Canada has become a “pawn” for international money launderers who exploit the country’s weak laws that allow hidden ownership of real estate and other assets, a new report says.

In the report from the C.D. Howe Institute, author Denis Meunier — a former deputy director with Canada’s anti-money laundering agency — writes that official estimates of the amount of money laundered in Canada each year range from $5 billion to $100 billion.

Criminals involved in drug trafficking, smuggling, tax evasion and corruption have parked their dirty money in Canadian real estate and businesses, the report says, because they do not have to be identified as owners of shell companies and legal trusts.

Meunier says that while European countries have moved to establish public registries that would identify true owners of assets, over the past 15 years Canada has lagged behind in ownership transparency laws.

Current loopholes are so glaring, Meunier says, that more identification is required to obtain a library card in Canada than to register a corporation.

The average Canadian “must provide a government approved photo identification to obtain a bank account, library card or official documents such as a passport and driver’s licence,” the report says. “No such scrutiny is placed on the beneficial owners of corporations or parties to a trust.”

Meunier says that in British Columbia, where serious and widespread money laundering problems have been identified, the government has promised reforms.

- ‘Shock and disbelief’ after Manitoba school trustee’s Indigenous comments

- Canadian man dies during Texas Ironman event. His widow wants answers as to why

- Several baby products have been recalled by Health Canada. Here’s the list

- ‘Sciatica was gone’: hospital performs robot-assisted spinal surgery in Canadian first

In its 2018 budget, B.C.’s government promised to establish a publicly accessible registry that will identify true owners of real estate. Illustrating the scale of B.C.’s problems, Transparency International revealed in a December 2016 report that hidden ownership methods — including shell companies, trusts, and false owners — are used to purchase about 50 per cent of Vancouver’s most expensive properties.

But other governments across Canada have yet to act.

“Knowing that the vulnerability to money laundering is high in the real estate sector, it is alarming that other governments, especially in the Greater Toronto Area, have remained passive about identifying the ultimate beneficial owners of corporations and trusts involved in real estate transactions.”

Meunier writes that money laundering and tax evasion trends in Canada force honest citizens to absorb costs and shoulder greater tax burdens. And public safety is risked.

Morneau’s press secretary, Pierre-Olivier Herbert, said the government is working to address some of the issues outlined in Meunier’s report.

“A working group composed of federal, provincial, and territorial government representatives has been created and is considering options for implementing beneficial ownership transparency commitments,” Herbert said in a statement.

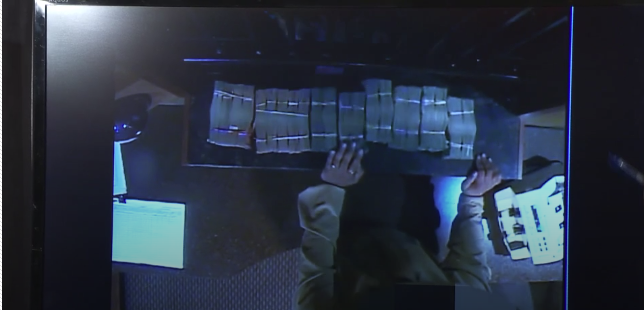

WATCH: David Eby shows money laundering in B.C. casino surveillance videos

In order to close existing loopholes, the report recommends:

- Reforming corporate registries. The federal government, in collaboration with the provinces and territories, establish a central publicly accessible beneficial ownership registry of corporations and certain trusts;

- Place the onus on corporations and trusts to fully disclose beneficial ownership information;

- Require all reporting entities (such as real estate agencies) to identify beneficial ownership information; and

- Follow the European example by keeping Canada current with the international standards, commitments and trends on beneficial ownership transparency.

Comments