Canada’s first personal income tax was proposed in a resolution on July 25, 1917 — 100 years ago. The government bill that eventually became the basis for nationwide income taxes was introduced the next day, on July 26.

It was meant to be a way to raise extra money during the First World War effort and has stuck around since.

READ MORE: Canadian tax deadline: 9 things you need to know

“I am confident, Mr. Chairman, that the people of Canada whose patriotism during this war has been so often and so nobly proven will in the light of the present conditions, which call for it, cheerfully accept the burden and the sacrifice of this additional taxation,” said then-minister of finance, Sir Thomas White in the House of Commons. He didn’t set a specific time limit on the tax, only a suggestion in Hansard that it be reviewed “a year or two after the war is over.”

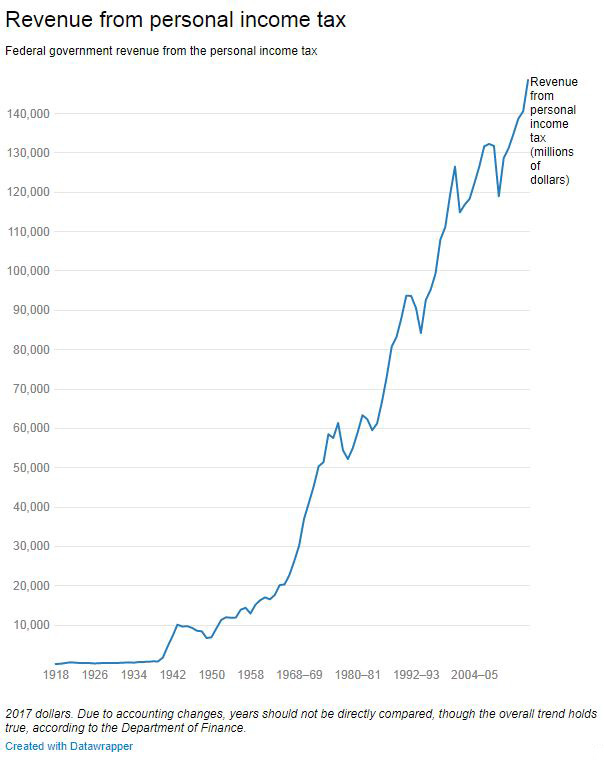

In 1918, about $118.6 million (in 2017 dollars) was raised by the federal government through personal income taxes. By 2015-16, that amount had grown to $148.5 billion, partly because of population growth, and partly due to changes in rates and income brackets.

Get breaking National news

READ MORE: Why the CRA waives penalties on many Canadians who admit they didn’t pay taxes

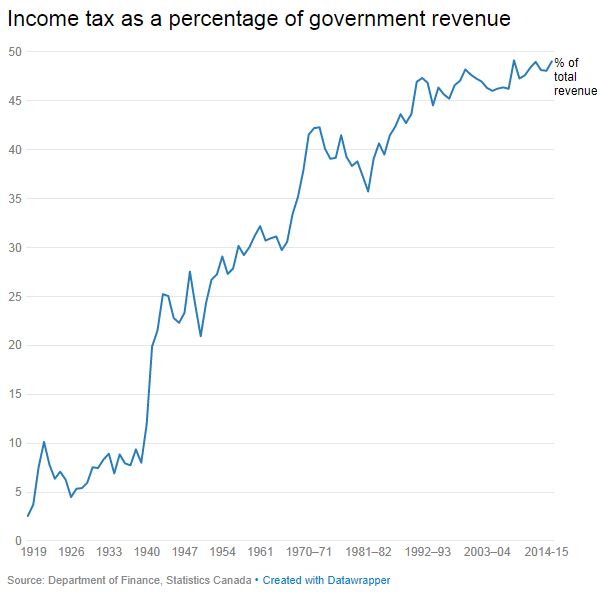

Income taxes have also formed an ever-growing portion of the federal government’s revenue. Back in 1918, the government made most of its money through customs duties. Even the post office made more money for the government than income tax did.

Over the last few years, personal income tax has accounted for just under half of all federal government revenue.

Comments

Want to discuss? Please read our Commenting Policy first.