London’s first-ever vegan fast-food restaurant is encouraging its customers to pay in plastic.

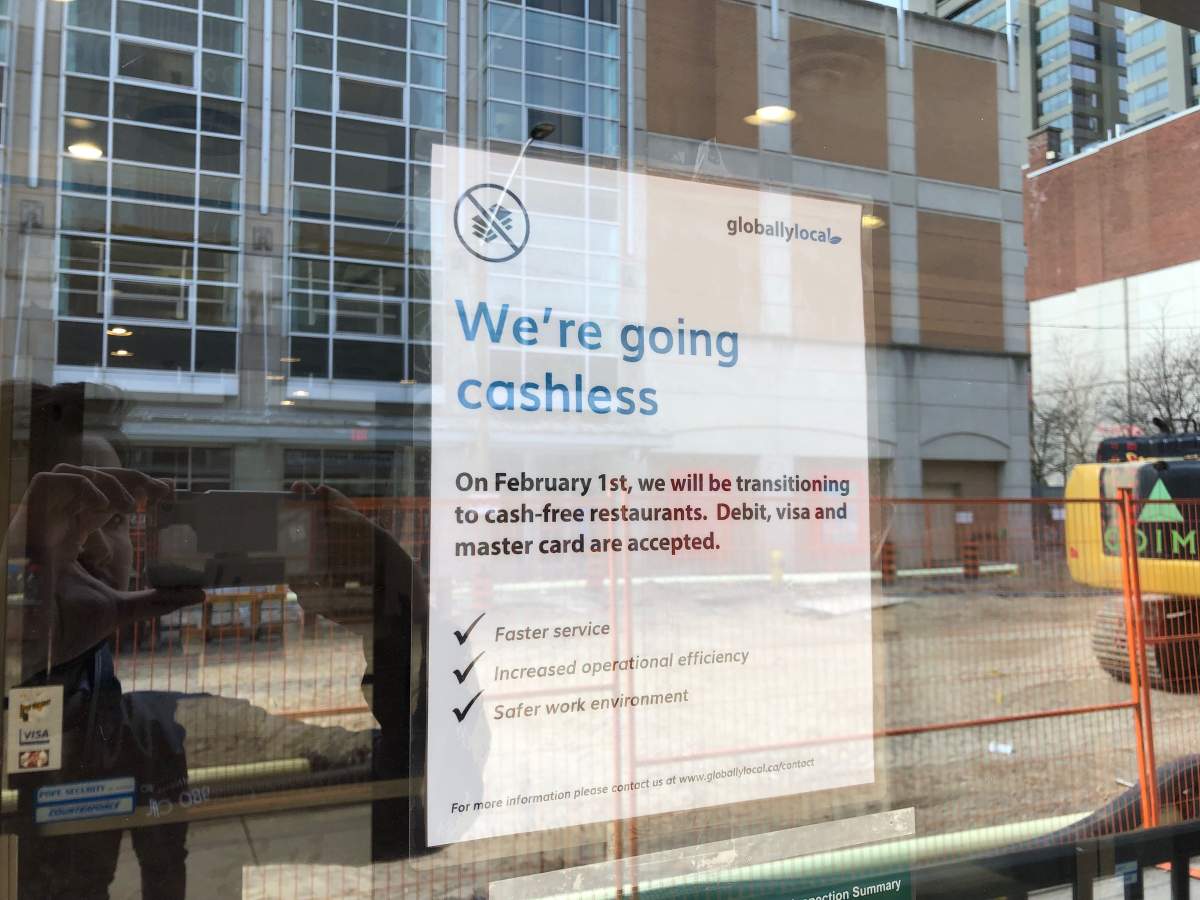

Globally Local has gone cashless, outfitting its downtown and Highbury Avenue locations with self-checkouts and asking customers to pay with debit, Visa or MasterCard.

The transition was first made in February, and since then, founder James McInnes said it’s helped keep prices low and efficiency high.

McInnes told Global News Radio 980 CFPL the transition was partly in response to a growing trend of cashless payments, adding that over 80 per cent of Globally Local’s transactions are done without cash.

“It (also) increased safety for our staff,” McInnes said.

“You’re not going to rob a place that has no cash.”

There is some relief, however, for cash-carrying consumers looking for vegan fast food.

Get weekly money news

McInnes added they can still make exceptions for those who cannot pay with plastic.

“Our preference is that you pay with a debit card, but if that’s absolutely not possible, you can just ask to speak with a manager or just ask one of the cashiers,” McInnes said.

According to Ivey Business School marketing professor Rod Duclos, businesses can benefit from transitioning to a cash-free system.

He says dealing with plastic can reduce the overhead costs that come with dealing in cash.

“It takes time to count all this money, it takes time to go to the bank and deposit it,” Duclos said.

“All these time savings by going cashless can be reinvested toward maybe hospitality training or toward marketing and promotional activities to grow the business.”

The convenience of not carrying cash can also benefit consumers, making them less susceptible to losing money or having it stolen.

However, there is some cause for concern.

Duclos, who specializes in behavioural psychology, added that consumers may end up spending more than they realize by ditching cash.

“It’s psychologically more painful to pay in cash,” Duclos said.

“If you go to the mall and you buy yourself a pair of shoes for $100, paying in cash makes you less likely to buy those shoes… than if you are planning to pay in your credit card.”

Consumers may also feel a loss of privacy. Cashless transactions are easier to track, making buyers more susceptible to targeting from marketers, according to Duclos.

Certain jobs can also make dependence on cashless payments more of a hassle than a convenience.

“Taxi drivers, busboys, waiters, waitresses (and) construction crews… they get part of their income in cash. Therefore, they’re much less likely to use dematerialized money when they go out to businesses,” he explained.

Cashless transactions remain a growing trend in Canada.

A 2018 analytical note from the Bank of Canada reports an increase in credit card use and a decrease in the use of cash.

Meanwhile, debit and credit transaction processor Moneris predicts that cash purchases will only make up 10 per cent of all money spent in Canada by 2030.

Given the changes, Duclos says it’s important for consumers to understand how the physicality of money can sway purchasing behaviour.

“Knowledge sets you free,” Duclos said.

— With files from Devon Peacock and Mike Stubbs

Comments