Despite the high cost of living making it harder to set aside money after expenses, a recent survey indicates Gen Z and millennial Canadians still want to start saving for retirement.

And even with the Bank of Canada’s most recent announcement on Sept. 6 stating it was holding its key interest rate steady at 5.0 per cent, financial pressures haven’t subsided after previous multiple hikes.

The Healthcare of Ontario Pension Plan survey, commissioned by Abacus Data, also indicates Canadians under 35 recognize the value of a workplace pension plan to prepare for their golden years — with 51 per cent stating they’d forego a job with higher pay for a better pension.

“If you’re under the age of 35, people say, ‘Oh, you’ve got 30+ years before you’ve really got to worry about retirement.’ But we know that particularly those that don’t have a workplace pension, they’re going to have to figure this out on their own. And that means starting as soon as they possibly can,” said Abacus Data chair and CEO David Coletto.

Coletto also said while this survey is conducted annually with similar results, what surprises him is that even with high-priced housing, inflation, and previous interest hikes, this remains the case.

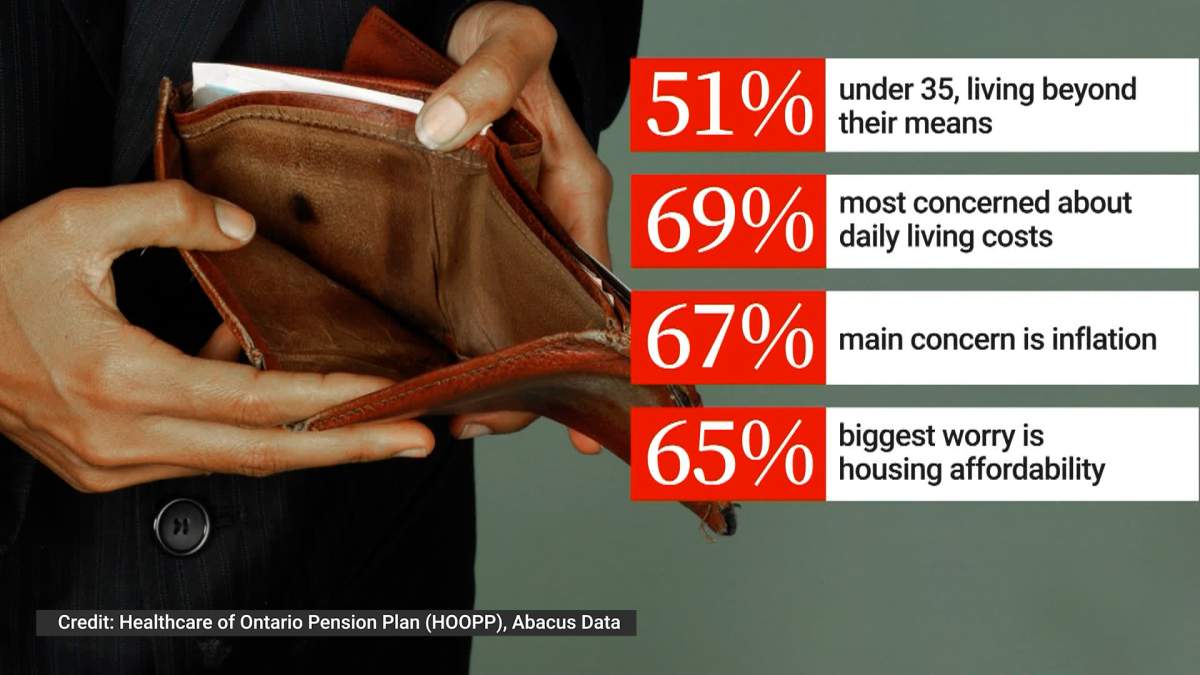

The survey also reveals 51 per cent of respondents under 35 say they’re living beyond their means — and it’s not by choice. Within this, 69 per cent of Canadians under 35 say they’re most concerned about daily living costs, 67 per cent say their main concern is inflation, and 65 per cent indicate their biggest worry is housing affordability.

But to save is to have money left over to put aside. These hurdles are where the challenge lies for many, including for Halton, Ont., millennial father, Owen Devine, who participates in a workplace Registered Retirement Savings Plan (RRSP) matching program.

Get weekly money news

“I’m not putting away as much as I should,” he said. “Maybe if you cobble together, like all of the employer matching for myself and my wife and what our projected living expenses will be at retirement, we’re probably hitting that goal.”

Devine told Global News his family started to feel a lot of financial burdens during the COVID-19 pandemic, when Canada really started to see the cost of essentials sharply increase. He said the loss of buying power for goods like groceries came with an emotional connection, and he had to buckle down, “nickel and diming,” to stay on budget.

Having an RRSP matching program in place helps him stay on track for the future, especially because that money can’t be spent any other way but for its intended purpose, he said.

Not everyone has the option to have a workplace pension or RRSP matching program, like business owners.

London, Ont.-based Gen Z business owner Ashley Rowe runs New Leaf Collective, and she has concerns that retirement will one day come later than the conventional retirement age of 65.

“No matter what job I have or description, I’m noticing that I still feel that barrier to retirement. And quite honestly, I’m unsure when that would be for me,” Rowe said. “I don’t know if that would be at the common age of 65 anymore.”

Rowe’s advice for young Canadians includes leveraging budgeting tools to manage day-to-day finances, as well as educating yourself on wealth management as early as possible.

“I like to stay optimistic. And with the right education and resources, I’ll be able to get there and be able to pursue those goals in that way,” Rowe said.

Comments

Want to discuss? Please read our Commenting Policy first.