Canada’s top one per cent of income earners pulled in an average of $454,800 in 2013.

They made 10.3 per cent of the total sum of all Canadians’ income.

And they paid an average of $151,900 in income taxes to federal, provincial or territorial governments.

Stats Canada released income data from the 2013 tax year on Tuesday, providing some insight into just how much Canada’s top-earners are taking home.

READ MORE: Pity the rich? Canada’s wealthiest see their take shrink: StatsCan

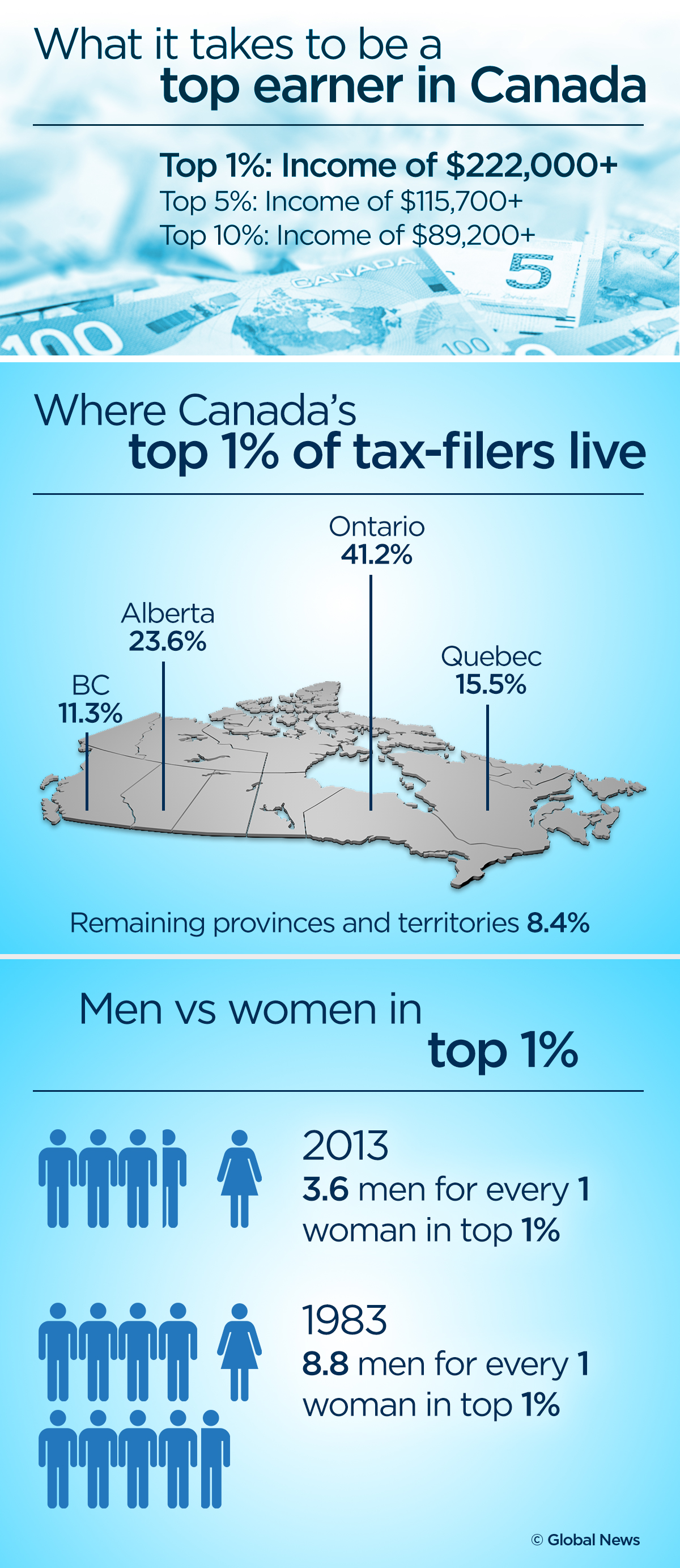

Here’s what it takes to be among Canada’s top earners:

- Top 1 per cent: income of at least $222,000. A total of 264,030 tax-filers earned that amount or more in 2013,

- Top 5 per cent: income of at least $115,700,

- Top 10 per cent: income of at least $89,200.

Where the top 1% income earners live

Get weekly money news

Ontario was home to 41.2 per cent of Canada’s top one per cent tax-filers in 2013 — a little more than the 38.9 per cent of Canadians live in the province.

Next is Alberta, with 23.6 per cent of 1 per cent income earners. Quebec has 15.5 per cent; British Columbia, 11.3 per cent.

The remaining 8.4 per cent reside in the remaining provinces and territories.

MORE: Canada’s middle class richest in the world, report says

Quebec was the only province to see a drop in its number of top one per cent income earners from the previous year, from 43,360 in 2012 to 40,825 in 2013.

Western Canadian provinces have stayed stable or increased the numbers of top income earners when compared with data from 2000. Eastern Canada didn’t fare so well: Only Newfoundland and Labrador showed an increase in top-earners since 2000.

Women continue to close the gap

For the 20th year in a row, Canadian women increased their representation in the top one per cent. But they still made up just over one in five (21.9 per cent) of the highest-income earners in 2013.

The proportion of women making up Canada’s top 0.1 per cent — those making more than $707,800 — also went up by 1.3 percentage points, to 15.8 per cent.

READ MORE: Canada’s best and worst cities to be a woman: report

The ratio of women at the top ranged from province to province. The gap between the number of men and women among the top income tax-filers was most apparent in Alberta, with men accounting for 83.4 per cent vs. 16.6 per cent for women.

Meanwhile, over in Ontario and Quebec women accounted for 24 per cent of high income tax-filers.

WATCH: When it comes to bridging the wage gender gap Canada is lagging far behind other countries. Grace Ke reports.

Comments