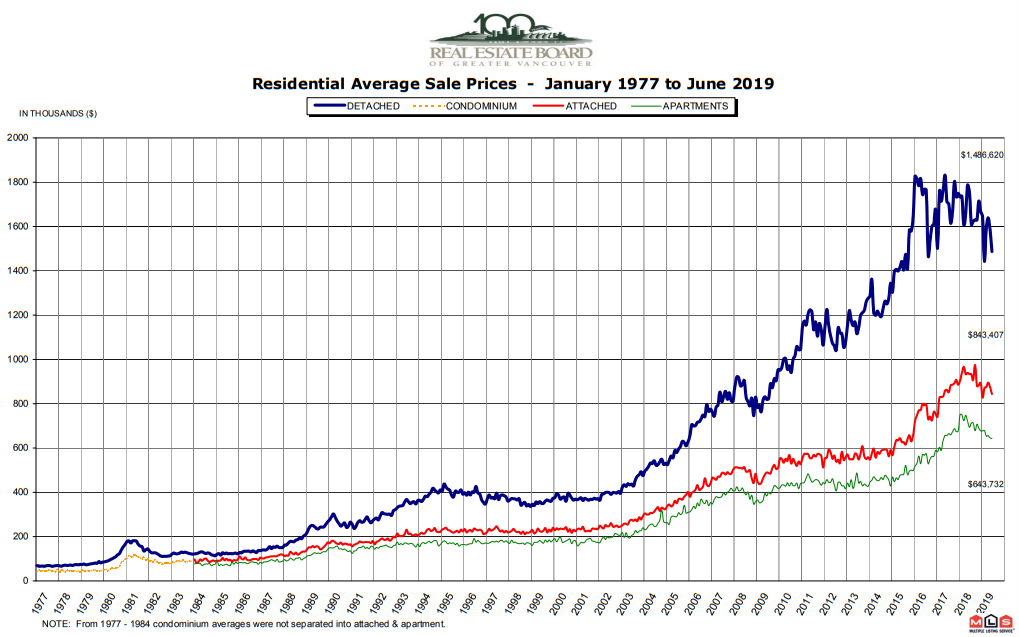

The assessment comes amid a continuing slump in both home sales and home prices in the region.

According to the Real Estate Board of Greater Vancouver, June sales for the region were the lowest since the year 2000, with the benchmark price across all home types slipping below $1 million for the first time in two years.

READ MORE: Metro Vancouver home prices slide again, April sales 43% below 10-year average

However, the CMHC said vulnerability in the housing market in Victoria remains “high.”

Overheating and price acceleration remain key concerns there, while a moderate level of overvaluation also remains a factor, the CMHC said.

Comments