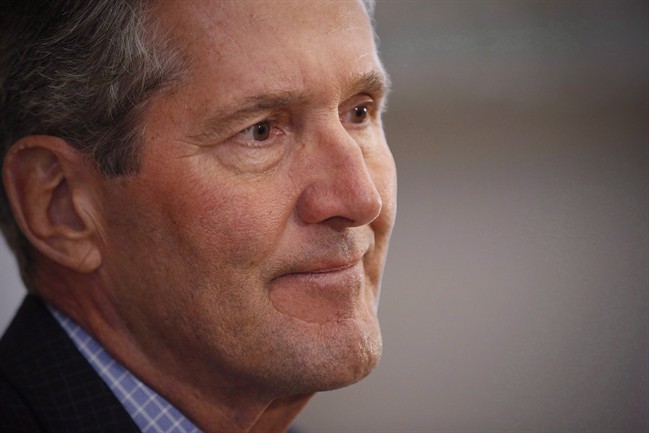

Manitoba Premier Brian Pallister has taken a hard stance against the federal government’s controversial tax reforms, which have angered business owners, doctors and farmers across Canada.

Pallister said the proposed changes are good for Ottawa but not for small businesses.

READ MORE: Tax reform: Scheer says Trudeau’s ‘arrogance is astounding’

“These proposed changes will take millions of dollars out of the hands of Manitobans and deliver them straight to Ottawa,” Pallister said. “There is no room for class warfare. No room whatsoever.”

The federal Liberal proposals to eliminate several tax incentives designed for private corporations have attracted waves of complaints from a range of sectors — as well as backbench Liberal MPs.

Pallister added his voice to the uproar out of concern about the potential damage he believes the changes could inflict on thousands of small- and medium-sized businesses and their employees.

“Ask yourself this question: who do you trust to create jobs in Canada? Is it small businesses or the federal government that taxes those small businesses?,” Pallister said. “Our government stands with the small and medium sized entrepreneurs and the people who run them in the province of Manitoba and across the country.”

“Tax professionals, the medical profession, small businesses and their representatives have uniformly denounced the proposals and have concerns over the serious impacts on small businesses, saving for retirement and Canada’s ability to attract medical professionals in the future.”

Get breaking National news

Federal Finance Minister Bill Morneau first released the three-part tax plan in mid-July.

Morneau and Prime Minister Justin Trudeau have argued that the tax system unfairly encourages wealthy Canadians to incorporate, so they can get a better tax rate than middle-income earners.

They say the changes are meant to end tax advantages that some wealthy business owners have unfairly exploited and to ensure all Canadians have a level playing field.

Morneau has also said there is a lot of misinformation circulating about the impacts of the proposals and Ottawa has been trying to bring clarity to the debate.

The package includes restrictions on the ability of business owners to reduce their tax rate by sprinkling their income to family members in lower tax brackets, even if those family members do not contribute to the company.

Morneau also proposed limits on the use of private corporations to make passive investments that are unrelated to the company.

Another change would limit business owners’ ability to convert regular income of a corporation into capital gains, which are typically taxed at a lower rate.

The government launched a 75-day public consultation period in July, which ends Oct. 2. Morneau has said he’s listening to feedback about the proposals and that he’s open to making changes, ifnecessary.

Manitoba Finance Minister Cameron Friesen wrote Morneau to demand that he hold off on the tax reforms until after the provincial finance ministers meet him in December.

A vocal opposition has grown since Morneau first announced the proposals in the summer. Critics of the plan have made it clear they won’t watch the changes go through without a fight.

An organized movement has argued the tax incentives targeted by the Liberals are critical for Canada’s economically crucial small-business sector. It insists the current tax structure is necessary for entrepreneurs, including those in the so-called middle class, who take personal financial risks when theydecide to open a company.

On Friday, Pallister will be joined by Dan Kelly, president of the Canadian Federation of Independent Business, which represents the interests of small- and medium-sized firms.

Kelly’s group has been among the most-outspoken critics of the federal plan and it called on other premiers Friday to join the campaign against the tax proposals.

“Over the past decade, most provincial governments have worked hard to lower small-business corporate tax rates to encourage job growth, investment and innovation,” Kelly said in a statement Friday.

“Unfortunately, these positive provincial actions may soon be undone by federal proposals, which will dramatically change the way that small businesses are taxed in Canada.”

Comments