Doing your taxes is easier than you think—and it could pay off.

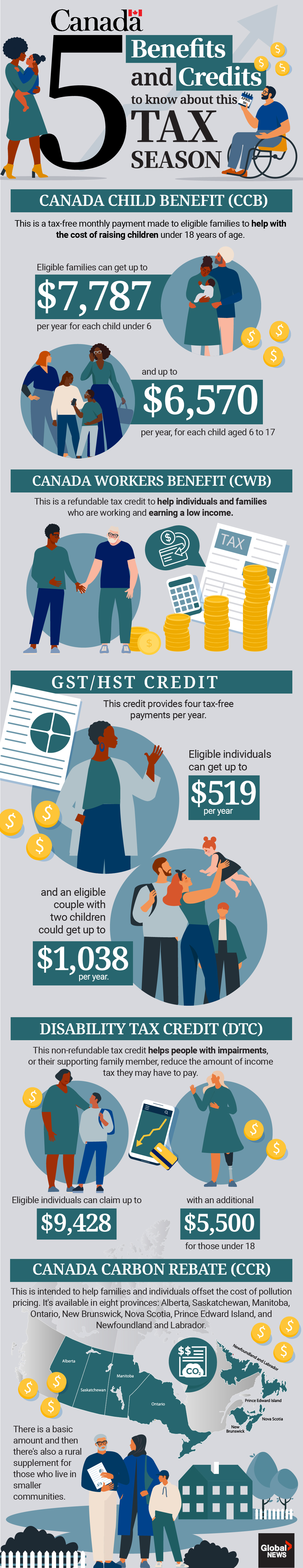

Across Canada, many people are struggling with the high cost of living, a rapidly changing job market, and mounting household debt. Keeping up with the bills is not always easy, particularly if you’re raising children, working at minimum wage, living with a disability, or supporting a loved one with a disability. For situations such as these, the Government of Canada offers a variety of benefits and credits to help make life more affordable.

“People that don’t file their taxes are leaving money on the table,” said Robert Greene, Director General of Individual Returns at the Canada Revenue Agency. “We want to encourage them to not miss out.”

Read more: Here are the tax changes that will affect your pocketbook in 2024

Get daily National news

Now is the right time to get ready for tax season, said Lise Proulx, Acting Director General of Benefit Programs at the Canada Revenue Agency. This is particularly true for people who are filing for the first time, or maybe haven’t filed in a while. As a first step, Proulx said you should gather the information you need such as T4s from employers, and make sure the Canada Revenue Agency is up to date on any life changes, such as a change in address, or a change in your marital status, to ensure you’ll receive the benefits to which you’re entitled.

For one-on-one assistance with filing, there are over 3,000 community tax clinics available across Canada to provide free tax help. This program has been around since the 1970s, when it was created to help individuals who have a modest income and a simple tax situation to learn how to file their taxes and get the benefits and credits for which they are eligible.

Greene said, “and there’s a variety of ways they offer their services—you can make appointments, walk-in, you can connect with them virtually or by phone, or in some cases, there’s drop-off services.”

For more information about Government of Canada benefits, credits, and programs available to help you, visit Every Dollar Counts.