TORONTO – The Liberal government will not “act in an impulsive way” in response to U.S. corporate tax cuts that economists say pose a threat to Canada’s competitiveness, the federal finance minister said after a pre-budget meeting Friday.

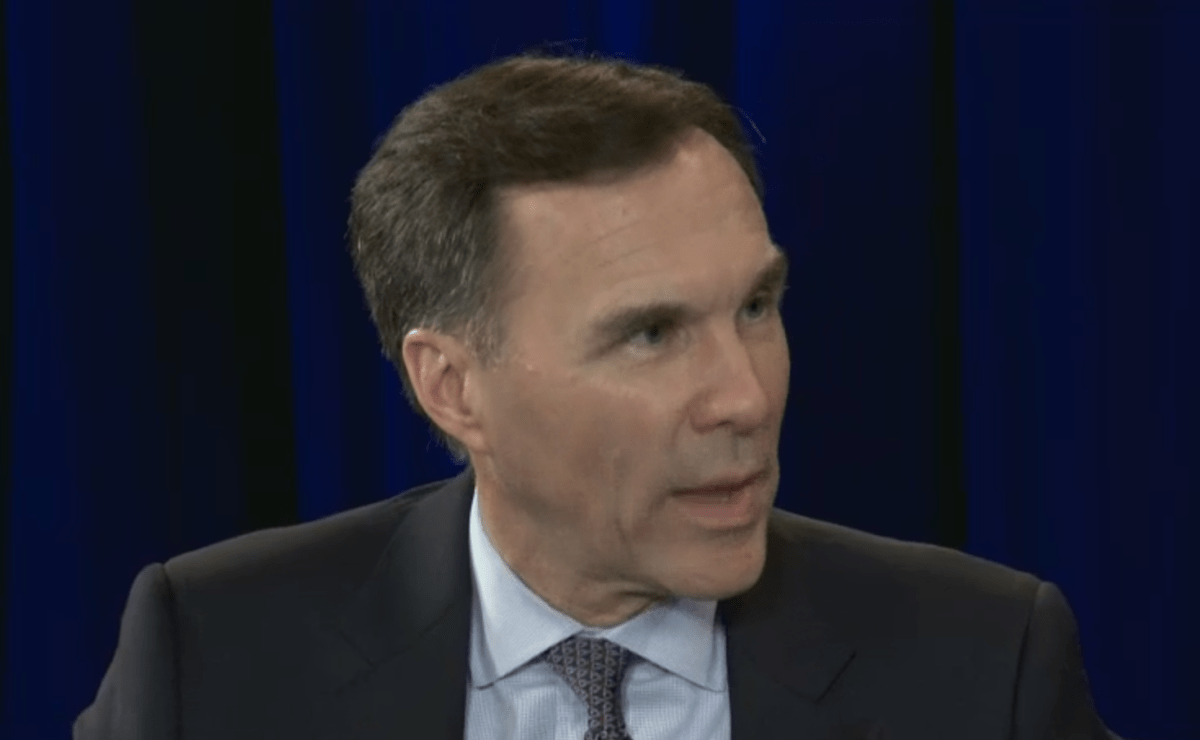

Bill Morneau said the government is conducting careful analysis in connection with U.S. President Donald Trump’s sweeping tax reforms, which cut the U.S. corporate tax rate from 35 per cent to 21 per cent at the beginning of the year.

“We are doing our analysis to make sure that we understand the impact of any changes, … to make sure we get it right and not to act in an impulsive way,” he told reporters on Friday.

Morneau’s comments came after he met with private sector economists in Toronto to get their input on everything from the North American Free Trade Agreement to global economic uncertainty ahead of the federal budget on Feb. 27.

The panel typically includes about a dozen experts from commercial banks, think tanks and trade associations.

The finance minister was tight-lipped Friday about the upcoming budget but said the discussion with economists touched on the uncertainty around NAFTA renegotiations and the impact of changes to U.S. tax rates on the Canadian economy.

Get weekly money news

WATCH: Federal budget will be tabled February 27: Bill Morneau

“We will carefully consider the U.S. changes and the international situation to make sure that our economy is competitive,” Morneau said.

He would not comment on whether tax cuts are in the cards for large Canadian corporations.

Economists have said the tax reforms will give companies another reason to set up shop or relocate south of the border.

When asked whether the upcoming budget would be a balanced one, Morneau said the government’s approach has a “long-term view to being fiscally responsible.”

“We’ll maintain that fiscal responsibility. But we’ll do it while thinking about how we ensure that the growth that we’ve seen (and) that the growth that we hope to continue to see, really benefits all Canadians,” he said.

Morneau also told reporters that while it’s important that the Bank of Canada remains independent, he is “open to ideas” on working with the central bank.

On Thursday, the Bank of Canada’s deputy governor Lawrence Schembri said one option to strengthen the central bank’s monetary policy framework is more “explicit co-ordination” with Ottawa. He added during his speech in Winnipeg that “simultaneous policy action” has benefits, and studies have shown that co-ordinating interest rates with government spending can be “highly effective.”

WATCH: How will Canada counter Trump administration’s corporate tax cuts? (Jan. 2017))

Morneau said Friday it continues to be important that Ottawa considers how the economy changes amid rising interest rates.

“We continue to see the Bank of Canada as independent from government … I’m open to ideas, always, from the Bank of Canada. It’s not something that we’re exploring in depth right now.”

Morneau also hinted Friday that clarifications to rules around passive income for small businesses would be coming, after a suite of changes announced last summer drew substantial backlash from the business community.

- Attack on Iran triggers global flight disruptions, impacts Canadian travellers

- Queen’s University students stranded in Doha after Iran attack shuts down airspace

- WWE Hall of Fame ring belonging to wrestling legend recovered after stolen

- Quebec politician praised for speaking openly about menopause symptom in legislature

Comments

Want to discuss? Please read our Commenting Policy first.