Vancouver home prices may have fallen off after years of growth but now Victoria, B.C.’s quaint capital, is picking up where Lotusland left off.

In fact, it’s helping to push Canadian home prices to the highest levels they’ve ever seen.

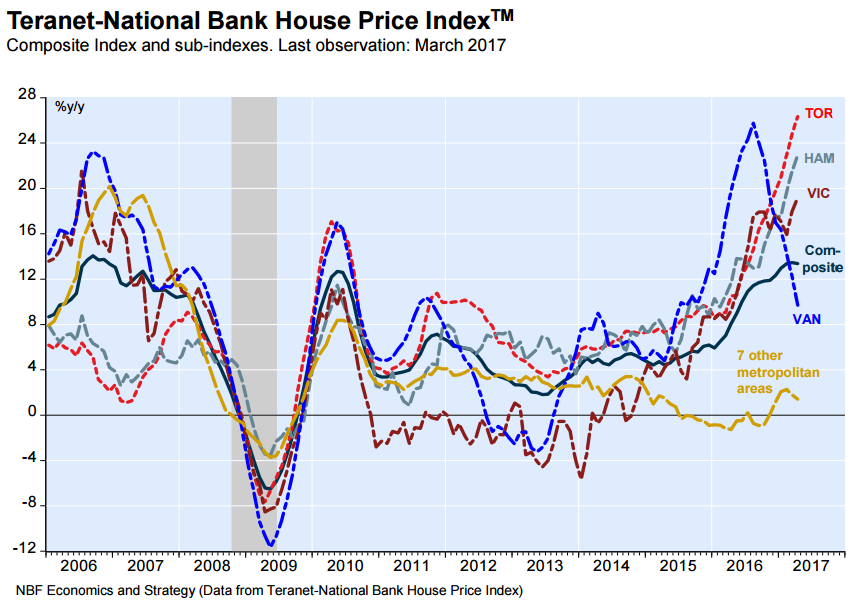

That’s according to the Teranet-National Bank House Price Index, a tool that tracks home prices by looking at residences that have sold at least twice in 11 metropolitan markets. The results for April 2017 were released on Friday.

The index showed home prices growing by 1.2 per cent in April over March, the 15th straight month in which they’ve gone up.

Meanwhile, prices grew by 13.4 per cent year-over-year, down from 13.5 per cent in March and representing the “first deceleration in 15 months.”

Home price gains year-over-year were driven by three cities: Toronto, where prices grew by 26.3 per cent; Hamilton, where prices jumped by a record 22.9 per cent; and Victoria, where home prices hiked by 19.2 per cent.

Get breaking National news

The gains were enough to push the index to the highest level on record.

And while Vancouver home prices remain Canada’s highest, the city only saw year-over-year growth of 9.7 per cent in April, which was below the average.

READ MORE: B.C. city now ranks among world’s top two luxury home markets, and it’s not Vancouver

The index was released in the same week as a report from Christie’s International Real Estate. It showed that Victoria now ranks second on a list of the world’s hottest luxury home markets — Toronto was number one.

The report came as Victoria recorded its “best ever” year for luxury home sales, which Christie’s said was driven by the 15 per cent property transfer tax that the B.C. government imposed on foreign buyers in Metro Vancouver last year.

Vancouver home prices started dropping once the tax came in, according to BMO, but they kept growing in Victoria, where the tax didn’t apply.

The median price of a single-family home in Greater Victoria was $730,000 in April, according to the city’s real estate board.

A condo’s median price was $351,000.

Servicing the mortgage of a single-family home in Victoria would have cost 59.3 per cent of the city’s median pre-tax household income in the fourth quarter of 2016, according to RBC’s Housing Affordability report.

It would have cost 34.1 per cent of median household income to service the mortgage on a condo.

READ MORE: Here’s what $500K homes look like in 14 Canadian cities

But the most recent housing prices out of Victoria suggest the market is “gradually moving toward a more balanced state compared to the record-setting pace of 2016,” real estate board president Ara Balabanian said in a news release.

“Local agricultural production has been delayed due to the late spring, and so has the local real estate market.” he said.

He added, however, that “inventory is still low, which means that buyers may encounter multiple offer situations in some of the high-demand areas.

“There is still more demand than supply.”

- With files from Reuters

Comments