Editors Note: This story has been corrected to note that the government did not announce capital gains tax changes on Dec. 7, 2015 but instead introduced other tax changes, one of which increased the amount of tax wealthy Canadians pay.

As Finance Minister Bill Morneau is pressed in the House of Commons for details on the circumstances of the sale of shares he held in his family business, Morneau Shepell Inc., Global News has analyzed insider trading reports of the company and discovered that Morneau’s father sold a significant number of shares days before his son announced a major tax policy change.

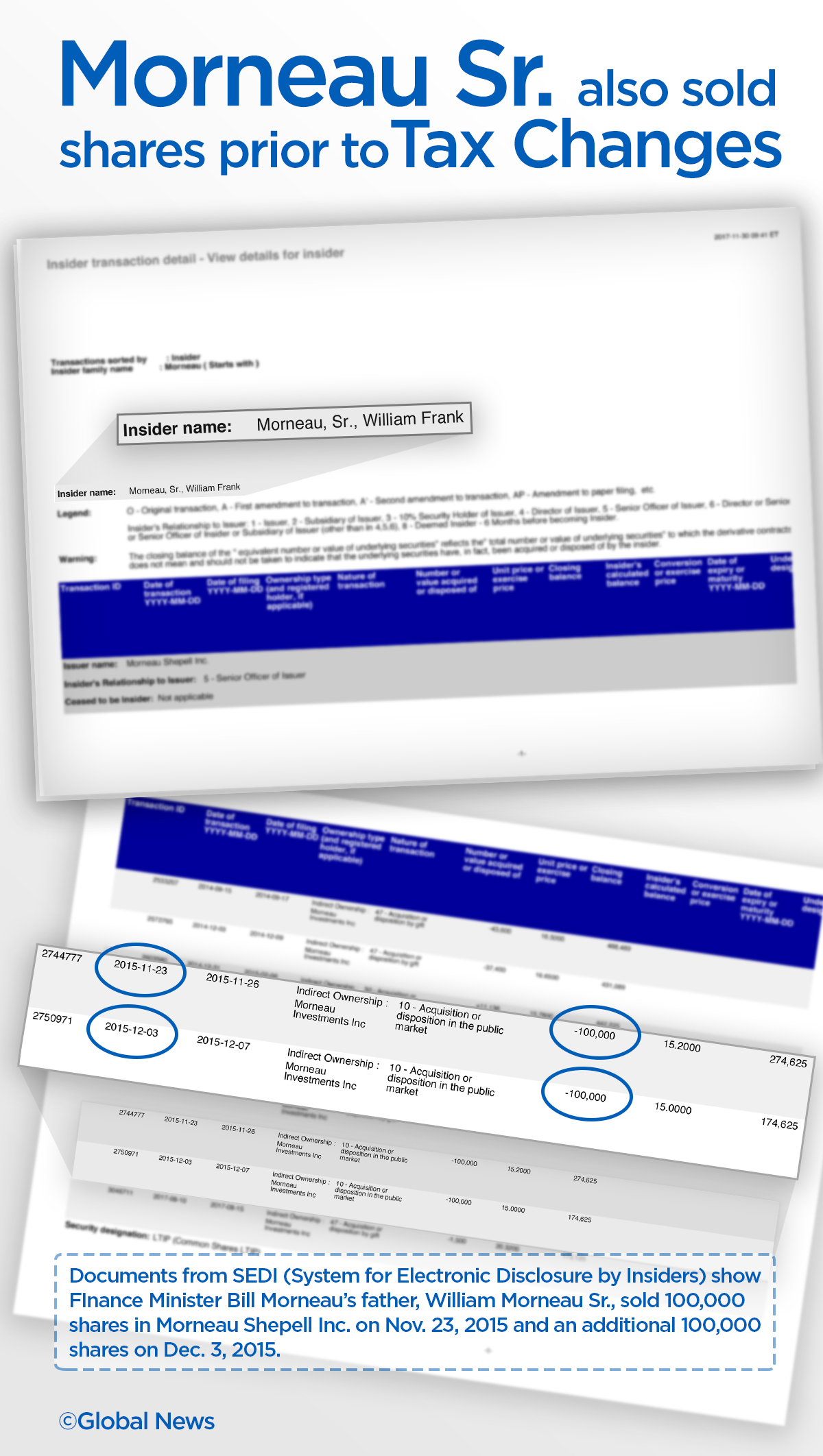

Regulatory filings show that William F. Morneau Sr. sold 100,000 shares of Morneau Sheppell Inc. (MSI) at a price of $15.20 per share on Nov. 23, 2015, and sold another 100,000 shares on Dec 3, 2015, at a price of $15 a share.

On Dec. 7, 2015, Morneau, the finance minister, tabled documents in the House of Commons which announced his government’s intention to change tax rules that would increase taxes on wealthy Canadians as of Jan. 1. 2016.

