The country’s big banks are set to report financial results in the next couple of weeks and experts are busy weighing in with estimates about how they’ve fared over the past few months.

There’s been plenty of focus on the Canadian housing market of late given the strong run-up in prices in some places (namely Vancouver, Toronto and their surrounding areas).

Some, like bank investors and those casting a skeptical eye on the boom, are watching to see how much lenders are doling out to borrowers who are forced to take on increasingly big loans relative to their incomes in order to buy a home.

Recent interest rate cuts from the Bank of Canada have only encouraged more lending, with some fretting about a renewed borrowing boom as buyers on the sidelines are convinced to take a rock-bottom rate.

‘Moderating’

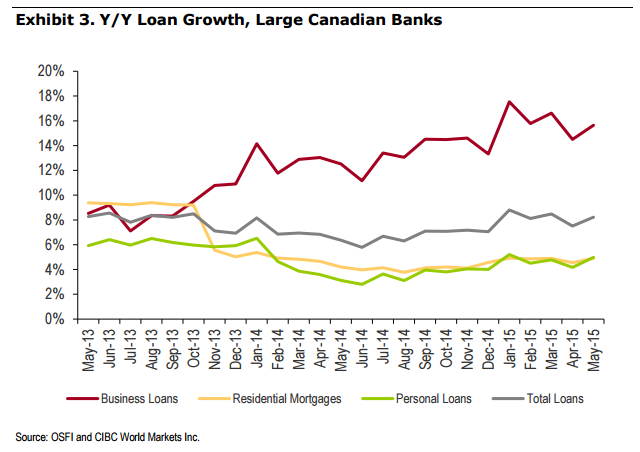

The good news for those worried about the rate-cut impact: Growth in residential home-lending, at least among the prime lenders, continued “moderating” over the summer months, experts at CIBC World Markets said in a new research note on Monday (ditto for other personal loans like auto and credit card debt).

“Growth in personal loans and residential mortgages looks to be moderating in line with recent trends,” the CIBC analysts said in a research note on Monday.

The report looked at Royal Bank of Canada, TD Bank, Bank of Montreal, Scotiabank and National Bank (CIBC wasn’t included).

MORE: Canada’s housing boom, complete coverage

As a group, growth in home lending from the big banks has come down markedly since the heady days of mid-2013 when the amount of money going into new mortgages was growing by nearly double digits. But “recent trends” – like a slowing economy, an increasingly tapped out consumer and tightening loan practices – have served to tap the brakes, experts suggest.

Major lenders passed on to customers only a portion of the central bank’s two rate cuts in the first half of the year, for example.

Loan losses

CIBC’s bank experts also said they expect big lenders to write off more loans to consumers as the economy continues to struggle through the current downturn. But ultra-low rates that are keeping payments current for most right now will help keep a lid on those losses.

Comments