As the weather heats up in Canada, cottages prices are cooling down, but sticky inflation and soaring interest rates are dampening plans for prospective first-time buyers, real estate experts say.

With the Bank of Canada increasing its key interest rate again this week, and future hikes not off the table, should you consider jumping into the cottage market this summer?

Even though the demand is still there, first-time cottage buyers have “stepped to the sidelines” as owners try to keep their vacation homes in the family, said Christopher Alexander, president of ReMax Canada.

“(In) the current interest rate environment, affordability has really changed for a lot of people,” he said in an interview with Global News.

“However, we’re still seeing multiple offers in a lot of parts of Ontario and even in western Canada on properties that are priced really well.”

Where are prices dipping?

A recent survey by ReMax looking at the cottage trends across the country found that 69 per cent of Canadians were hesitant to invest in a cottage due to economic uncertainty.

This is despite the fact that prices have already dipped and are expected to continue going south in many parts of Canada.

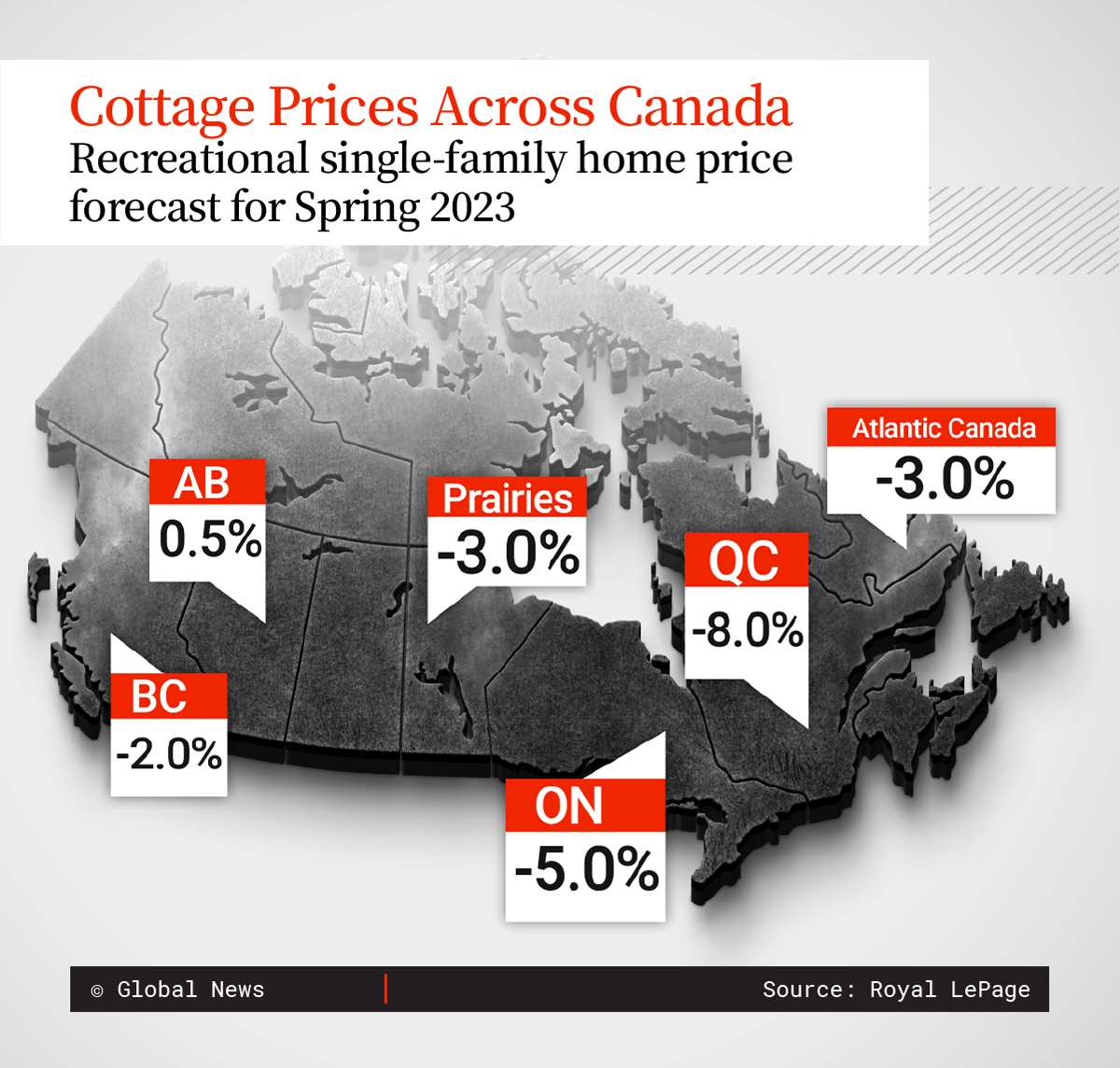

Prices are forecast to drop in every province, except for Alberta, which was the only market expected to see a bump in aggregate price this year, Royal LePage said in its spring forecast from March.

Quebec is forecast to see the biggest decline of eight per cent compared to 2022, with the aggregate price of a recreational single-family home estimated at $343,528.

In Ontario, the aggregate price of a recreational single-family home is forecast to reach $603,060 – a five per cent dip compared to last year.

- N.S. mom calls for better ultrasound access after private clinic reveals twins

- 3 women diagnosed with HIV after ‘vampire facials’ at unlicensed U.S. spa

- Posters promoting ‘Steal From Loblaws Day’ are circulating. How did we get here?

- As Canada’s tax deadline nears, what happens if you don’t file your return?

Atlantic Canada and the Prairie provinces would see those prices go down by three percent and in British Columbia, the aggregate price remains over $1 million with a two per cent drop.

Mark Pedlar is a broker with ReMax Bluewater Realty Inc. in Ontario’s Grand Bend area. He said he’s seeing a “softening of the market,” with a 10 per cent decrease in average price for that region.

