The Canada Mortgage and Housing Corporation (CMHC) issued a report this week with some ideas on how to calm soaring home prices in overheated cities like Toronto and Vancouver.

And its main conclusion was familiar: encourage more supply.

Coverage of Vancouver housing on Globalnews.ca:

The report was 225 pages long, and it was the result of “advanced, data-driven quantitative and statistical analyses” looking at a multitude of factors such as housing starts, population growth, interest rates and zoning.

But there’s one analysis that the report did not carry out: how foreign buyers’ taxes have affected home prices in Canada’s hottest housing markets.

READ MORE: Foreign homebuyer tax? Not the best fix for Vancouver, Toronto: CMHC

The CMHC carried out its research at the behest of the federal Ministry of Families, Children and Social Development, which wanted answers about why home prices have sprung up so rapidly in major Canadian cities since 2010.

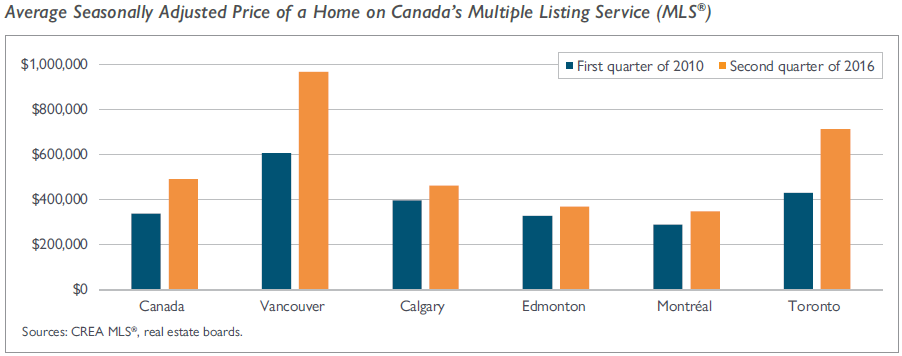

The report looked at home prices in Vancouver, Calgary, Edmonton, Toronto and Montreal, using data from 2010 to 2016.

Vancouver and Toronto stood out for home price gains in that time frame: the West Coast city saw prices jump by 48 per cent, while in the Six, they climbed by 40 per cent.

The CMHC said it had numerous reasons for only looking at data up to 2016.

First, that was the only data they had; second, they wanted to examine the “period of price growth in Canada, and not the policy reactions that happened in late 2016 and 2017.”

But a lack of analysis of those policy changes didn’t stop the CMHC from issuing a strong conclusion on what should be done to alleviate house price pressure.

“Measures targeted at alleviating supply challenges are more likely to have positive impacts on high-priced markets than measures focused on the demand side,” the CMHC said in a news release.

Foreign buyers’ taxes have been implemented in two regions across Canada.

B.C. introduced a property transfer tax (PTT) of 15 per cent for the Metro Vancouver area in August 2016, while Ontario rolled out its Fair Housing Plan, which included a 15-per-cent non-resident speculation tax (NRST) for the Greater Golden Horseshoe region (including Toronto and surrounding areas), in April 2017.

The CMHC may not have analyzed the effects of those taxes, but others have.

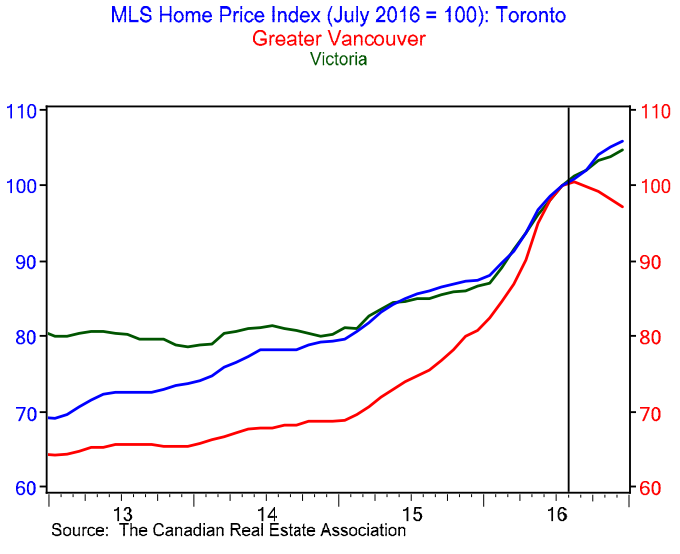

A chart produced by BMO chief economist Douglas Porter in January 2017, showed that Greater Vancouver home prices were yanked down compared to other cities across Canada following the introduction of the tax.

