For the first time in years, climate change is shaping up to be a major issue in the federal election campaign this fall.

And when it comes specifically to the question of whether the carbon tax is the best way to address the challenge, the four main parties will all be offering competing visions to Canadians ranging from plans that focus on having government set the rules or leaving more power in the hands of the private sector and getting rid of the price on pollution all together.

READ MORE: Ontario court rules federal government’s carbon-pricing law is constitutional

What the plans from the four main federal parties — Liberals, Conservatives, NDP and Greens — all have in common is a recognition that Canadians facing extreme flooding, droughts and fires are demanding the federal government they elect has a plan to deal with the challenges.

Here’s where the parties stand on the carbon tax.

Liberal Party

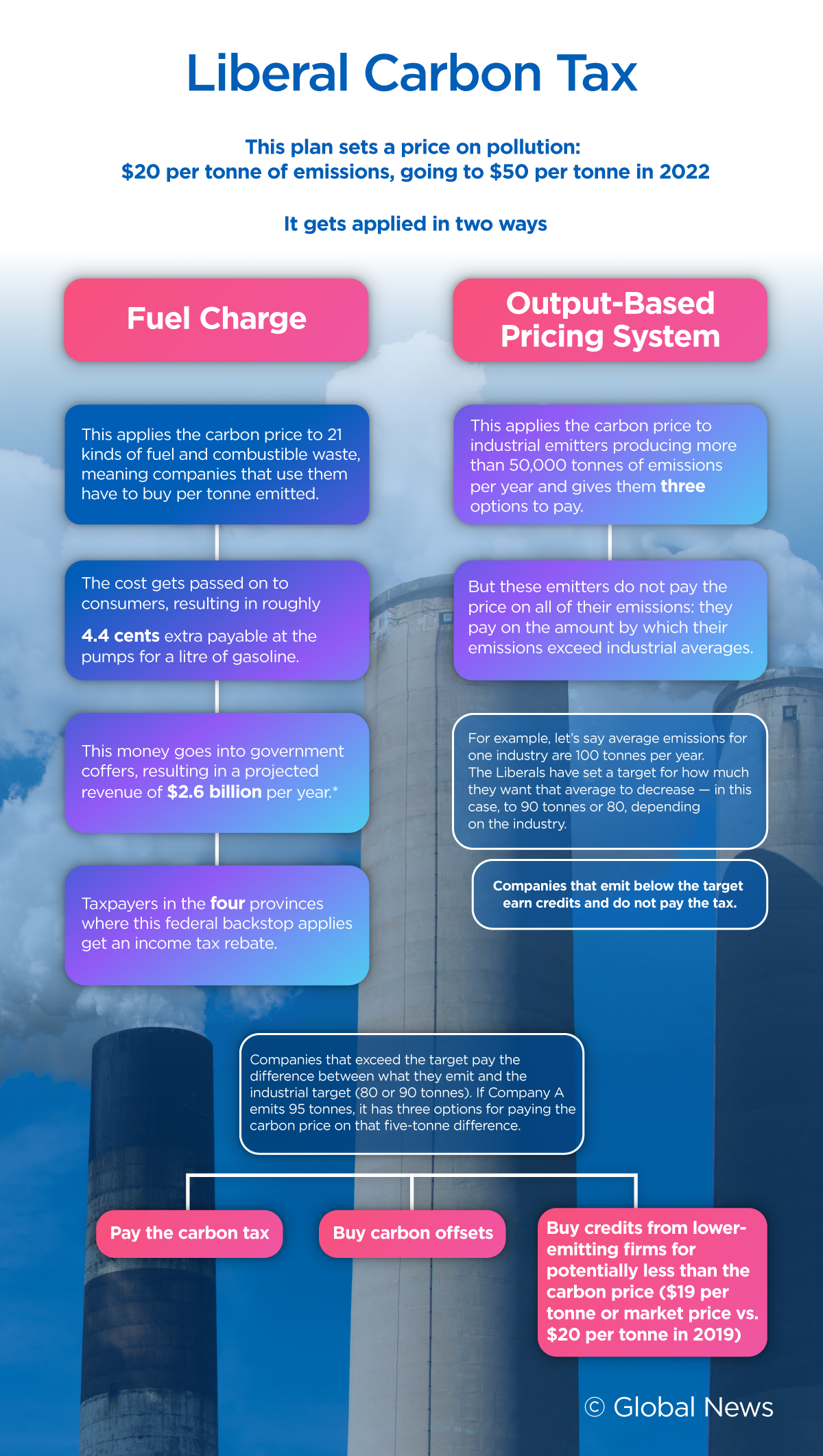

The Liberal carbon tax is in place now and functions, at its core, around a set price on each tonne of carbon emitted into the atmosphere: $20 per tonne right now, increasing by $10 per year until that price hits $50 per tonne in 2022.

