A rise in mortgage loans through the summer helped keep the country’s housing market ticking in spite of fears of a slowdown this year.

It’s also pushed household debt levels to another record high.

Statistics Canada said Friday $19.7 billion in mortgage loans went out to home buyers between July and the end of September, up 1.8 per cent compared to the spring quarter.

That figure contributed to a rise of 1.5 per cent in total household debt, which includes credit cards, lines of credit and mortgages. It’s also continues a trend of rising debt levels at time when many experts say Canadians should be paying down what they owe.

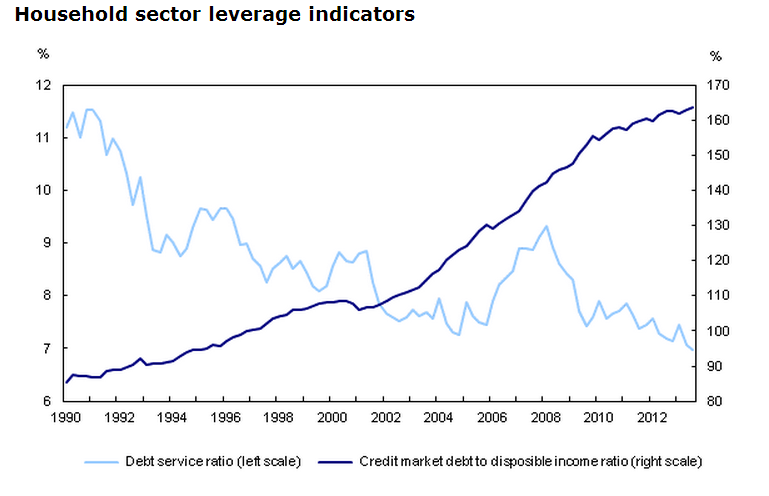

Still, debt to disposable income hit 163.7 per cent by the end of September – up six tenths of a percent to a new all-time high. That means for every dollar in after-tax income brought in, Canadians owe more than $1.63, a level of indebtedness similar to what U.S. households had accumulated before that country’s slide in 2008.

READ MORE: Paying for the boom — Mapping the rise of housing prices by neighbourhood across major markets

While there’s some debate around whether that’s a fair comparison, there’s little argument over whether consumers can continue to borrow – a trend that’s helped bouy Canada’s economy through the downturn but has now left households exposed if interest rates rise or the economy and employment soften.

Policy makers such as the Bank of Canada – which has kept its benchmark interest rate near record lows in recent years – suggest consumers will wind down debt levels over the next couple of years while Canada’s bubbly housing market glides toward a soft landing.

On the plus side, rising property values and stock prices lifted overall household net worth by 2.2 per cent between July and the end of September, with per capita household worth sitting at $211,400.

Comments