The latest monthly statistics from the Real Estate Board of Greater Vancouver appear to raise some red flags that the Vancouver real estate bubble may be at its breaking point.

While prices continued to soar in June, a key indicator of the health of the market showed a dramatic decrease: the sales to listings ratio. In layman’s terms, it is the supply and demand of properties.

Last month there were a total of 2,618 listings for detached homes on the MLS and only 1,555 sales; a sales-to-listings ratio of 59 per cent. It is the lowest percentage of homes sold during the month of June since June 2013, the beginning of Vancouver’s sharp spike in home prices.

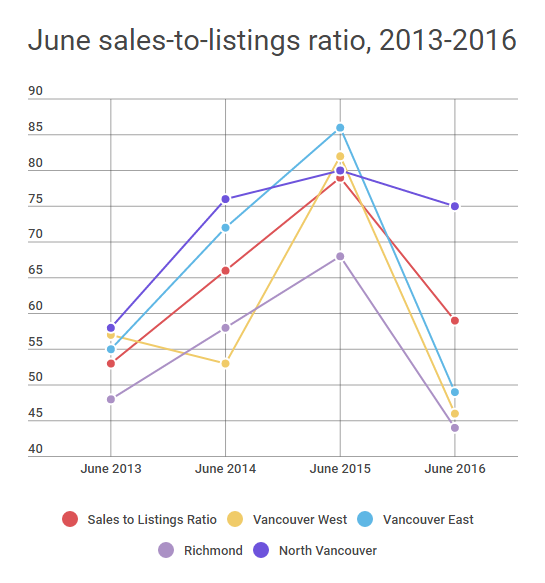

The effect was experienced throughout Metro Vancouver with some communities seeing a sharper drop than others. East Vancouver went from an 86 per cent sales-to-listings ratio in June 2015 to only 49 per cent last month.

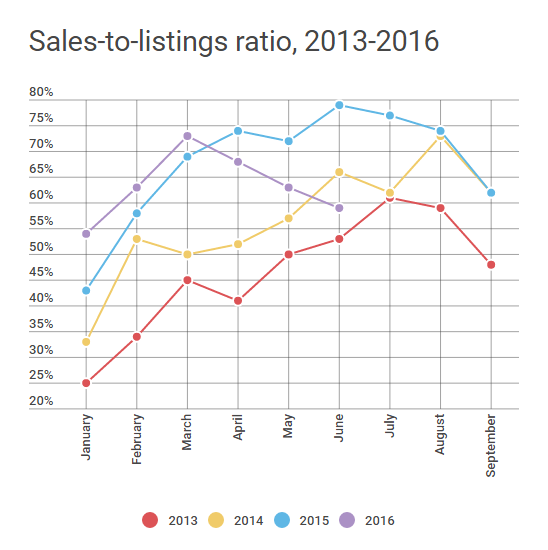

It’s a pattern that has been subtly occurring all year.

This year’s highest sales-to-listings ratio so far happened in March when 73 per cent of the month’s inventory sold. The number has been dropping each month since, albeit home prices rose faster than ever, moving up over 16 per cent between March and June.

The sales-to-listings ratio isn’t a figure that consistently increases. With the cyclical market, the ratio tends to get higher – meaning more pressure on the market – in the spring and summer before dipping to a low in January. The decrease of the last three months has been inconsistent with the pattern of years previous.

How to spot a bubble bursting

Get daily National news

UBC’s Tom Davidoff, an associate professor at the Sauder School of Business and a real estate analyst, says the first signs of a bubble bursting might be sales volume slowing down and inventory rising. A rising rental vacancy rate could also be indicative of the market slowing down as well as lenders becoming more cautious about issuing and underwriting mortgages.

In the last few months, all of these red flags have been appearing in the Vancouver market, aside from a growing rental vacancy rate.

At the end of May, the CEO of Scotiabank, Brian Porter, said they were “a little concerned” with housing prices in Vancouver and had been easing off their mortgage lending business because of too much risk.

Canada’s financial regulator, the Office of the Superintendent of Financial Insititutions (OSFI), warned just a week later that banks should be extra-cautious to whom they lend mortgages. They had found that some borrowers were misrepresenting their income or employment status when applying for loans.

The Canadian Mortgage and Housing Corporation (CMHC) also warned earlier this year that there was “strong evidence of overvaluation” in the Vancouver market. It was the first time the agency had ever made this warning in Vancouver. Among other things, CMHC insures all mortgages in Canada when the buyer of a home has less than a 20 per cent down payment.

These warnings are just part of a strong chorus issuing caution over a potentially fragile real estate bubble.

Earlier this week, Marc Cohodes, a former U.S. hedge fund manager and short-seller, told Global News he thinks Vancouver real estate is a “money-laundering induced market” that “won’t last.”

