“I’ve had better days.”

That was Unifor president Jerry Dias on Friday, hours after he announced that General Motors (GM) was cutting 625 jobs at the CAMI Assembly plant in Ingersoll, Ont., which employs 2,800 people.

It’s a facility where workers will assemble the auto giant’s GMC Terrain and Chevrolet Equinox SUVs until July, when production of the latter will be transferred to Mexico.

READ MORE: General Motors moving more than 600 jobs in Ontario to Mexico for cheaper labour: union

A spokeswoman for GM Canada said the cuts relate to a change of production from an older Equinox to a next-generation model. GM is also transferring production of the Terrain to Mexico.

Unifor called the job cuts a “betrayal” that shows “why NAFTA is a terrible deal for Canadian jobs.”

They come years after the federal and Ontario governments gave GM Canada and Chrysler Canada a combined $13.7 million to support the auto sector amid the financial crisis, in 2009.

WATCH BELOW: Kevin O’Leary slams PM after GM job cuts saying he ‘didn’t pivot’ with Trump election

But the 625 Ingersoll jobs are just the tip of the iceberg when it comes to what Canada has lost to Mexico in the decades since NAFTA came into force.

And it’s a move that has a union leader lining up with U.S. President Donald Trump, at least when it comes to free trade.

Car trouble

It’s difficult, even impossible, to quantify how many manufacturing jobs Canada has lost to America’s southern neighbour.

But the latest cuts are far from the first time that auto manufacturing has shifted southward, where workers can earn as little as US$2.90 per hour, while Canadian workers have been known to make as much as $30 per hour, The Globe and Mail reported.

In 2015, Toyota announced it was moving production of the Corolla from a plant in Cambridge, Ont. to a facility in Guanajuato, Mexico. The company later announced that the Toyota RAV4 would be produced at the Cambridge plant.

Earlier that year, the federal government earmarked $100 million in taxpayer funds to help Toyota expand its operations in Ontario.

And in 2008, German automaker Daimler announced it would close its Sterling Trucks facility in St. Thomas, Ont., The Toronto Star reported.

Daimler was opening a plant in Saltillo, Mexico, around the same time that it was closing up shop in St. Thomas, union officials told the newspaper.

News like this didn’t always garner so much attention. But that’s changed with the election of Trump, who earlier this month personally threatened tariffs against automakers that have tried to move their operations south of the U.S. border.

The U.S. president has also heralded an era of renewed skepticism about NAFTA, and fueled concerns about how it has allegedly taken jobs away from Americans.

Get weekly money news

Dias is no fan of Trump’s heated rhetoric around immigration and other issues. But he thinks the president, who hasn’t exactly spoken highly of unions, has a point when it comes to free trade.

“The man is cracked in different ways,” Dias told Global News.

“When it comes to the fact that American workers have gotten screwed, he’s right.”

NAFTA lifted tariffs between Canada, the United States and Mexico, and it opened the door for companies to choose where they wished to manufacture their products within North America.

But data released by CIBC in November shows that Canada has lost ground to Mexico in the two decades that NAFTA has been in force.

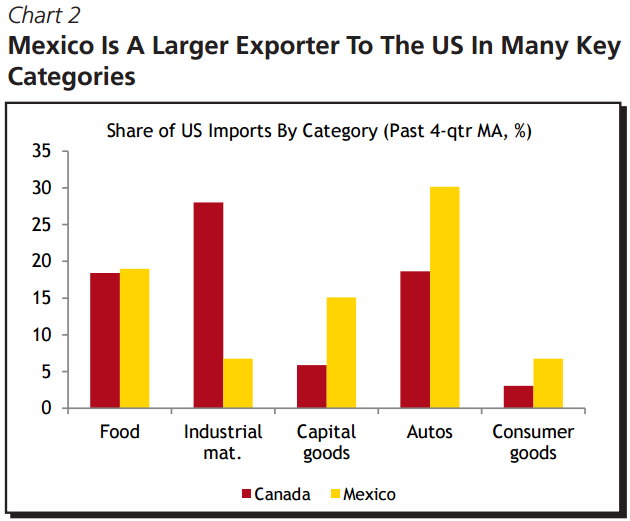

The chart below makes it clear who’s gained the upper hand.

Mexico beats Canada on auto exports.

And other sectors.

Dias offers more numbers to suggest NAFTA hasn’t been great for Canada.

“Pre-NAFTA, Canada had a $12 billion trade surplus in manufacturing, today we have a $120 billion deficit,” he told Global News.

“The overwhelming majority of our trade is in NAFTA, so $12 billion surplus, $120 billion deficit, 22 years.”

READ MORE: Protecting Canada from a U.S. border tax could lie in NAFTA negotiations: Trump adviser

These trends have also come as manufacturing has come to occupy a smaller share of Canadian employment.

In 2001, manufacturing (blue) made up a 15.26 per cent share of total employment in Canada (green).

That number dropped to 8.37 per cent in 2015.

A downward trend is even clearer when you look at employment in Canada’s auto sector alone.

Trends like these aren’t particular to Canada, and one can’t necessarily attribute them to Mexico alone.

Other high-income countries like France and the U.S. are also seeing manufacturing declines, Keith Head, a professor at UBC’s Sauder School of Business, told Global News in an email.

Nevertheless, Canada clearly hasn’t gained a manufacturing advantage in this free trade environment, said John Ries, a UBC professor specializing in international trade at UBC.

“What has happened with free trade is, in a lot of manufacturing industries, Canadians don’t have a competitive advantage, and end up being a bit higher-priced than foreign producers,” he told Global News.

“It’s very hard to know which country that Canada’s losing jobs to.”

GM’s decision to locate in Mexico makes sense from a business perspective, Ries added.

The loonie’s value against the U.S. dollar has plummeted in recent years, going from around $0.90 in January 2014 to $0.76 on Friday. That decline has fed hope that Canadian manufacturing could see increased activity.

But the Mexican peso has fallen in tandem with it, going from MXN$0.07603 in January 2014 to $0.04788 on Friday.

So Ries understands GM wanting to move productions to Mexico.

But he also thinks it’s a dangerous move for the auto giant at a time when the U.S. government has floated the idea of a 20 per cent tariff on Mexican imports to help pay for its wall along the southern border.

“This is kind of a surprising thing to do if the U.S. does cut off access from Mexico into the U.S.,” Ries said.

Given all the “sabre-rattling” that’s happening around trade with Mexico, he would have expected a company to locate somewhere else.

“This is the exact opposite of what I would expect.”

Dias understands that Canada is facing competition for trade with countries besides Mexico — China, for example, or India.

But, like Trump, he still feels it’s time for the agreement to be renegotiated.

And his union thinks that Prime Minister Justin Trudeau could be a little more like him, and step in to protect jobs in the auto industry.

“You can’t dodge the numbers,” Dias said.

- Jasper mayor says CN Rail relocation will be devastating: ‘Deeply disappointed’

- Retired Quebec teacher buys winning lottery ticket at last minute, wins $40M

- N.B. election: Higgs went to ‘very dark place’ with Liberal joke, opponent says

- GM, Volvo, Land Rover vehicles among those in big recall. What to know

Comments