More than 3,100 Americans shed their citizenship last year, FBI figures show.

The numbers come from published statistics and documents obtained by Global News under U.S. freedom-of-information laws.

The total of 3,128 is lower than the 4,652 people added to an FBI database of ex-citizens. But the 2012 total includes about 2,900 names entered in October, 2012 as the State Department cleared a backlog, FBI spokesperson Stephen G. Fischer Jr. explained in an e-mail. Deducting those names brings 2012’s total down to 1,752, and makes last year’s total the highest since at least 2006. In 2011, 958 names were added.

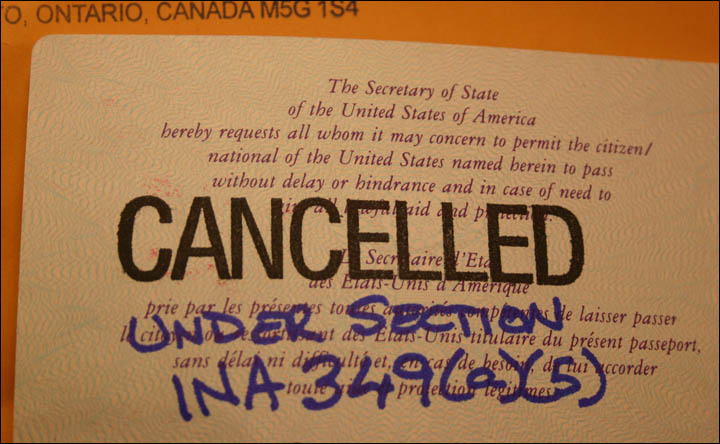

The FBI data captures only part of the total number of ex-Americans. Some people “relinquish” U.S. citizenship – for example, by taking citizenship in another country while intending to lose U.S. citizenship, then asking the State Department to document the loss. Relinquishing is more attractive for several reasons, not least because it’s free – a renunciation costs $450 US.

Global News’s efforts to get more detailed statistics from the State Department through American freedom-of-information laws have so far been unsuccessful .

Under U.S. law, people who renounce citizenship are barred from buying guns in the United States. They’re entered in an FBI database that includes fugitives, convicts, drug addicts, people dishonorably discharged from the military and people subject to domestic violence-related restraining orders.

U.S. consulates in Canada have seen their share of renunciations. In November 2011, the U.S. consulate in Toronto tried to cope with the rising numbers of would-be ex-citizens by handling them on a group basis.

So what’s driving the exodus?

- Posters promoting ‘Steal From Loblaws Day’ are circulating. How did we get here?

- Solar eclipse eye damage: More than 160 cases reported in Ontario, Quebec

- Video shows Ontario police sharing Trudeau’s location with protester, investigation launched

- Investing tax refunds is low priority for Canadians amid high cost of living: poll

Unlike other industrialized countries, the United States requires citizens to file tax returns whether or not they live in the country.

READ: Why are so many American expats giving up citizenship? It’s a taxing issue

(What is it like to renounce U.S. citizenship? Several dozen first-hand accounts can be seen here (.pdf).)

The State Department did not respond to a request for comment.

Between 2008 and 2012, an average of 172 Canadians renounced their citizenship each year – typically because they want to run for office in a foreign country, join a foreign country’s military or become citizens of a country that doesn’t allow dual citizenship, Citizenship and Immigration spokesperson Mary Jago explained in an e-mail.

“That was all fine, because until about 2010 the U.S. was not really enforcing compliance with its own worldwide citizenship tax regime,” she added. But now, “the U.S. basically just put a really big price on citizenship, saying, ‘We’re going to crack down on this now, we’re going to find you, and if you haven’t been paying your taxes we’re going to fine you for not filing, even if you’ve never owed any taxes.'”

The pressure to lose U.S. citizenship may increase when the U.S. Foreign Account Tax Compliance Act, or FATCA, comes into force this summer. The act would require financial institutions outside the country to identify and report their American customers, or face punitive taxes on their U.S. investments.

Canada’s Department of Finance continues to negotiate an agreement with the IRS. Retired law professor Peter Hogg, an expert on the Charter of Rights, wrote in 2012 that an agreement would be “discriminatory in a way that would not withstand Charter scrutiny.”

“The objective of ensuring compliance with U.S. tax laws is probably not important enough to justify breaches of the Canadian Charter, and even if it was important enough, the measures contemplated are grossly disproportionate to the objective.”

On Thursday, a report released by the U.S. National Taxpayer Advocate strongly criticized FATCA in a report to Congress, saying the costs exceed projected revenue, the law creates sovereigntyconflicts with other countries – using Canada as an example – and the IRS’s computer systems aren’t ready to handle such a complex project.

Comments