Buying a house in Canada briefly became a little less challenging late last year, but that small gain is now already gone, as rising interest rates erase the impact of a cooling housing market, according to RBC.

But home prices and borrowing costs aren’t all that homebuyers and homeowners have to contend with. There are also, of course, taxes.

READ MORE: Welcome to the era of flat home prices

Depending on where you live in Canada, land transfer and property taxes might be just enough to push your dream home out of your reach.

So how does the tax burden of homeownership compare across the country?

LOOKING FOR MORE REAL ESTATE INSIGHTS? SIGN UP FOR GLOBAL NEWS’ MONEY123 NEWSLETTER

Land transfer taxes and fees

Not all governments call it a tax – in Alberta and Saskatchewan it’s a fee – but all provinces charge it when real estate changes hands. It’s a levy that buyers must pay in cash – they can’t add it to the mortgage – and adds to their closing costs.

But depending on tax rates and local property values, what Canadians end up paying can be as little as a few hundred or as much as tens of thousands of dollars.

And the LTT is bad news for buyers in Canada’s two most expensive markets.

READ MORE: Why aren’t home prices falling? Home sellers won’t have it

In Vancouver, where housing affordability is at “crisis levels,” according to RBC, the tax adds a whopping $20,000 to the cost of buying an average-priced home worth $1.1 million, according to calculations by real estate website Zoocasa.

And in Toronto, where buyers face both a provincial and a municipal LTT, the tally is nearly $17,000 based on an average home price of just over $800,000. And that’s accounting for nearly $8,500 in rebates for first-time homebuyers. Repeat buyers face a tax bill of over $25,000.

WATCH: Home prices are flat-lining in many Canadian cities. What does this mean for buyers and sellers?

This can add years to the time it takes buyers in this market to save up the cash they need to finally afford a home, Zoocasa managing editor Penelope Graham noted in the report.

That’s in sharp contrast with Calgary and Edmonton, where both first-time and repeat home buyers would pay less than $300 for a property worth $471,000 and $387,000 respectively.

And in London and Windsor, Ont. average home prices are still below the threshold of $368,333 at which first-time homebuyers are spared the LTT.

Here’s how Canada’s major cities compare, according to Zoocasa:

Property taxes

While land transfer taxes might force some buyers to postpone a home purchase, property taxes are forever. That’s a recurrent bill you’ll face for as long as you own a house.

How much you’ll have to pony up every year depends on your municipality, which assesses both the value of your property and the tax rate, usually between 0.5 per cent and 2.5 per cent, once a year. Intuitively, that would imply that if the value of your home should dip in a downturn, so would your tax property bill.

In practice, however, municipal governments tend to adjust property tax rates in response to home price variations in order to keep revenue inflows stable.

READ MORE: Here’s the income you need to pass the mortgage stress test across Canada

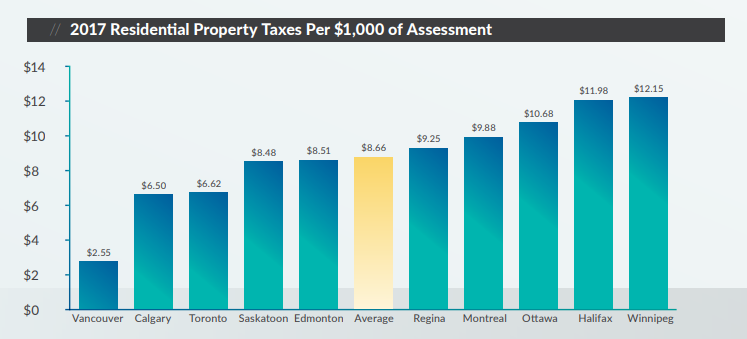

Between 2016 and 2017, for example, Calgary and Edmonton saw the biggest increases in property tax rates, as the municipalities tried to offset the impact of softer home prices, according to the 2017 Canadian Property Tax Rate Benchmark Report by AltusGroup, a real estate services provider.

Vancouver and Toronto, on the other hand, had experienced residential tax rate cuts for 14 and 9 consecutive years, respectively, as of 2017, according to the study.

Indeed, Vancouver has the lowest residential property tax rate among Canada’s largest cities, with the city charging just $2.55 for every $1,000 in assessed home value. Toronto comes in third from the bottom, with a rate of $6.62, only marginally higher than Calgary’s $6.50 for every $1,000 in value.

Winnipeg, Halifax and Ottawa, on the other hand, posted the highest rates, at $12.15, $11.98 and $10.68 for every $1,000, respectively.

The actual tax burden faced by homeowners also depends on local tax rebates. But if it’s any consolation to Vancouverites, the property tax on a $1.1 million property in their city would have been roughly $2,800 — and that’s around $1,000 less than what a Winnipegger would have paid on a $300,000 home.

LOOKING FOR MORE REAL ESTATE INSIGHTS? SIGN UP FOR GLOBAL NEWS’ MONEY123 NEWSLETTER

Comments