Under the system, there are effectively two streams for how that price gets implemented: a fuel charge and a program for industrial emitters called the output-based pricing system. Both systems act as a backstop if provinces fail to set up carbon pricing plans of their own.

That means the system is now in place in four provinces: Ontario, New Brunswick, Saskatchewan and Manitoba.

It is set to kick in for Alberta next year and has also been implemented in Nunavut and the Yukon at their request.

READ MORE: 2 provincial courts sided with Trudeau’s carbon tax — what happens next?

The fuel charge works by applying the carbon price to businesses that buy any of 21 kinds of fossil fuels or combustible waste.

That cost gets passed on to consumers by the businesses and, in the case of gasoline, translates to consumers paying an extra 4.4 cents per litre at the pumps.

An official estimate by the Parliamentary Budget Officer projects the total revenue from the tax will come to $2.6 billion by the end of this year, and the legislation implementing the carbon tax mandates it must go back to the residents of the provinces in which it was collected.

Ninety per cent goes back to taxpayers in the form of an income tax rebate, while the remaining 10 per cent gets allocated to a range of school and municipal green programs, such as energy-efficient retrofits.

The revenue gathered from the industrial emitter program also gets collected into the same pool of money.

WATCH: Canadian driving habits far from green

That industrial program works by setting emission targets based on the average amount of emissions per industry. Companies that emit below that target do not have to pay the carbon tax and earn credits, while those that exceed the target pay the carbon tax only on the emissions above the target.

Those targets state that companies can only emit 80 or 90 per cent of the average amount of emissions for their industry (whether it is 80 or 90 per cent depends on the industry and how vulnerable the government deems it to be to changes in its competitive environment).

Get breaking National news

Wait, There’s More: When climate change hits home

Let’s say Company A emits the industrial average of 100,000 tonnes per year and is part of an industry that has to adhere to the 80 per cent of industrial average target. That company would not pay the carbon tax on 80,000 tonnes of emissions but will have to pay it on the 20,000 tonnes by which it exceeds the limit.

Now, let’s say Company B is in the same industry but only emits 75,000 tonnes per year. That company does not pay the carbon tax, plus it earns credits for the five tonnes it did not emit and can sell those to companies that have to pay the carbon tax.

Companies that have to pay have three options: Company A could either pay the government directly at the current $20-per-tonne price, buy credits from Company B at whatever price Company B deems fair (for example, $19 instead of the $20 federal price) or purchase carbon offsets from other companies that do certain qualified activities like tree-planting.

The idea is that this approach for industrial emitters gives them a commercial incentive to reduce their emissions and compete with each other to earn credits they can sell to other firms, rather than having to pay a tax on any and all emissions, even if they are industrial leaders.

