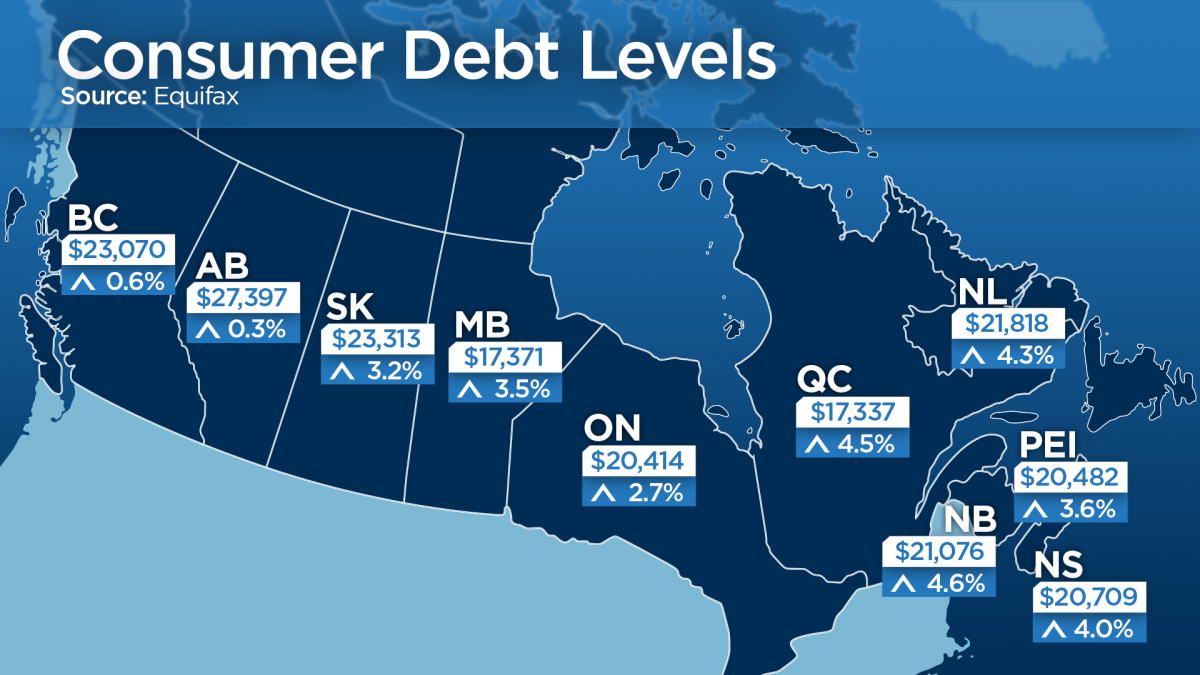

Canadians in provinces east of Ontario are diving deeper into debt at more than twice the rate of Western Canada, new data shows. However, they’re not as heavily indebted — yet.

According to consumer credit monitoring agency Equifax Canada, debt levels excluding mortgages have climbed by 4.2 per cent on average in Quebec and Atlantic Canada, compared with 1.9 per cent in B.C. and the Prairies.

MORE: Here’s the ‘worrisome’ amount of debt Canadians have built up

Average debt levels in eastern Canada however are lower, averaging $20,284 – about $2,500 less than what the average Western Canadian debt load totals. The data is for the third quarter, or three months ended Sept. 30 (compared to the same period of 2013).

For its part, average debt levels in Ontario, the country’s most populous province, rose 2.7 per cent, to $20,414. The national average rise was 2.6 per cent.

Basic needs

Experts suggest more households in eastern areas, where economic conditions have lagged, are tapping more debt not simply to shop or purchase a vehicle but cover bills and other basic costs. “It comes down to the economic environment,” Regina Malina, senior director of at Equifax Canada, said.

“There’s a need to supplement incomes,” Benjamin Tal, deputy chief economist at CIBC said.

- Canadian man dies during Texas Ironman event. His widow wants answers as to why

- ‘Shock and disbelief’ after Manitoba school trustee’s Indigenous comments

- Several baby products have been recalled by Health Canada. Here’s the list

- ‘Sciatica was gone’: hospital performs robot-assisted spinal surgery in Canadian first

Job growth in areas west of Ontario this year has fueled higher incomes and meant consumers are less likely to use debt, such as high-interest credit cards, to pay for things. Employment in Alberta has grown 2.4 per cent, Tal said, compared to flat or even negative job growth in Atlantic Canada provinces.

That’s meant wages have slipped further behind the cost of living in those parts of the country, Tal said. “It’s a one to one relationship.”

Graphic by Janet Cordahi, Global News

Comments