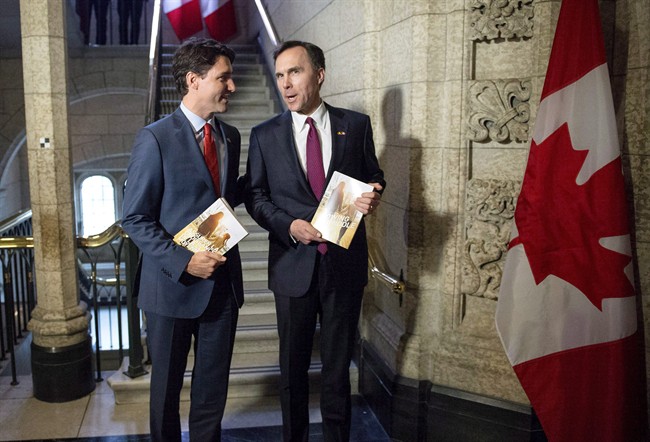

The proposed new small business tax changes do not impact family trusts or numbered companies, used by Canadian Finance Minister Bill Morneau and Prime Minister Justin Trudeau to shield their family’s vast fortunes.

Trudeau’s personal wealth, which was inherited from his father, is held in numbered corporations. And Morneau has money in a family trust and numbered corporations.

The NDP took direct aim at Morneau who argued that the Liberals are going after wealthy people who try to use small-business structures to avoid paying taxes, but would not respond to questions about his family businesses and why the new rules leave out the sheltering of funds for both Trudeau and himself.

Morneau is the beneficiary of a number of Canadian companies on one hand, and on the other states “we also want to make sure that we do not have a situation where some people that are, frankly, very well compensated, pay a lower tax rate than others,” said Trudeau.

To which I say “exactly!”

Comments