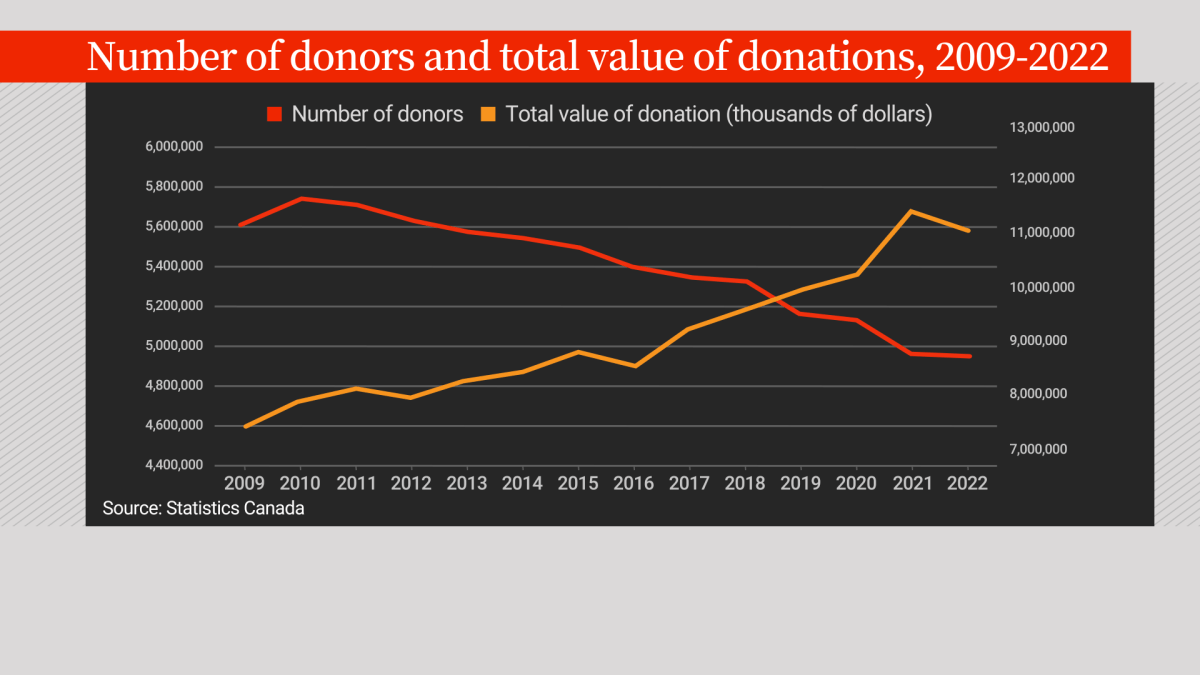

As charities face higher demands and costs, Canadians appear to be giving less to them, according to newly-released data from Statistics Canada.

The agency reported on Thursday that fewer Canadians gave less money to charities in 2022 as inflation began to set in.

In 2022, fewer than five million Canadian tax filers, or 17.1 per cent, declared making a charitable donation. That is 0.3-per cent lower than the year before, despite the number of tax filers going up three per cent, according to Statistics Canada.

The total amount donated fell as well, decreasing 3.1-per cent to $11.4 billion. It was the first time donations had gone down since 2016, and followed an increase of 11.5 per cent in 2021.

“There were 1.6 per cent fewer donations of $499 or less,” StatCan said.

“It’s not surprising that Canadians are donating less to charities because of the cost of living crisis that we’re all facing right now,” personal finance expert Rubina Ahmed-Haq told Global News. Ahmed-Haq hosts For What It’s Worth on the Corus Entertainment radio network. Corus is the parent company of Global News.

“Unfortunately, when money is tight, it’s always those extra things that we seem to cut back on,” she said.

Inflation began to hit in 2022 as COVID-19 restrictions were beginning to loosen.

Ahmed-Haq said people were in a more charitable mood during the COVID-19 pandemic and had more savings to give since they were staying at home, but that began to wane once prices started going up and restrictions lessened. Many charitable events also were cancelled or parred down in 2022 as well, she noted.

The reduction in donations comes as charities themselves are having a hard time with the higher costs.

Get daily National news

“The combination of need and inflation have, for example, doubled our food costs,” Marie MacCormack, a VP at charity Fred Victor, previously told Global News in November.

“To be able to pay the bills, to be able to pay your staff and to buy the supplies and make the food, to keep the doors open, the lights on, the heat … all the things that go into providing a meal or providing service.”

As charities’ costs go up, demand has as well. Nearly one in four (24 per cent) respondents to an Ipsos poll for CanadaHelps, an online donations platform, conducted in late October said they expect to need help from a charity for food, health or housing services in the next six months. That’s up two percentage points from 2022.

The situation for charities might get worse yet as the Ipsos polling showed that 27 per cent of Canadians said they don’t plan to give financially to charities in 2023, up five percentage points from 2022. While 15 per cent of respondents said they’d give more to charity in 2023 than 2022, 19 per cent indicated they’d give less.

Among those with more money to give, StatCan said that the number of donors giving $100,000 and more also fell by 12.4 per cent in 2022 after rising 33.6 per cent in 2021. The total amount they donated went down by 13.4 per cent in 2022.

Higher earners still make up the majority of donors, though, with 39.2 per cent of those making $100,000 or more reported to have donated to charity in 2022 compared to 6.2 per cent of those making below $40,000.

The median income of charitable donors was over $70,000, “significantly higher” than the median income of all tax filers, which was nearly $42,000, according to Statistics Canada.

Those with $100,000 or more income had the largest share of charitable giving in 2022. Those who made between $200,000 and $499,999 had a 14.1-per cent increase in the number of reported donations, but the average donation amount fell 23.1 per cent in 2022 from 2021.

Ahmed-Haq noted that there are tax benefits to donating to charity, which can act as an incentive for wealthy donors since they will get some of the money back.

“I don’t think that we should be confused that that money is all just coming right out of their bank account and going straight into building a new hospital wing or supporting a new cause,” she said.

“There is definitely tax benefits that go with that that they would know before they made that donation.”

Seniors remained the most charitable of Canadians, StatCan said, making up 23.9 per cent of donors for those 65 or older.

The decline of charitable donations in 2022 was driven by B.C. and Ontario, according to the report, dropping 11.8 per cent and six per cent, respectively.

“Manitoba remained Canada’s most charitable province in 2022 with just under one in five tax filers (19.3 per cent) declaring a donation on their tax form,” StatCan said.

Ahmed-Haq says she advocates for donating about three per cent of what you make, but said there’s nothing wrong with putting that down to one per cent if money is tight.

However, she warned about stopping altogether, as she says it is difficult to start again when that is done.

“Just like savings, giving to charity is a muscle that you have to continue to flex,” she said.

“So if you give up on giving to the charity of your choice, it’s going to be difficult for you to remember and then start that up again once your financial situation improves.”

— with files from Global News’ Craig Lord.

Comments

Want to discuss? Please read our Commenting Policy first.