For the majority of Canadians who don’t own property, the dream of homeownership is feeling elusive, a new CIBC report suggests.

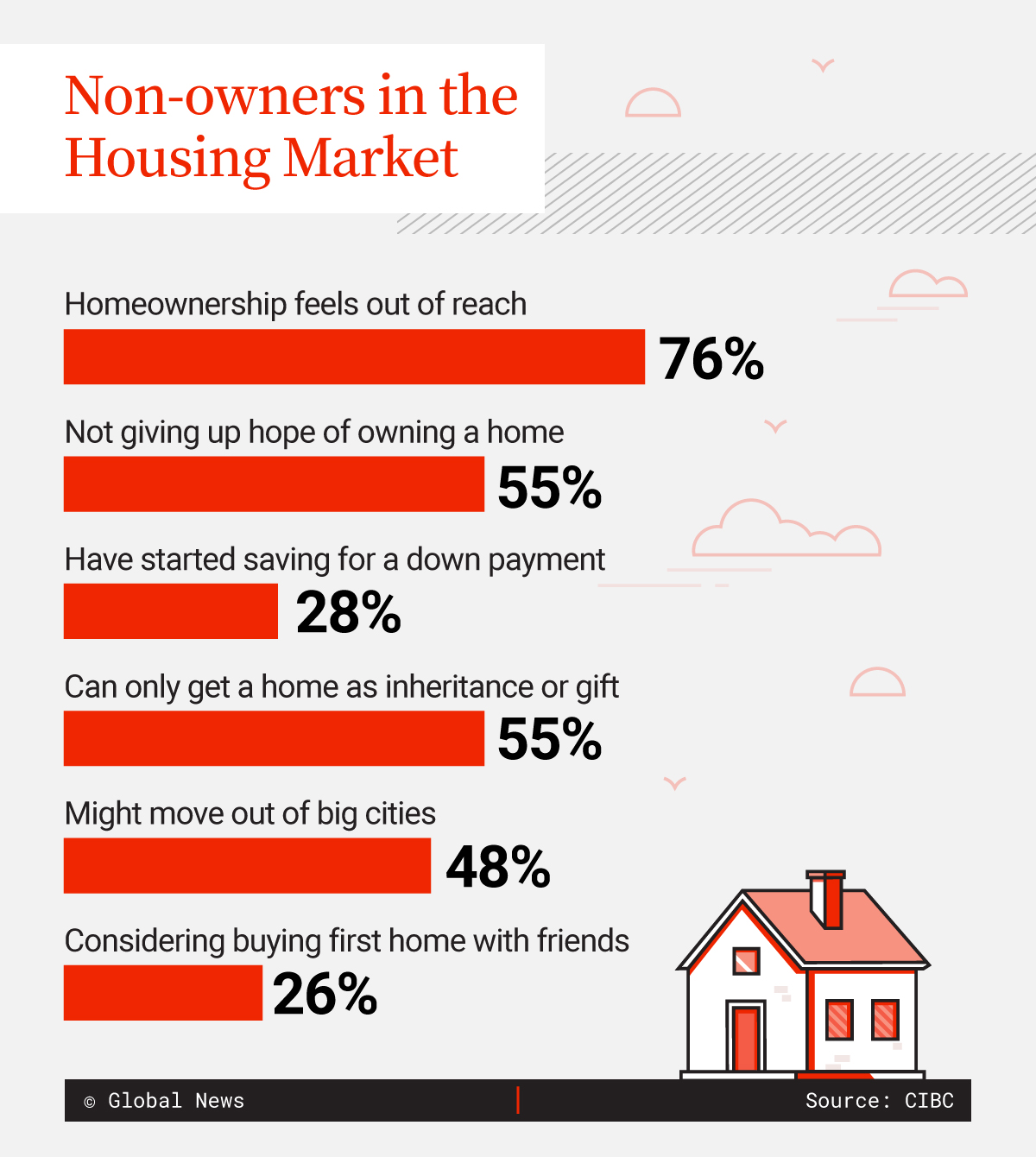

According to the report released on Thursday, 76 per cent of Canadians who aren’t homeowners say that entry into the housing market feels out of reach.

However, the results of the report are not all gloomy.

More than half of Canadians without property (56 per cent) say they are not yet giving up hope that they will own their own home someday.

The two biggest reasons for homeownership feeling out of reach were overpriced housing markets (70 per cent) and the inability to save for a down payment (63 per cent), according to the survey.

Only 28 per cent of respondents without property said they were currently saving for a down payment.

For most non-owners (55 per cent) homeownership only feels possible with inheritance or a gift from a family member.

Get weekly money news

John Pasalis, Realtor and broker at Realosophy Realty, said he does not find the numbers surprising. “If you consider some of the biggest cities in Canada, in Toronto (for example), home prices are roughly ten times the median household income. And that’s a huge problem because home buyers, when they’re getting a mortgage, can’t really borrow much more than four and a half times their income,” he said.

Pasalis said skyrocketing rent prices could be behind people’s inability to save for a down payment.

“How do you save, as a first-time buyer, when your rent costs are surging and it’s so expensive just to even rent an apartment? I think this partly explains why many can’t even save. They’re getting hit on both. Not only are home prices high, but they can’t save for a down payment.”

With high home prices in major Canadian cities like Toronto and Vancouver, 48 per cent said they were considering moving out of a major city to get more real estate value for their money. The housing crisis is also forcing some to consider out-of-the-box solutions, with 26 per cent saying they would consider buying a property with their friends to be able to afford a home.

“Housing affordability is a challenge across the country and many Canadians could use guidance on how to make their homeownership dream a reality,” Carissa Lucreziano, vice-president, financial planning and advice, at CIBC, said in a release.

Lucreziano added that about 80 per cent respondents said they needed help navigating the housing market.

“Working with a trusted advisor can help prospective buyers get a clear picture of their financial situation through customized planning and recommendations, providing a realistic pathway to achieving their homebuying ambitions,” she said.

Many current homeowners surveyed by CIBC said they were making several adjustments to manage mortgage payments. A little over half (51 per cent) of variable mortgage holders said they’ve been cutting down on household payments, while 21 per cent said they are putting lump sum payments toward their mortgage.

The report found that 45 per cent of Canadians homeowners with fixed-mortgage rates said they anticipate cutting back on daily expenses when their mortgage comes up for renewal in the next two years, while 34 per cent said they plan to shop around for the best rates.

These findings are from a Maru Public Opinion online survey undertaken exclusively for CIBC and fulfilled by the sample and analyst experts at Maru/Blue. The results were produced in two waves among a random sample of Canadian adults who are Maru Voice Canada panelists and then weighted to be representative of the Canadian adult population. Each probability samples of each size carry with them an estimated margin of error. Wave 1 was among homeowners with either a fixed or variable mortgage, and among those who intend to purchase a new home in the next two years, conducted Feb. 23-27, 2024. Wave 2 was among 1,526 Canadians, conducted, Feb. 28-29, 2024.

Comments

Want to discuss? Please read our Commenting Policy first.