U.S. markets got a boost from the Federal Reserve’s latest interest rate announcement, moving higher in the afternoon while Canadian markets followed suit.

The U.S. Federal Reserve held its key rate steady for the fifth consecutive meeting on Wednesday, a widely expected move. It also signalled that it still expects to cut three times in 2024 despite surprisingly strong inflation data at the start of the year, the same projection it gave a few months ago.

Fed chair Jerome Powell said at a news conference that while inflation has cooled considerably from its peak, it’s “still too high, ongoing progress in bringing it down is not assured and the path forward is uncertain.”

The S&P/TSX composite index closed up 185.13 points at 22,045.71.

In New York, the Dow Jones industrial average was up 401.37 points at 39,512.13. The S&P 500 index was up 46.11 points at 5,224.62 points, while the Nasdaq composite was up 202.62 points at 16,369.41.

For investors, “there’s a lot to like” in the Fed’s announcement today, said Mike Archibald, vice-president and portfolio manager with AGF Investments Inc.

The market thought the Fed would lower its projections to two cuts in 2024, so it was welcome news that the central bank held firm at three, said Archibald.

However, he noted that the central bank did lower its expectations for cuts next year — three, rather than the four projected in December.

The Fed is still looking for more confidence before it makes cuts, but believes that confidence will come in time for several cuts this year, he said.

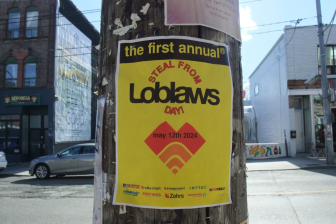

- Posters promoting ‘Steal From Loblaws Day’ are circulating. How did we get here?

- As Canada’s tax deadline nears, what happens if you don’t file your return?

- Do you need to own a home to be wealthy in Canada? How renters can get ahead

- Investing tax refunds is low priority for Canadians amid high cost of living: poll

The central bank upgraded its growth outlook, noted Archibald — new projections from the central bank forecast stronger growth and inflation would persist into next year, which is why it expects fewer cuts in 2025.

Equities rose sharply after the release and as Powell was speaking.

“You’re seeing your risk-on type sectors outperforming,” said Archibald, such as discretionary, communications, services, industrials and financials in the U.S.

“So I think the market is still looking for better times ahead.”

Cuts are still likely to come mid-year, said Archibald.

Canada, meanwhile, could see rate cuts a little earlier than the Fed as the economy has not been as persistently strong, he said.

The Bank of Canada on Wednesday released the summary of its deliberations leading up to its latest interest rate decision, when it also held its key rate steady.

Officials still expect to start cutting rates this year but are split on timing, the summary showed.

The Canadian dollar traded for 73.75 cents US compared with 73.63 cents US on Tuesday.

The May crude contract was down US$1.46 at US$81.27 per barrel and the May natural gas contract was down three cents at US$1.85 per mmBTU.

The April gold contract was up US$1.30 at US$2,161 an ounce and the May copper contract was down two cents at US$4.05 a pound.

— With files from The Associated Press

Comments