Conservative Party

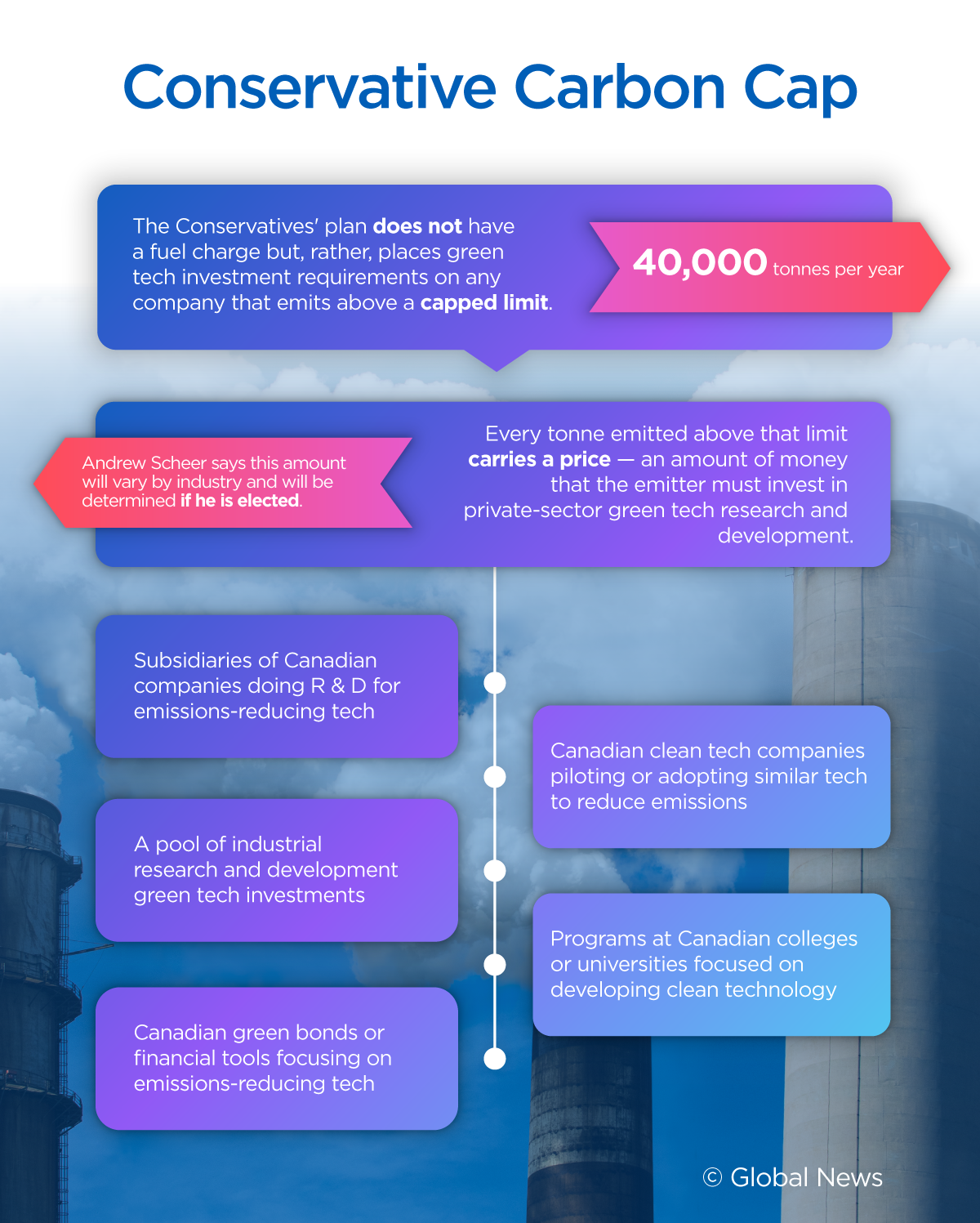

The Conservative plan takes a very different approach.

Under this plan, there would be no fuel charge and the party would get rid of the set price per tonne of pollution that underscores the Liberal systems.

Instead, the Conservatives would create a different industrial system for companies that emit more than 40,000 tonnes per year. Right now, the Liberal industrial plan applies to those that emit 50,000 tonnes or more.

The Conservative system would effectively cap allowable emissions and then force companies to spend a certain amount of money investing in private-sector green technology for every tonne by which they go over that limit.

READ MORE: Scheer’s climate plan puts focus on ‘tech not taxes’ with $2.5B in pledges

It’s not clear how much companies would be required to invest per tonne of emissions above that cap. Conservative Leader Andrew Scheer has said those amounts would vary by industry but that the figures would not be determined unless he is elected to government.

The investment requirements would focus on several different private-sector areas.

Emitters that exceed the capped limit could meet their still-unclear investment requirements by activities such as investing in subsidiaries of Canadian companies that do eligible research and development for emissions-reducing technology, a pool of industrial research and development for green tech investments and Canadian green bonds or other financial tools focusing on emissions-reducing technology.

They could also invest in Canadian clean technology companies that are piloting or adopting similar technology to reduce emissions, or into programs at Canadian colleges or universities focused on developing clean technology.

Scheer argues that forcing private companies to invest in green technology will spur a “technological revolution” and spark increased innovation as investment flows into private-sector research and development for clean tech.

New Democratic Party

The NDP plan would keep the Liberal system in place but tweak how the system works for industrial emitters.

While the Liberal system requires companies to pay for emissions that exceed 80 or 90 per cent of their industry’s average, the NDP wants to set that limit at 70 per cent, which would have the effect of making companies pay the carbon tax on a larger portion of their emissions.

For example, Company B from above did not have to pay the carbon tax under the Liberal plan but would have to pay the tax under the NDP plan.

That’s because while they emitted an amount that fell beneath the target limits under the current system, setting a tougher limit would mean they have to pay the tax on five of their 75,000 tonnes of total emissions.

The NDP would keep the fuel charge as well as the pricing system for carbon, including the cost increases set by the Liberal government through 2022.

