VANCOUVER – A report released today finds the living wage in Metro Vancouver has risen to $20.68, up 58 cents from 2014.

The report finds that two working parents with two young children must make this amount in order to meet their basic expenses, including rent, child care, food and transportation, once taxes, deductions and subsidies have been taken into account.

The findings are outlined in Working for a Living Wage 2015: Making Paid Work Meet Basic Family Needs in Metro Vancouver, a report published by the Canadian Centre for Policy Alternatives’ BC office, First Call: BC Child and Youth Advocacy Coalition and the Metro Vancouver Living Wage for Families Campaign.

It states the cost to live in Metro Vancouver is increasing by 2.9 per cent, which is higher than the general inflation rate of 1.1 per cent for Vancouver.

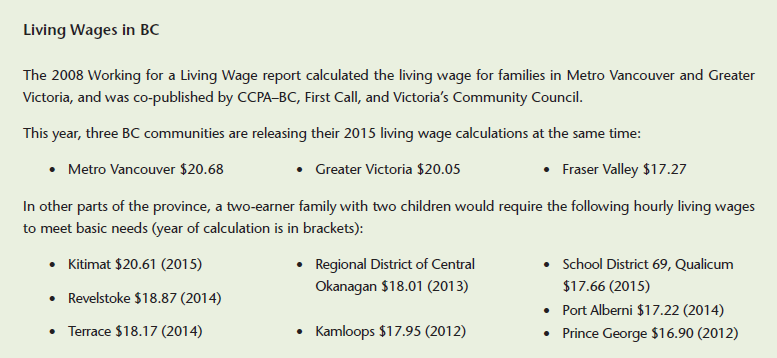

Living wage rates have also risen faster than inflation for the Capital Regional District, School District 69 (Parksville-Qualicum) and the Fraser Valley to $20.05, $17.66 and $17.27 respectively, where reports were also released today.

“The Metro Vancouver living wage rate demonstrates what many families already know: costs are increasing at a rate much faster than any increases in wages,” says Deanna Ogle, the campaign organizer with the Living Wage for Families Campaign, in a release. “Thanks to the combination of a low-wage economy and lack of government supports, many families are struggling to make ends meet.”

The biggest increases came from child care and housing. Child care increased by $83 a month and rent costs were up by $75 a month.

“Though a $20.68 hourly living wage rate seems high to some, it is important to remember that this wage rate reflects, in part, a failure of public policy to ensure affordability and a decent quality of life for all families,” says Iglika Ivanova, CCPA economist and co-author of the report, in a release. “Investing in universal affordable child care would significantly reduce the costs of raising a family and lower the living wage. For example, the proposed $10/Day Child Care Plan would reduce the Metro Vancouver living wage by $3.93 per hour, bringing it to $16.57.”

The report outlines a bare bones budget for a family in Metro Vancouver:

At $20.68 per hour for Metro Vancouver — or $37,638 annually for each parent working full-time — here’s what a family could afford:

FOOD: $783/month (based on estimates by the Provincial Health Services Authority for a nutritious diet).

CLOTHING AND FOOTWEAR: $191/month.

SHELTER: $1,573/month (includes conservative rent estimate for a three-bedroom apartment, utilities, telephone, and insurance on home contents).

TRANSPORTATION: $517/month (includes the amortized cost of owning and operating a used car as well as a two-zone bus pass for one of the parents, replaced by a discounted student transit pass, the U-Pass, for eight months of the year).

CHILD CARE: $1,324/month (for a four-year-old in full-time care, a seven-year-old in before and after school care, full-time care during winter break (one week, the other assumed covered by the statutory holidays and informal arrangements) and spring break (two weeks), and six weeks of full-time summer care). Notably, child care is the second most expensive item in the living wage family budget after shelter.

MEDICAL SERVICES PLAN (MSP) PREMIUMS: $144/month.

NON-MSP HEALTH CARE: $139/month (the cost of a basic extended health and dental plan with Pacific Blue Cross Insurance; does not include expenses only partially covered by the insurance plan).

PARENTS’ EDUCATION: $91/month (allows for two college courses per year).

CONTINGENCY FUND: $241/month (two weeks’ wages for each parent, which provides some cushion for unexpected events like the serious illness of a family member, transition time between jobs, etc.).

OTHER HOUSEHOLD EXPENSES: $734/month (covers toiletries and personal care, furniture, household supplies, laundry, school supplies and fees, bank fees, some reading materials, Internet, minimal recreation and entertainment, family outings (for example to museums and cultural events), birthday presents, modest family vacation and some sports and/or arts classes for the children).

This living wage calculation does not cover:

- Credit card, loan, or other debt/interest payments;

- Savings for retirement;

- Owning a home;

- Savings for children’s future education;

- Anything beyond minimal recreation, entertainment, or holiday costs;

- Costs of caring for a disabled, seriously ill, or elderly family member; or

- Much of a cushion for emergencies or tough times.

For a full list of communities see the Living Wage website.

Comments