The CEO of Suncor Energy Inc. says it will continue to avoid spending on large growth projects in Canada despite the federal government’s move last week to purchase the Trans Mountain pipeline system and its stalled expansion from Kinder Morgan Canada Ltd.

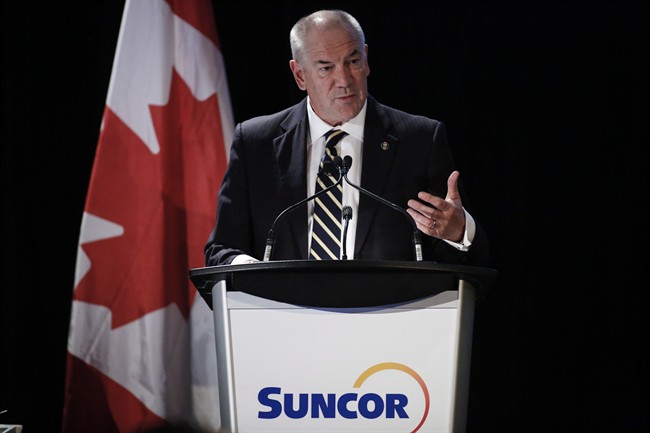

The $4.5-billion sale to ensure the project is built doesn’t change his view that Canada is falling behind other nations, notably the United States, in terms of competitiveness, Suncor CEO Steve Williams said Wednesday in Calgary.

READ MORE: Ottawa inks deal to buy Trans Mountain pipeline project for $4.5B

“What I said was, ‘If you look at the competitiveness of Canada, we’re not in great shape,”’ Williams said after taking part in a panel discussion on how the country can balance economic and environmental issues.

“And competitiveness for me is the sum of all those things, so royalties, taxation, regulatory certainty, confidence in regulators today and in the future. And we need to make some progress.”

He said Ottawa’s support of Trans Mountain is encouraging but its decision is “two-edged,” considering that the $7.4-billion pipeline expansion had received regulatory approval and a private company was willing but unable to build it.

READ MORE: Here is everything you need to know about Ottawa’s plan to (maybe) buy the Kinder Morgan pipeline

“On the one hand, it’s a clear, unambiguous commitment that it’s a piece of infrastructure which is in the national interest and needs to be built.

“On the other hand, it’s also recognizing that the normal processes didn’t work very well,” he said.

Suncor is ramping up production of its recently completed $17-billion, 194,000-barrel-per-day Fort Hills oilsands mine north of Fort McMurray, but has approved no other major growth projects for its northern Alberta oilsands leases.

READ MORE: Edmonton Metro mayors pledge support for Trans Mountain pipeline expansion project

The Trans Mountain expansion, designed to increase pipeline capacity from 300,000 to 890,000 barrels per day between Edmonton and the Vancouver region, still faces vocal and legal opposition from the provincial and municipal governments in B.C., as well as environmentalists and Indigenous people.

Williams said he’s confident it will be built. He said it could eventually have some Indigenous ownership as the federal government has vowed to return it to private hands as soon as practical.

The panel discussion was introduced with a speech by former Bank of Canada governor David Dodge, now an adviser with law firm Bennett Jones LLP.

Environmental activists who want all oil and gas production and pipelines stopped would make Canada unable to afford its own environmental policies, while ardent developers who want zero limits on production are ignoring the long-term threat posed by climate change, he said.

READ MORE: Industry reaction mixed over Trans Mountain pipeline buyout

“It is very important to combine carbon pricing policy with policies to gain the maximum economic rent on the sale of our hydrocarbon products to foreigners, including the sale of bitumen from the oilsands, while global demand for oil is robust and still growing,” he said.

“(That’s needed) to pay the cost of achieving that long-run benefit of avoiding catastrophic climate change.”

In a report released this week, the Canadian Association of Petroleum Producers said Canada’s oil and natural gas sector will pay more than $25 billion over the next 10 years to address provincial and federal climate initiatives.

It estimated that will translate into an average of about $1.40 per barrel for bitumen recovered with steam-driven wells and about $1.10 per barrel of oil equivalent for non-oilsands oil and natural gas developments.

- Three B.C. men fined, banned from hunting after killing pregnant deer

- B.C. child-killer’s attempt to keep new identity secret draws widespread outrage

- Inquest hears B.C. hostage was lying on her captor before fatal shooting

- ‘We’ve had to make a 180’: What Oregonians say they got wrong with decriminalization

Comments