It seems Torontonians can’t get enough of clicking on real estate websites that have recently started listing sold prices for homes in the city. Chatter on social media boards suggest that even homeowners with no plans to buy or sell can’t resist the temptation to check out what their neighbours got for their properties.

While residents of Toronto are now able to access that information on their own, most Canadians aren’t so lucky. Soon, though, that may change.

In Toronto, websites like HouseSigma and MongoHouse have made sold prices publicly available after the Federal Court of Appeal recently ruled against the Toronto Real Estate Board (TREB), which has long argued such information the Multiple Listing Service (MLS) should only be shared by realtors with their clients. The case will now likely make its way to the Supreme Court, with the final ruling affecting all of Canada.

READ MORE: Here’s what the new mortgage rules will do to home prices in 2018: Royal LePage

Should the Supreme Court uphold previous rulings, “listing and sold prices will be publicly available everywhere,” said Toronto-based real estate lawyer Bob Aaron.

Aaron is confident the final verdict will come down in favour of the Competition Bureau, which brought the case against TREB. But a decision might be a year or more away, he adds.

Still, home sellers outside Toronto may already be able to get some answers online.

READ MORE: Number of home sales expected to drop further in 2018 due to new mortgage rules: CREA

Instant home valuations now available online for many Canadians

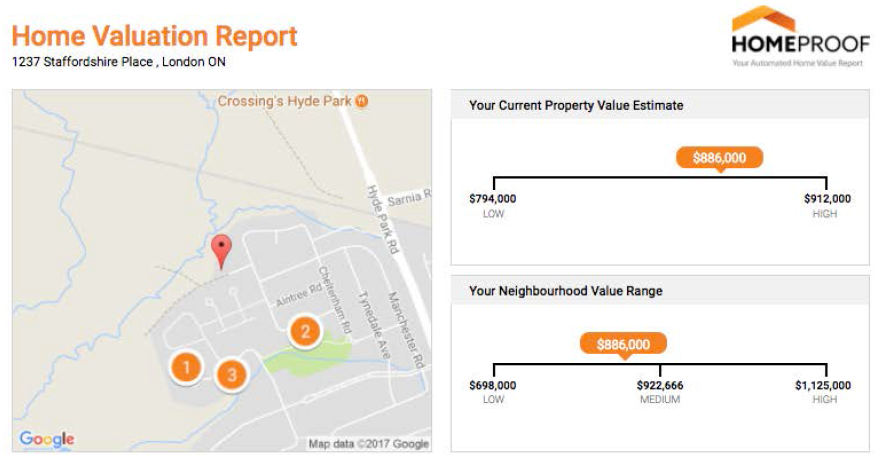

For example, HomeProof, which launched in November, allows homeowners to get an estimate of how much their house might be worth in a snap. The service relies on information from municipal property assessments, among other sources, to provide an instant valuation report along with the sold prices of three comparable nearby properties.

The service costs $79, but the fee is waived if users agree to be connected with a mortgage broker or real estate agent, who will foot the bill instead. Other than sharing their contact information with the real estate professional, there are no additional obligations for customers who use the service for free, said James Hayes, CEO and co-founder of Mobials, which created HomeProof.

READ MORE: New mortgage rules 2018: A practical guide

So far, the service is available throughout Ontario and British Columbia, as well as in Calgary, Edmonton, Winnipeg, Montreal and Quebec City.

Aaron said the service would be “of limited use” to prospective home sellers, based on his experience with property assessment provided by Ontario’s Municipal Property Assessment Corporation (MPAC).

- Posters promoting ‘Steal From Loblaws Day’ are circulating. How did we get here?

- Canadian food banks are on the brink: ‘This is not a sustainable situation’

- Is home ownership only for the rich now? 80% say yes in new poll

- Investing tax refunds is low priority for Canadians amid high cost of living: poll

“MPAC data is notoriously unreliable,” said Aaron, adding that it doesn’t reflect market data.

In fast-appreciating real estate markets like Toronto and Vancouver, even an assessment that is six months old might undervalue a property by tens — if not hundreds of thousands of dollars — he said. And the latest-available sold prices MPAC has at-hand might be several years old, he added.

READ MORE: As tougher federal mortgage rules loom, will Canadians turn to credit unions?

Hayes, though, said HomeProof uses municipal property assessments in conjunction with other sources such inflation numbers and data from the Canada Mortgage and Housing Corporation (CMHC). Extensive testing showed the tool’s results were accurate, he said.

And HomeProof, whose home valuation prices are provided as a dollar figure within a broader range, is only meant to be a homeowner’s first step in the selling process, said Hayes.

“HomeProof is a benchmark,” he told Global News, adding it’s not meant as a substitute for getting a valuation from a real estate agent.

Rather, it’s an online pit-stop for that moment on your couch in the evening when you start thinking about putting a “for sale” sign on your lawn and searching for information on the web that might give you an idea of how much your home is worth.

WATCH: New mortgage rules mean you might have to buy a smaller home

Publicly available sold prices would be ‘a big game changer across the country’

Home valuations may be more of an art than a science, but real estate agents will tell you, the key ingredient is recent sold prices for comparable nearby properties.

That information becoming widely accessible across Canada would be “a big game changer,” said Aaron.

What you really need when assessing the value of your home is “real-time sale prices,” he added.

Asked about whether HomeProof plans to incorporate MLS sold prices should they become publicly available, Hayes said the Supreme Court decision is something that “we’re watching.”

READ MORE: On Vancouver housing, Bill Morneau cites ‘stress tests’ that don’t seem to have cut prices

Opening up the MLS would allow Canadians to get a much better idea of the market they’re facing, said Aaron, enabling them to make decisions about when and if to sell.

But if you’re thinking your online research might one day spare you a real estate agent’s fee, think again, said Aaron.

Knowing how much your house should sell for and being able to sell it for that or a better price are entirely different things, he noted.

“I would know exactly what my house is worth, down to the penny, but I would be very bad at marketing it.”

Comments