At that time, Vancouver was the only region with a foreign buyers’ tax. The measure didn’t apply in Victoria, and a tax hadn’t yet been introduced in Toronto.

Get daily National news

Prices just kept climbing in those cities.

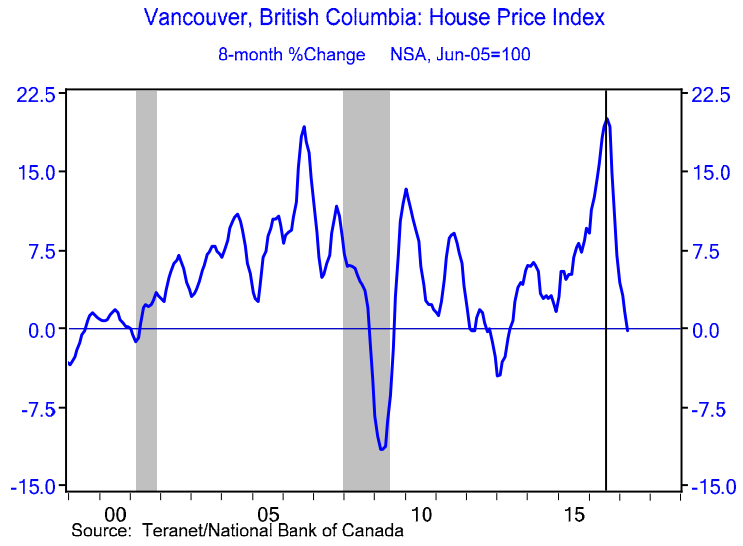

A subsequent chart, issued by Porter in June 2017, showed that Vancouver home prices stayed mostly unchanged in the eight months after the foreign buyers’ tax came into effect — a significant change from the 20 per cent runup in prices that happened in the eight months before it was implemented.

“One narrative we are hearing a lot of recently is that the Vancouver market is supposedly shaking off last year’s non-resident tax and is firing back up,” Porter wrote at the time.

“While it is true that sales are coming back from the depths, the market is much better balanced now than a year ago, as evidenced by the calm in prices.”

READ MORE: Vancouver home prices may have finally shaken off foreign buyers’ tax: index

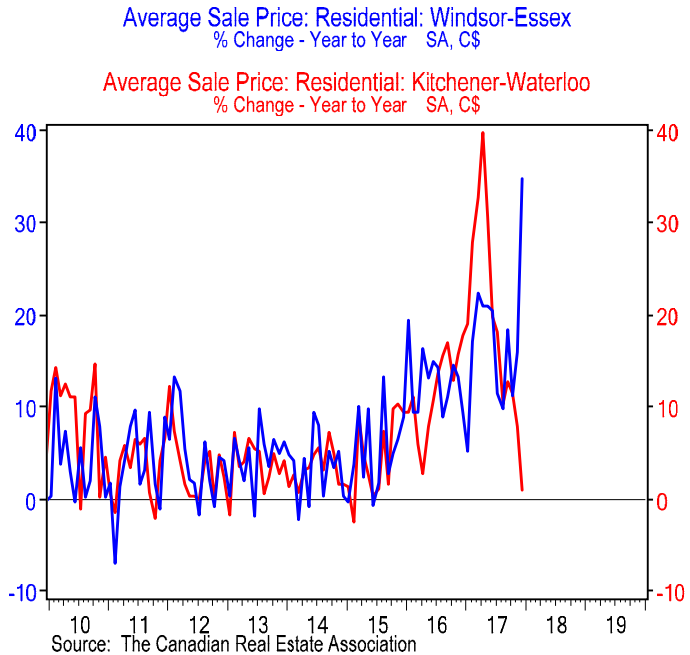

Porter observed a similar trend in Ontario after the implementation of the Fair Housing Plan.