Green Party

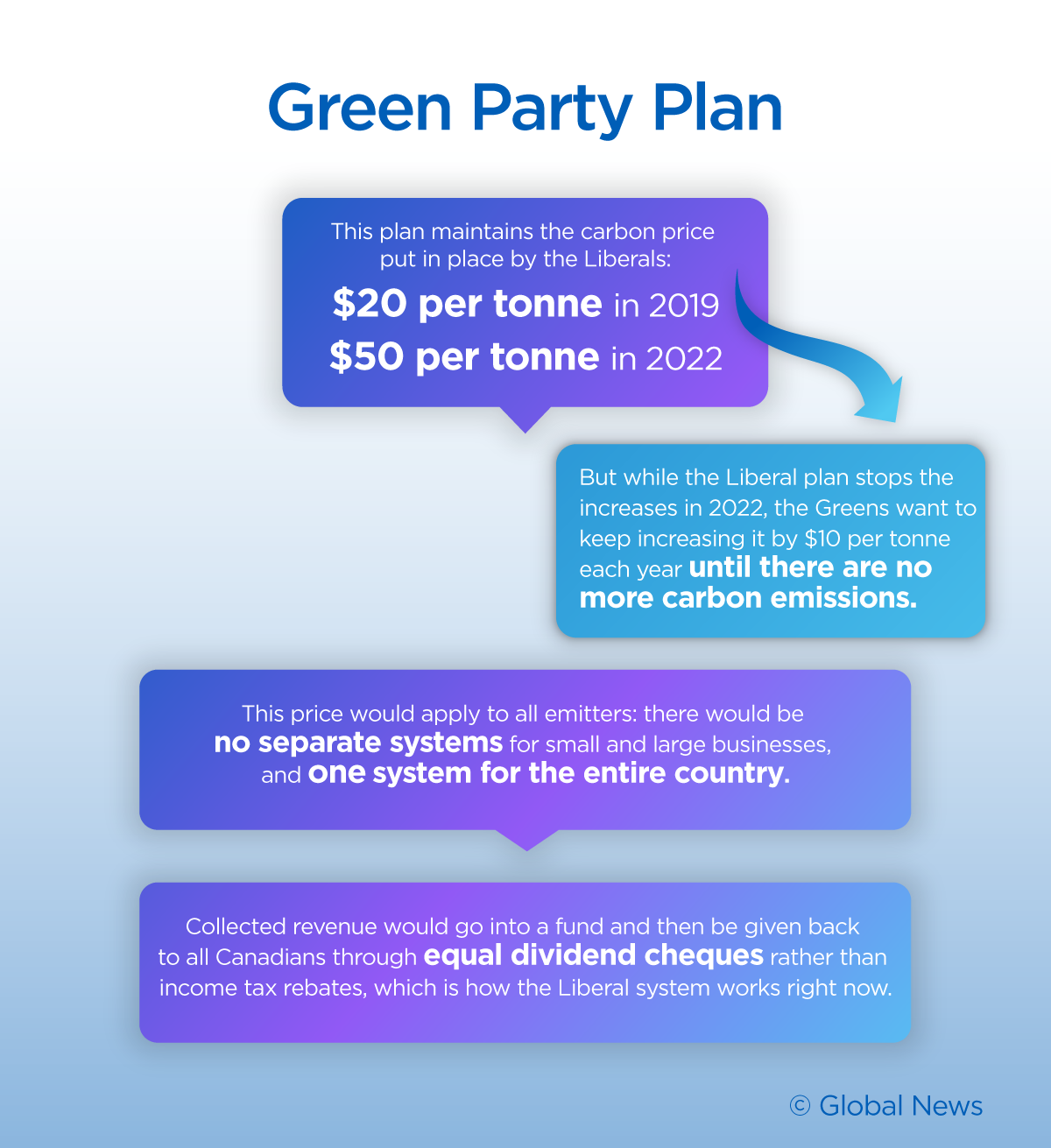

The Green Party plan would get rid of the separate system for industrial emitters and impose one price for all.

Its plan relies on the same baseline pricing on carbon as the Liberal and NDP plans but goes a step further. While the Greens would maintain the current pricing and the scheduled increase of $10 per year until the price hits $50 per tonne, the Greens would not stop there.

Instead, the party would continue the annual increases by $10 per year until there are no more carbon emissions.

READ MORE: Green Party calls for Canada to stop using foreign oil — and rely on Alberta’s instead

The party’s plan also pitches what it describes as a “carbon fee and dividend” system.

It’s similar but different to the Liberal system, in which revenues are deposited into government coffers and then paid back to the provinces from which they were collected through both income tax rebates and federal investments in green programs.

But the Green plan wants to see all emitters, large and small, across the country pay the same price and then use that revenue to give a dividend cheque back to all Canadians equally on a per capita basis, with none of the revenue staying in government coffers.

The party bills this as a way to make the benefits more equitable for all Canadians and says it would especially help low-income Canadians.

Comments