Equifax Canada

-

Young Canadians more likely to have missed a bill payment this year: surveyEquifax Canada says young Canadians are more anxious about their personal debt and more likely to have missed a bill payment this year.CanadaOct 30, 2023

-

Businesses are increasing their credit usage. Why that’s a worrying trendEquifax Canada says new data suggests a major shift in credit usage among businesses in the first quarter of 2023, and that casts doubts on the stability of the Canadian economy.MoneyJun 20, 2023

-

-

Advertisement

-

Mortgage originations in Canada dipped in first quarter: reportEquifax Canada says credit demand was high in the first quarter of the year while the mortgage market saw a significant slowdown.MoneyJun 6, 2023

![]()

-

-

Advertisement

-

Credit card debt up 15% in Q4 with younger Canadians feeling pinch: EquifaxEquifax says Canadians' credit card debt increased by more than 15 per cent from the same period a year earlier and totalled more than $100 billion for the first time.EconomyMar 9, 2023

![]()

-

Canadian consumer debt climbs 7.3% to $2.36 trillion in third quarter: EquifaxEquifax Canada says an increase in borrowers helped push total consumer debt to $2.36 trillion in the third quarter, even as mortgage volumes decline.ConsumerDec 6, 2022

![]()

-

-

Canada’s housing market hotter than ever — and investors are playing a big roleThe share of home purchases by buyers who already have multiple mortgages is rising, data shows.MoneyDec 3, 2021

![]()

-

-

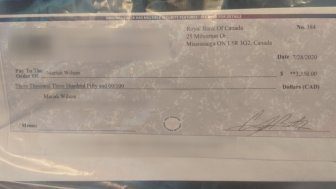

Overpayment scam making the rounds in Kelowna, RCMP warnFake cheques can be business or personal cheques, printed to look like legitimate cheques, stolen from a victim of identity fraud, or even a fake money order.CrimeOct 8, 2021

![]()

-

Canadian consumers are now carrying $2.1 trillion in debt, driven by mortgagesEquifax says the debt profile of Canadians has changed throughout the COVID-19 pandemic, with mortgages accounting for a larger portion of people's debt.ConsumerJun 8, 2021

![]()

-

-

Advertisement

-

Police say alleged identity thief tried to obtain credit from jewelry stores in Oakville, BurlingtonInvestigators say the woman tried to set up accounts with jewelry stores at Mapleview Mall and Oakville Place.CrimeSep 3, 2019

![]()

-

-

Advertisement

-

‘It makes no sense’: Toronto woman with no debt calls out credit score swing, credit report errorsRobin Harvey was surprised to see a drop in her credit score, despite paying off a large credit card balance in full. She was even more surprised to find the same old errors in her credit report.MoneyMar 16, 2019

![]()

Trending

-

![]() Here’s what to know about changes to capital gains taxes in Budget 202451,366 Read

Here’s what to know about changes to capital gains taxes in Budget 202451,366 Read -

![]() Toronto Pearson gold heist: Multiple people charged in historic $20M theft49,439 Read

Toronto Pearson gold heist: Multiple people charged in historic $20M theft49,439 Read -

![]() El Niño looks to be fading. What Canadians can expect in the months to come32,292 Read

El Niño looks to be fading. What Canadians can expect in the months to come32,292 Read -

![]() All 787 Dreamliners should be grounded, Boeing whistleblower says28,401 Read

All 787 Dreamliners should be grounded, Boeing whistleblower says28,401 Read -

![]() Gas prices in Ontario, Quebec to jump to highest level in 2 years: analyst12,242 Read

Gas prices in Ontario, Quebec to jump to highest level in 2 years: analyst12,242 Read -

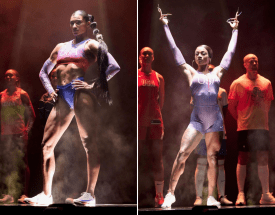

![]() ‘Body on display’: U.S. Olympians debate skimpy women’s uniform11,071 Read

‘Body on display’: U.S. Olympians debate skimpy women’s uniform11,071 Read -

Top Videos

-

![]() Budget 2024 introduces capital gains tax changes that will impact 0.13 per cent of Canadians

Budget 2024 introduces capital gains tax changes that will impact 0.13 per cent of Canadians -

![]() Pearson gold heist: arrests made but very little gold recovered

Pearson gold heist: arrests made but very little gold recovered -

![]() El Niño may be over — what weather could Canadians see in the coming months?

El Niño may be over — what weather could Canadians see in the coming months? -

![]() Boeing whistleblower says entire 787 Dreamliner fleet should be grounded

Boeing whistleblower says entire 787 Dreamliner fleet should be grounded -

![]() Gas prices across Ontario set to soar

Gas prices across Ontario set to soar -