He compared Kitchener-Waterloo, which was affected by the foreign buyers’ tax, against the Windsor-Essex area, which was not.

There’s also evidence to suggest that the foreign buyers’ tax and other measures helped to clamp down on speculation in Vancouver.

Data provided to Global News by TransUnion in June 2017, showed average new mortgage balances dropping in Vancouver, even as they grew nationally.

Matt Fabian, TransUnion’s director of research and analysis, told Global News at the time that policy changes like the foreign buyers’ taxes and new stress tests for mortgages had helped to stop speculation in Vancouver.

“I think the people that were speculating on real estate seem to have stopped, and that contributed to some of the drop,” he said.

In an email, CMHC said 2016 represented the endpoint for its data because that was all it had when its research began.

The corporation added, “This report is only a beginning and there will be opportunities to study trends in the post-2016 period in future work.

“Evidence suggests that foreign buyers have an impact on housing demand and prices, but other factors were found to be more important.”

In its report, the CMHC attributed 75 per cent of the increase that Vancouver home prices saw from 2010 to 2016 to “conventional economic factors” such as “higher disposable incomes, positive population growth and low mortgage rates.”

The corporation blamed those factors for 40 per cent of the price growth in Toronto.

And while the CMHC acknowledged to Global News that foreign buyers have an impact on housing, the corporation characterized it as a small one in its report.

In reaching this conclusion, the CMHC cited a Statistics Canada release looking at non-resident home ownership in Vancouver and Toronto.

That report, released in December 2017 (after the endpoint of the CMHC’s data), had many findings.

One of them was that non-residents owned 4.8 per cent of residential properties in Vancouver, and 3.4 per cent in Toronto.

The CMHC also said that non-resident ownership was more prevalent among condos (seven to eight per cent) than it was among single-detached homes (two to three per cent).

“Although we do not have historical data to correlate changes in foreign ownership with increases in housing prices, the prevalence of the stock of non-resident investment in condominium apartments makes it difficult to state that foreign investment is a major causal factor in driving prices higher, given that the prices of condominium apartments declined relative to single-detached homes,” the report said.

But different ownership levels emerged when you looked at factors such as municipality, housing type and the years in which homes were built.

READ MORE: Foreign buyers ‘not the problem’ in Canada, says CEO of Chinese overseas real estate portal

Andy Yan, director of SFU’s City Program, found that non-residents owned as much as 19 per cent of condos in the City of Vancouver that were built from 2016 to 2017.

In an interview with Global News, Yan said there are two ways to look at housing markets.

“There’s the view from Ottawa and a view on the ground, and our views aren’t necessarily the same,” he said.

“This report itself just looks at the overall Metro Vancouver market, but it doesn’t look specifically within the respective municipalities of the region.”

Yan said the CMHC’s report represents a “beginning,” to “give us a more complete understanding of the housing market.

“But then, it also I think needs a deeper look in toward particular municipalities.”

READ MORE: In Vancouver, you’re competing with non-residents for condos worth as little as $600K

In an email, CMHC said, “We acknowledge there are pockets within markets that have higher proportions of foreign buyers than others.

“Despite the relatively high proportion of foreign buyers you are pointing out in condos, the majority of the price pressure in both Toronto and Vancouver has come from single-family homes where the concentration of foreign ownership is lower, but where supply constraints are more acute,” it said.

The CMHC stressed that it doesn’t dispute that foreign buyers affect home prices.

Once more, the CMHC said its own analysis suggests foreign ownership is low.

But it added, “This remains an important area of focus for CMHC and this is why we are working with different partners to gain more information on it.”

- With files from Ted Chernecki

Comments