Asked about the proposed U.S. tariffs on steel and aluminum imports, Prime Minister Justin Trudeau told reporters on Friday that the decision “makes no sense.”

READ MORE: Justin Trudeau says move by Trump ‘makes no sense,’ adds he spoke with president

Mainstream economists on both sides of the border agree – and not just because the move could harm U.S. workers and consumers and spark a trade war.

U.S. President Donald Trump on Thursday announced plans to impose broad-based tariffs of 25 per cent on steel and 10 per cent on aluminum. The administration is saying it wants to protect its domestic industry from underpriced imports from China, but it is Canada that could suffer the most from it, according to experts.

https://twitter.com/MikePMoffatt/status/969559361017098241

Canada is the top source of foreign steel for the U.S., accounting for 17 per cent of imports in 2016, according to data from the U.S. Department of Commerce. China comes in 11th in the ranking.

READ MORE: Donald Trump’s steel, aluminum tariffs: Here’s what you need to know

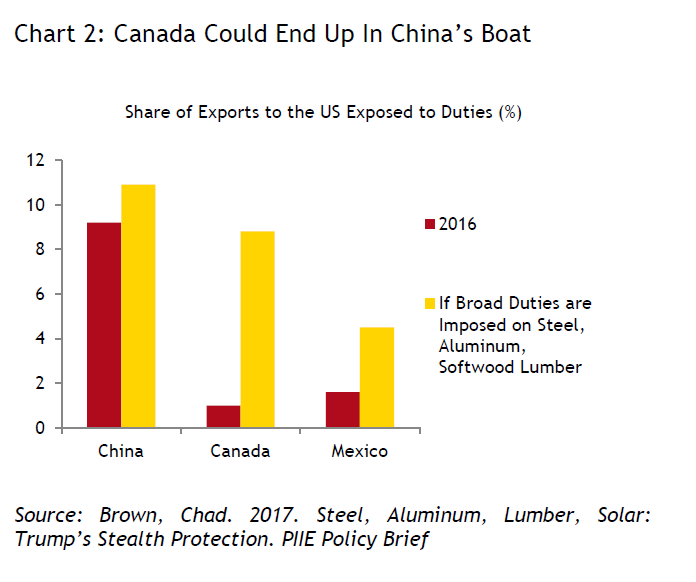

If the steel and aluminum tariffs are implemented to U.S. imports from all countries, they would add to the U.S. trade barriers Canada already faces on softwood lumber, paper and pipes. The share of Canadian exports to the U.S. that would be subject to tariffs would rise to 10 per cent, CIBC economists Royce Mendes and Avery Shenfeld wrote in a research note on Thursday.

“It’s striking that the share of Canada’s exports to the U.S. facing tariffs would be just a shade under that of China,” they note.

So what’s going on?

WATCH: Prime Minister Justin Trudeau says Trump’s move ‘makes no sense’

Trump isn’t the first to take aim at China’s steel

Get weekly money news

Blasting China for its cheap exports was one of the cornerstones of the Trump electoral campaign, and this is the president’s first meaningful step intended to address the issue. But Trump isn’t the first U.S. president to levy tariffs on China’s steel, nor is the U.S. the only jurisdiction trying to stem the inflow of Chinese steel imports.

READ MORE: Trump’s tariff announcement leaves Canadian steel, aluminum producers in limbo

In 2016, former U.S. president Barack Obama imposed tariffs of more than 200 per cent on some Chinese steel products, but that had only a limited impact.

It’s the same story in the European Union (EU).

COMMENTARY: Donald Trump’s tariff threat shows his ignorance of international trade

Economists suspect that the tariffs aren’t working because China can easily get around those restrictions by exporting steel through third countries.

In the EU, for example, “Chinese imports are replaced by products from places like Iran, Russia and Ukraine. Imports from Iran have increased almost tenfold since 2012,” according to Greenwood.

WATCH: U.S. President Trump may finally have started an all-out global trade war. David Akin has more on the potential impact on Canada

China has a steel overproduction problem

There is little doubt among trade experts that China is exporting massive amounts of steel, even if statistics don’t always capture that. Half of the global supply of the metal in 2016 came from China, according to a recent report from the U.K. parliament.

“Imports now account for a quarter of the EU market, and at the same time, prices for a range of major EU product classes have collapsed,” Greenwood writes.

China started ramping up its steel production capacity in the 1970s, as it began the process of industrialization that would turn it into a 21st-century economic superpower.

READ MORE: Here’s how Trump’s tariffs on aluminum could make your beer more expensive

But Beijing kept pumping money into the steel industry, among other sectors, whenever the economy hit a rough patch, said Gary Hufbauer, a non-resident senior fellow at the Washington, D.C.-based Peterson Institute for International Economics.

“China has been very successful in resisting the various recessions that have hit the world economy in the past two decades,” he told Global News. “Their response was invest, invest, invest. Steel was one of the places where they invested.”

The country’s steel production capacity vastly overgrew its domestic consumption needs. So Chinese steel markers “sold it everywhere they could find markets, often at market-losing prices,” Hufbauer said.

WATCH: Donald Trump confirms that tariffs will be imposed on steel, aluminum imports.

Where this leaves Canada

The U.S. can’t really prevent China from depressing global steel prices, because it is “in no position to tell, say, Indonesia or Pakistan to stop buying steel from China,” Hufbauer noted.

But the trade restrictions could represent “a stiff blow to Canadian industry,” according to CIBC.

The U.S. is the No. 1 destination of Canadian steel exports, a sector that directly supports 20,000 jobs, according to the Canadian Steel Producers Association (CSPA). The industry is a major employer in Sault Ste. Marie and Sorel-Tracy, Que., as well as Hamilton, Ont., the CSPA said.

U.S. tariffs, to which the Trudeau government would likely retaliate, would disrupt a number of highly integrated industries in North America, from the auto to the aerospace sector. A number of steel and aluminum-importing companies in the U.S., as well as a host of prominent Trump supporters, are urging the White House to carve an exception for Canada.

The U.S., though, might be concerned “that China is dumping certain goods onto the U.S. market, using Canada as a back door,” according to CIBC.

“Canada takes concerns about transshipment very seriously, and we would act to end the practice,” CSPA president Joseph Galimberti told Global News.

Hufbauer believes Canada will get some kind of exemption. That, however, might come in the form of a quota, which would aim at capping any shipment increases driven by Chinese imports.

Comments