On Tuesday, TransUnion released a study that concluded even a small hike in interest rates could leave almost a million Canadians unable to manage their household finances.

READ MORE: Two-thirds of Canadian couples enter marriage or common-law relationship in debt

The problem is that far too many Canadians are living on the brink: they may find themselves able to manage their debt at the current pace, but if just one thing changes — a car that needs repairing, a death in the family, or a job lost — they’re unable to cope and may be building up further debt.

“It’s a bit of a house of cards. If we pull one of those cards away, then all of a sudden, they’re going from okay and getting by to … struggling quite a bit,” said Jeff Schwartz, executive director of Consolidated Credit Counseling Services of Canada.

Here are some ways you can ensure you’re able to cope should an emergency arise. While they may seem like common sense, most people don’t do these simple things that could one day be the difference between being overwhelmed with debt and being able to cope.

1. “Pay yourself first”

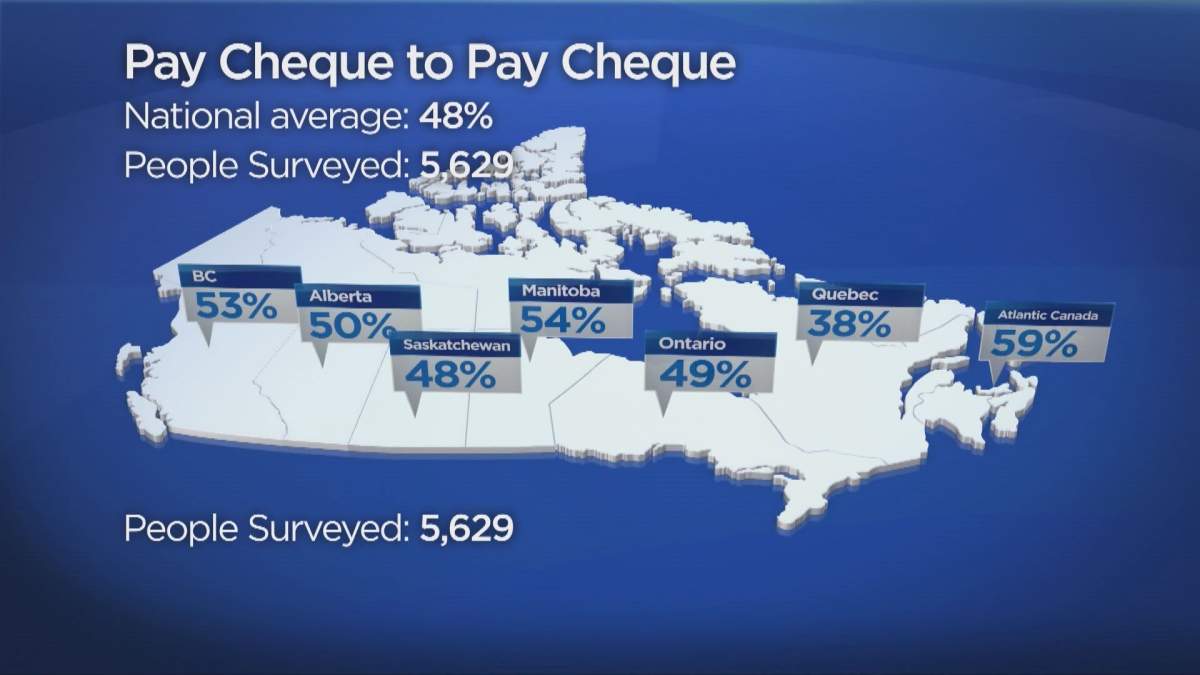

Back in the late 1970s and late 1980s, people were saving in the high teens to 20 per cent, Schwartz said. Now, it’s less than five per cent. That means that there is no room for movement. In fact, according to the Canadian Payroll Association, almost 50 per cent of Canadians are living paycheque to paycheque.

“If they miss a paycheque, they don’t have any savings to go into,” Schwartz said. “And 50 per cent…is an astounding number in my eyes.”

Schwartz said that Consolidated Credit suggests people have three to six months’ savings tucked away. And while that might sound a bit daunting to some, there are ways you can do that easily. One is to put small amounts into a liquid bank account like a tax-free savings account. It might take a while to get there, but it’s something you should work towards.

“Pay yourself first,” Schwartz said. “Banks and employers are of the ilk that you can do a payroll deduction and funnel it to a savings account.”

Get weekly money news

The key is to make it automated and invisible, so that you’re less likely to want to touch it.

2. Try to pay down debt

“If you’re trying to pay down debt and put money away, don’t add to your debt,” Schwartz said.

While this may sound obvious, oftentimes most people are living beyond their means, always after new and upgraded gadgets like new smartphones and bigger, better televisions.

Not using your credit card is the first way to stop living beyond your means. As well, try to pay more than the minimum, otherwise you could be paying that credit card — and the accumulating interest — for a very long time.

“At the bottom of your credit card bill, it tells you how long it’s going to take you to pay that off if you only pay the minimum, and that’s not just years, it’s decades,” Schwartz said.

3. Pinch nickels and dimes

Track all of your spending. Consolidated Credit has an app that allows you to track all of your spending. You can even download it to a spreadsheet, which allows you to see just where that $20 you once had in your wallet disappeared to.

Tracking your spending can be a bit tricky. That’s because with the new technologies like tap-and-go, it’s easy to start sucking money out of your bank account without even realizing it. So try paying in cash more often.

4. Unsubscribe from daily deal emails

This is all about avoiding temptation.

We want to get deals, so oftentimes we turn to daily deal emails, with the intention of saving some money. The problem with that is, we may be finding ourselves spending on things we don’t necessarily need under the guise of finding a deal.

So don’t subscribe to anything and avoid spending unnecessarily.

5. Brown bag it

Schwartz said that food is one of the largest expenses in our lives.

Bringing your lunch to work each day will definitely save you money. But you can even do more. Menu-planning is one way. If you plan ahead this allows you to buy things in larger quantities and you can use the ingredients in several meals.

6. Get a financial advisor or seek credit counselling

Schwartz said that Canadians are often afraid of admitting that they may be having some difficulty with their money.

“Shame and pride play a huge roll in how we manage our money,” he said. But it’s nothing to be ashamed about.

“A lot of the advice…is quite simple. But it’s definitely not easy because it means behavioural changes; it means looking at things from a different set of eyes. Sometimes you need someone to hold your hand.”

And that someone could be a credit counsellor or a trusted financial advisor who will help you draw up a budget and find ways to pay off your debt faster.

Comments