“The inventory is up, and the sales unfortunately are down right now. So it is a softer market than what we’ve seen the last two years,” Pedlar said in an interview on London Live, a Corus Entertainment radio show earlier this week. Corus is the parent company of Global News.

“There’s still good value for the sellers, but even better value for buyers looking for a deal that they might have missed out on last year.”

However, because mortgage payments have gone up so much, it’s making cottages – like any other real estate – harder to afford.

Pedlar says many cottage owners are getting their money’s worth through rentals.

“The rental income we’re seeing continues to be strong. So if you can buy a cottage and rent it out, that’s how a lot of people afford the secondary properties.”

In recent weeks, there has been a flurry of activity with new cottage listings, but there’s still not enough inventory to meet the current demand, Alexander said.

One of the factors contributing to low inventory is that many owners are less eager to sell because they want to keep their cottages in the family, he explained.

Long-time cottage owners looking for an upgrade are waiting it out as they look at what they can or cannot afford, Alexander said.

“A lot of people bought in the last couple of years with rock-bottom interest rates and it’s too early in the cycle for them to be considering a sale,” he added.

What to consider before buying a cottage

While buying a cottage can be a great long-term investment, it all comes down to what fits your pocket, says Alexander.

“Overextending yourself to own a property is not a good idea. However, over the long term, buying a home or buying a cottage can be a great investment,” he said.

Along with the price tag, there are a number of other things prospective buyers should consider.

Alexander said buyers are being more creative and flexible in terms of how far they want to drive to find a recreational home.

Making sure the place suits your recreational needs is “critically important,” he said, which will require doing research on how big and busy the lake is around you.

“It’s so important to spend the time researching and looking at properties that suit your needs because the average cycle for a cottage is much longer than a home,” Alexander said.

“And so you want to be able to be there for many, many years if not decades.”

— with files from The Canadian Press

Comments