“Something is going to change and change drastically,” he added.

But it might be too soon to tell if last month’s data indicates a bubble burst is coming.

“I don’t think 59 per cent is crash territory,” Davidoff told Global News, in response to questions about the falling sales-to-listings ratio.

“When this ratio is high, buyers perceive poor options outside of bidding on a given home. There’s little reason to think that the next home they bid on will be a bargain. When the ratio is low, buyers can be picky, because if they don’t get the house in question they are likely to find another home available soon,” he added.

“If we see inventory pile up, we should be concerned about a bust.”

Vancouver real estate is “not out of the ordinary”

Cameron Muir, the chief economist for the B.C. Real Estate Association (BCREA), the professional association for B.C. realtors, is one of few who deny there is anything unusual about Vancouver’s scorching market. When asked about a bubble, Muir laughed the label off.

“This is not a shock, it’s not out of the ordinary.”

“A bubble is where prices grow at an unsustainable rate for a long period of time, where you end up seeing rampant speculation in the market place,” he added. “This current market cycle has been rather short to be calling it a housing bubble. One year of pretty strong price growth in the market is not enough evidence to suggest there is a bubble.”

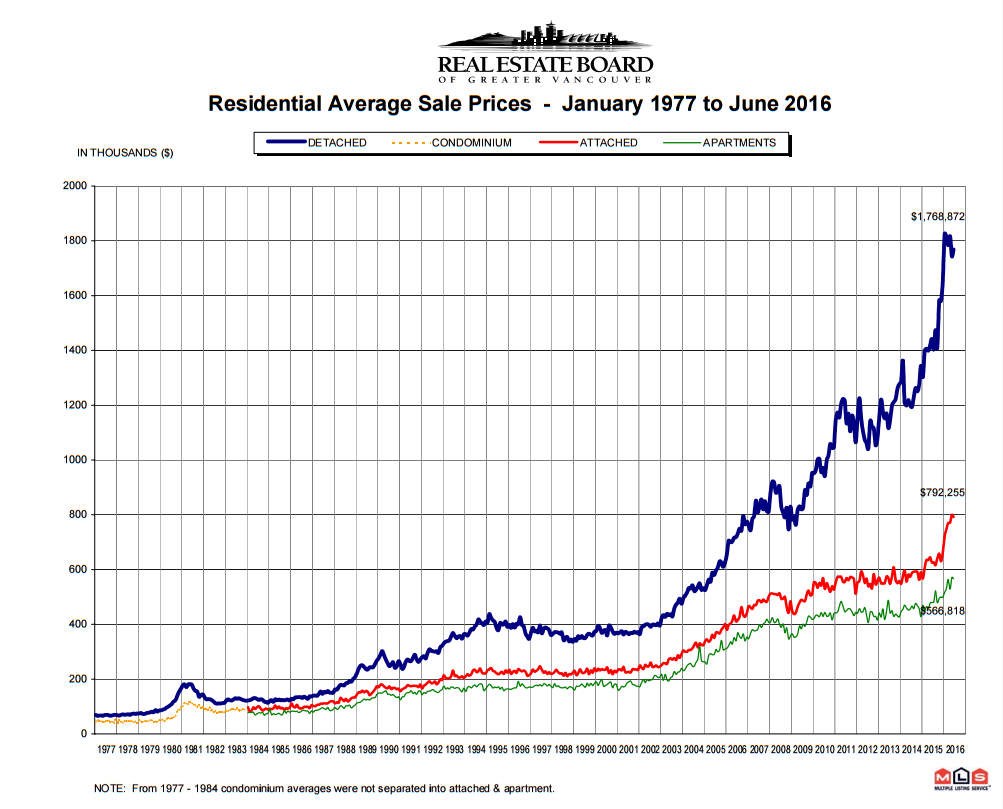

In fact, Vancouver’s detached home market has been growing at a steady rate since 2002, aside from a short hiatus around the 2008 recession. The benchmark price for these properties increased 290 per cent from 2002 to 2016. The previous 14-year period (1988 to 2002) saw an increase of 122 per cent.

“Just because you see the sales-to-active listings ratio edging lower, that’s no indication of any kind of bubble bursting. In fact, I don’t think there’s any economist around that’s telling you there is a housing bubble in Vancouver,” said Muir.

According to Muir, a balanced market typically has a sales-to-active listings ratio between 15 to 20 per cent, meaning Vancouver still has a ways to drop before we reach that threshold.

Davidoff argues that there is some indication the market is beginning to change.

“It does seem like high-end markets have cooled a bit from their amazingly scorching pace of the winter,” he said.

The benchmark price of a detached home in Greater Vancouver reached $1,561,500 in June. A home on Vancouver’s West Side is now pegged at $3,547,300.

Comments