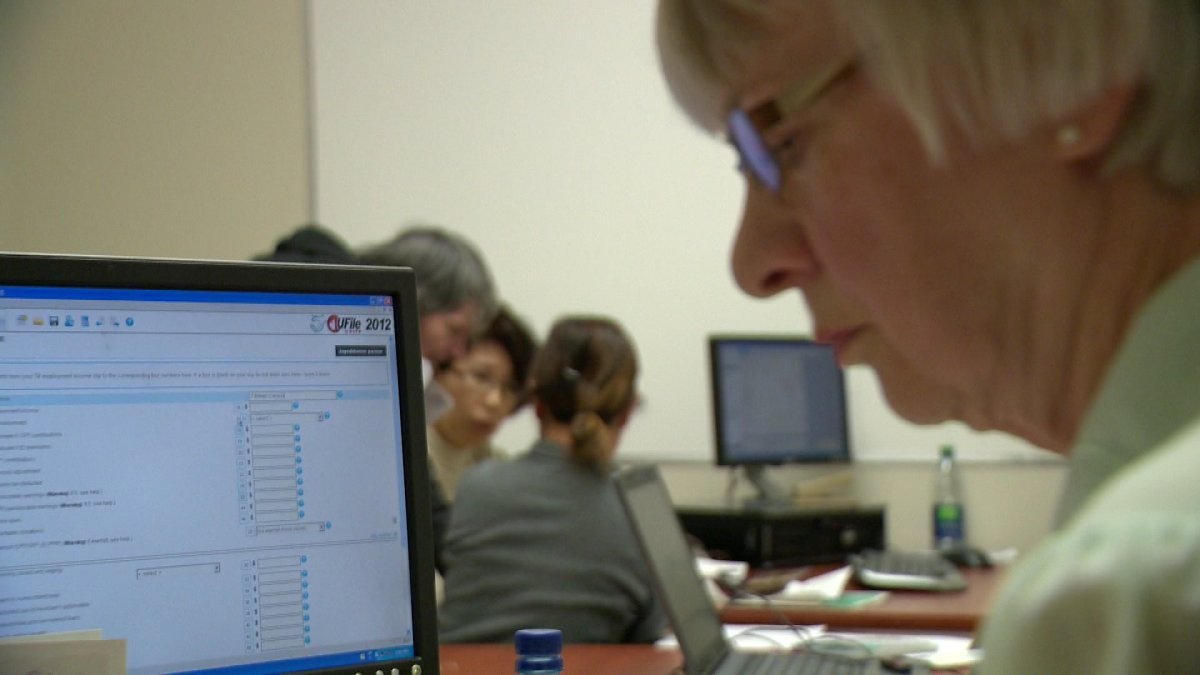

REGINA – With one week left until the tax deadline The Salvation Army is offering free help to those who still need to file.

“Everyone must do taxes,” said Val Wiks, The Salvation Army’s community ministries coordinator. “If they haven’t done their taxes by the end of April, come July, there won’t be a GST cheque or there won’t be a child tax cheque.”

For those who do not make a lot of money, missing out on those cheques can be difficult.

But many others just do not know how to complete the forms properly and need some help.

“I was doing it online at home, but I found some difficulties to get the exact refund,” said Jayesh Parmar, who recently moved to Regina from India.

He said there was some confusion about how to file a claim with the graduate retention program from previous years. Parmar found that help from a volunteer helping out The Salvation Army.

Free tax help was offered to any individual with an income under $30,000 or a family with an income under $35,000. So far, 1,400 people have visited the tax clinic.

“Just the idea that someone is doing their taxes, they don’t have to navigate all this paperwork on their own and make sure they’ve put it in the right spot,” said Wiks.

Experts say there are some things Canadians can claim that not everyone is aware of. Bus passes, and sports or dance lessons for kids can be claimed. Another is a tax benefit for low income workers.

“It’s an encouragement by the government to get out and work and it can amount to nearly $1,000 for a single person,” said Leroy Gorski, a senior tax professional at H&R Block.

No matter how much money someone thinks they might owe, Gorski says everyone does have to file taxes.

“It’s important that people file, even if they don’t have the money to pay because it’s better off to pay a bit of interest rather than pay interest and pay penalties,” he said.

Now, it is all starting to make sense to Parmar, who says it is a good learning experience for future tax seasons.

“It’s not that much rocket science,” Parmar laughed. “I can learn easily, anyone can learn easily.”

Comments