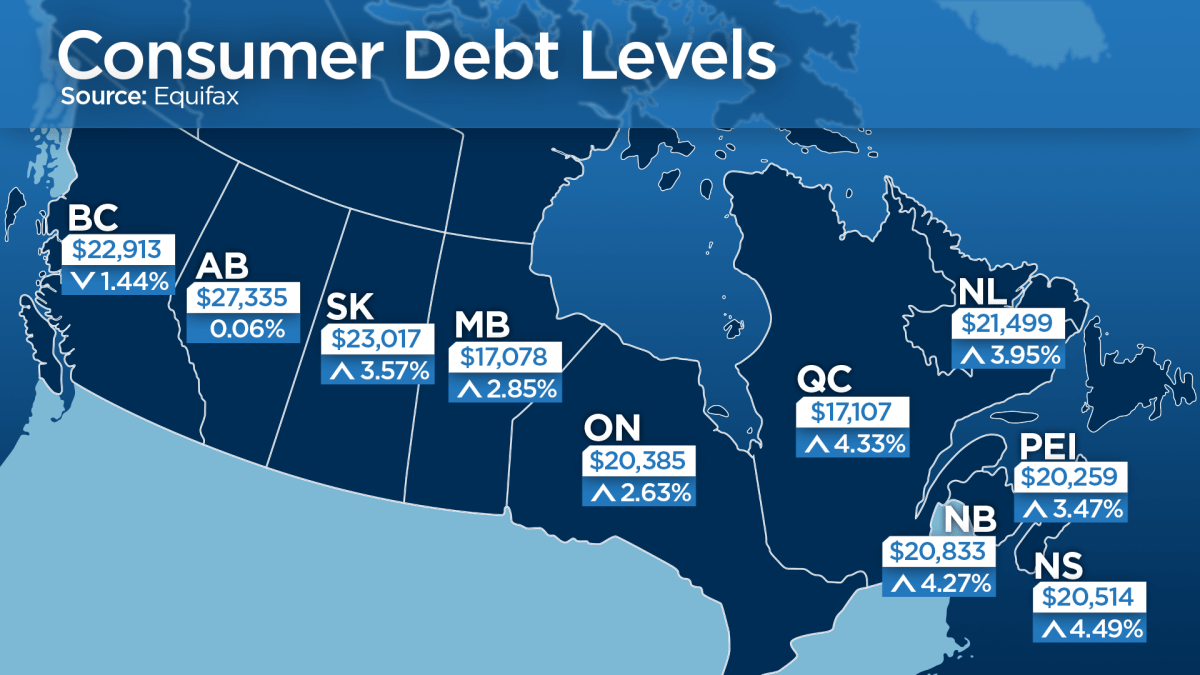

Fresh figures published Thursday show consumers in provinces east of Ontario have ratcheted up debt loads this year, even if they’re among the least able to afford the added burden.

Meanwhile across the country in more economically prosperous British Columbia and Alberta, consumers appear to be dialing back.

“You can see big increases in the east,” said Regina Malina, a statistician and lead author of a quarterly snapshot of consumer debt from Equifax.

Credit monitoring agency Equifax says the amount borrowed on credit cards, bank loans and other forms of credit excluding mortgages rose by an average of 4.1 per cent across Quebec, P.E.I., New Brunswick, Nova Scotia and Newfoundland.

That’s nearly double the national average, Equifax said, and perhaps highlights a greater reliance on tapping debt to make ends meet in areas of the country where economic growth has been sluggish and a the jobless rate high.

MORE: Experts fret Canada becoming a ‘nation of part-time workers’

- Posters promoting ‘Steal From Loblaws Day’ are circulating. How did we get here?

- Video shows Ontario police sharing Trudeau’s location with protester, investigation launched

- Canadian food banks are on the brink: ‘This is not a sustainable situation’

- Solar eclipse eye damage: More than 160 cases reported in Ontario, Quebec

Average debt loads grew the quickest in Nova Scotia in the second quarter, a three-month stretch that runs from the spring into early summer. Consumer debts rose an average of 4.49 per cent, to $20,514 in the province of 950,000.

Lower than national average

Despite the higher growth rates, consumers east of Ontario owe less on average than borrowers in Ontario and provinces further west.

Ontarians increased their obligations by more than 2.5 per cent in the second quarter compared to the same period a year ago, to $20,385.

Despite seeing no material rise in average debt loads, Alberta – whose economy has roared compared to the rest of the country in recent years – boasts the biggest average debt burden per consumer at $27,335.

MORE: Workers in Western Canada set for biggest wage increases next year

Record debt burdens

Though experts say the pace of debt growth has been slowing in recent quarters, the amount being shouldered by Canadian consumers and households remains worryingly elevated at near-record levels.

Experts, including the Bank of Canada, have cited towering debt levels as the chief internal risk to the Canadian economy.

MORE: Consumers on fresh spending spree despite lofty debt loads

Equifax said Thursday “significant” increases in the use of bank lines of credit (up 10.8 per cent) and credit cards (up 4.4 per cent) in the second quarter reversed a lull in borrowing at the start of 2014.

“Consumer debt has increased again after slowing down earlier in the year,” the credit monitoring agency said.

Comments