It’s a tough time to be in the home-loan business, ask Christopher Molder.

The Toronto mortgage broker is caught up in the same housing slowdown that’s crimping the incomes of everyone tied to the residential real-estate market, from agents to big banks.

“There’s still money to be made, but I basically have to do double the business of last year in order to make as much,” Molder says.

Like agents and banks, brokers are already experiencing a market correction.

Molder is the exception to the new normal for brokers, with fewer loans being made by the segment these days. But with a client base that includes riskier borrowers and with consumers generally already awash in debt, that could be a good thing.

New RBC poll figures released this week show a sharp retreat in home-buying intentions over the next two years. The figures add to evidence that the market, especially in overheated cities like Vancouver and Toronto, is cooling fast.

Big lenders like Bank of Montreal, have tried to prop up demand by reintroducing record low interest rates. For brokers fighting each other and the banks for business, they’ve responded by slashing commissions to beat the bank rate.

“It’s not really good for anyone’s business. Although it gets people to come to the table, when it’s this wonky and this amount of competition, it really causes some cut-throat activity,” Molder, who blogs about the industry, said.

- Can Trump decertify aircraft? What experts say amid Bombardier threat

- Bombardier warns of ‘significant impact’ to travellers from Trump’s threat

- Canadians have billions in uncashed cheques, rebates. Are you one of them?

- Head-Smashed-In Buffalo Jump heritage site enjoys boost after shout out on ‘The Pitt’

Up until about a year ago, commission margins for most brokers were healthy, the market seemingly still booming.

Over the last decade, mortgage brokers, either independents or those from franchises like Dominion Lending, have proliferated.

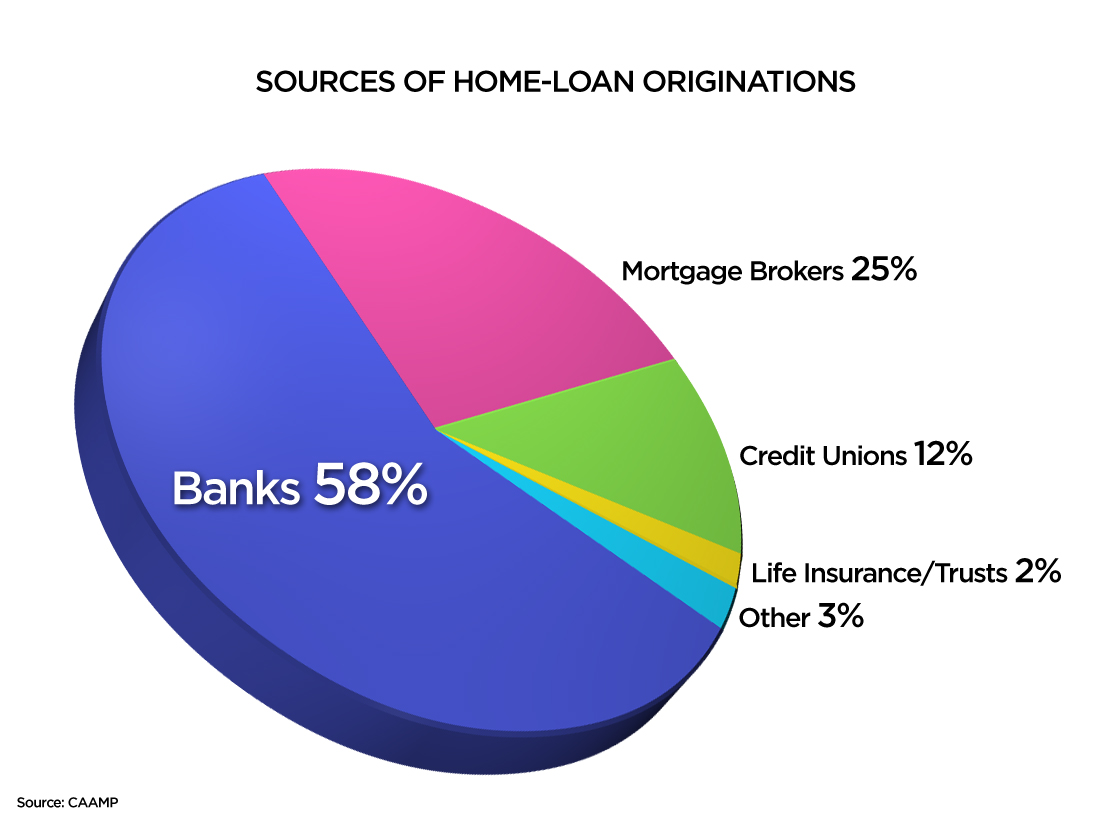

Though direct borrowing from the big banks still makes up the lion’s share of home-loan activity, roughly a quarter of the $1.2 trillion in outstanding mortgages in Canada stems from third-party brokers.

The slowdown, which market watchers say began last spring, now threatens a contraction in the segment. Yet that might actually be beneficial — at least from the standpoint of consumers saddled with unprecedented levels of debt.

Get weekly money news

Besides drumming up more business for banks and other financial institutions that underwrite broker loan making, brokers have served as suppliers of home financing for riskier customers and those with lower credit quality.

As the housing market soared in recent years, so has appetite from banks and other lenders for loans originated by brokers.

In 2012, the segment accounted for half of all new home loans made, according to the Canadian Association of Accredited Mortgage Professionals — double the long-term average.

According to people familiar with the broker business, most of the loans made are “prime,” or mortgages extended to folks with decent credit who can afford to pay their mortgages.

Still, big lenders have begun pulling away from taking on broker loans.

The retreat is in part because of new rules put in place by regulators growing increasingly nervous about the record bulge in household debt, which now stands at more than $1.60 on average for every $1 brought home in after-tax income.

A Montreal broker source said units at TD Bank and Canadian Imperial Bank of Commerce that had been taking on loans from brokers with riskier clients have sharply reduced or wound down loan-making in recent months in that market.

The person, an established broker who asked not to be named said another lender, Home Trust, just recently tightened lending standards.

“Since January they’ve cut back,” the person said.

A spokesperson for TD said the bank adjusted its broker lending business last March to a “risk-based approach.”

Pino Decina, executive vice-president of residential mortgages at Home Trust, said the implementation of the new rules imposed by the national housing insurer as well as so-called “B20” lending guidelines that took effect last year have begun to curtail riskier loan-making.

“Every lender has had to tighten somewhat,” he said.

A spokesman for CIBC confirmed that FirstLine Mortgages, a CIBC-owned lender to brokers stopped taking on new loans last July.

He said the decision was made because CIBC was shifting to “branch originations” or direct lending, which allowed the bank to sell clients additional credit products.

Comments