According to historical share price data published by Yahoo Finance, MSI shares dropped from $14.90 a share on market open of the morning of Dec. 7 to $14.09 a week later, on the morning of the Dec. 14. That represents a drop in value of just over 5.4 per cent.

Morneau has said — as recently as Wednesday in the House of Commons — that he sold “some shares” in MSI after the 2015 general election, though he has not confirmed details of that sale, such as the date it took place. The National Post, though, has reported that Morneau sold 680,000 shares of MSI on Nov 30.

On Thursday Morneau said he did not know the exact date of the sale, having only provided instructions to his financial advisor to sell “some shares.”

The Liberals have argued this week that the drop in the value of Morneau Shepell shares — and the 2.4% drop in the value of the broader market index, the TSX Composite — was unrelated to the finance minister’s Dec. 7 tax announcement and, in any event, could hardly be considered a market-moving event. The Liberals say they telegraphed the tax change during the just-concluded election campaign.

Get daily National news

“We campaigned to 36 million Canadians that we would raise taxes on the one-per-cent, which we did,” Morneau said in the House of Commons Wednesday. “As everyone knows, except for perhaps the opposition, no one knows what the stock market will do in advance.”

A spokesperson for Morneau Shepell Inc., Heather Macdonald, said in an emailed statement sent to Global News Thursday that “individual shareholders (including insiders) elect to buy or sell shares from time to time, but Morneau Shepell does not have insight into the reasons for their transactions.”

WATCH: Morneau reiterates desire to have opposition repeat accusations ‘in the foyer’

Global News was unable to reach William Morneau Sr. to comment on his trading activity.

But in the House of Commons Thursday, his son said no one outside “a close circle” of advisors in government knew about the timing of the announcement of the tax changes.

BMO Wealth Management distributed a note to its clients after Morneau tabled his tax changes on Dec. 7, 2015 advising “affected individuals may wish to consider the

possible benefit of accelerating the recognition of discretionary income or capital gains to 2015” in order to avoid paying extra taxes.

In the House of Commons over the last two days, members of the opposition have alleged that the timing of the sale of shares by the finance minister was inappropriate.

“Somehow, thousands of shares in Morneau Shepell were sold a few days before a major tax announcement. When people say they no longer believe politicians and that they think we are all crooks, that is why,” NDP MP Alexandre Boulerice said in the House of Commons Wednesday.

Both Morneau and Prime Minister Justin Trudeau challenged opposition MPs to repeat allegations of inapproprate trades outside the House of Commons. In the House of Commons, MPs are protected by parliamentary privilege and therefore can make comments which, outside the House of Commons, might leave them open to libel and slander lawsuits.

“One of the ways for Canadians to judge what members say is to see whether they are prepared to repeat their comments outside the House, where there is no parliamentary privilege,” Trudeau said in the House of Commons Wednesday. He made the same point again Thursday. “I would suggest that my friend opposite (Boulerice) be very explicit in his comments, inside and outside the House. We will see if he really wants to support the allegations he is making.”

COMMENTARY: Hey, Minister Morneau? Wouldn’t a blind trust have been nice?

Trudeau characterized the insinuations made by opposition members in the House of Commons that Morneau the finance minister’s sales of shares was prompted by “inside knowledge” as a “smear campaign” and “unfounded, baseless, personal attacks.”

The Conservatives, on Wednesday, citing conflict-of-interest allegations involving Morneau’s personal financial arrangements, called for Morneau to resign as finance minister.

Morneau Sr., the founder of Morneau Shepell, remains on the company’s board of directors as honorary chair. He has had a long and distinguished career in business and has served on a number of corporate and charitable boards. In 1999, Pope John Paul II made him a Knight Commander of the Order of St. Gregory the Great and in 2012 Pope Benedict elevated him in that order to “With Star,” the highest honour a Catholic layperson can receive.

Under Ontario securities law, Morneau Sr. is considered an “insider” and, as result, must disclose acquisitions or sales of any shares in Morneau Sheppell. Global News has reviewed Morneau’s regulatory filings for his acquisition or disposition of MSI’s common shares. The first entry is dated Jan. 1, 2011, and the most recent entry is August 10, 2017.

Between March 25, 2015 and June 3, 2015, Morneau Sr. sold 67,600 shares spread out over three separate transactions.

The two trades in late November and early December 2015, a combined 200,000 shares, are easily the largest blocks of shares Morneau Sr. has sold between 2011 and 2017. In June of 2013, he sold 70,500 shares and between Sept. 4, 2014, and Dec. 9, 2014, he sold 104,000 shares in three separate transactions. Morneau Sr. has made dozens of acquisitions and dispositions of commons shares since 2011.

In its analysis of trading activity by all Morneau Sheppell insiders, Global News has found that Morneau Sr. is the only insider to have significant activity in the days before the finance minister’s tax announcement.

Comments