As Canada’s premiers express disappointment over Ottawa’s health-care funding offer, questions are being raised about why provinces are demanding more federal cash while sitting on tens of millions of surplus dollars and other financial gains in their own budgets.

The 13 premiers have signalled their intent to accept a new funding deal with Ottawa that will infuse $46.2 billion in new money for health care over the next decade, but they have done so reluctantly, saying the amounts on offer fall short of what is needed. They have said they can no longer afford to shoulder the growing burden of health-care costs at the current rate.

They’ve been demanding what would have amounted to an annual $28-billion increase in funding from the federal government for health care by way of a structural change to the formula of the Canada Health Transfer.

But while the premiers have been calling for Ottawa to pay more, Prime Minister Justin Trudeau and his cabinet ministers have been firing back, pointing to the increasingly rosy financial situations of the provinces.

Last week, Trudeau said it’s time provinces and territories “step up” and use more of their own surplus budget dollars to support health-care workers.

So, where do the provinces and territories stand when it comes to their budgets and how much more money do they have this year?

Provinces experiencing financial windfall

Almost every province and territory experienced significant financial gains over the last year, due in part to inflation driving up tax and natural resource revenues, their detailed financial data shows.

As a result, more than half of the provinces and territories now have surplus budgets — which means they will take in more money than they plan to spend this year.

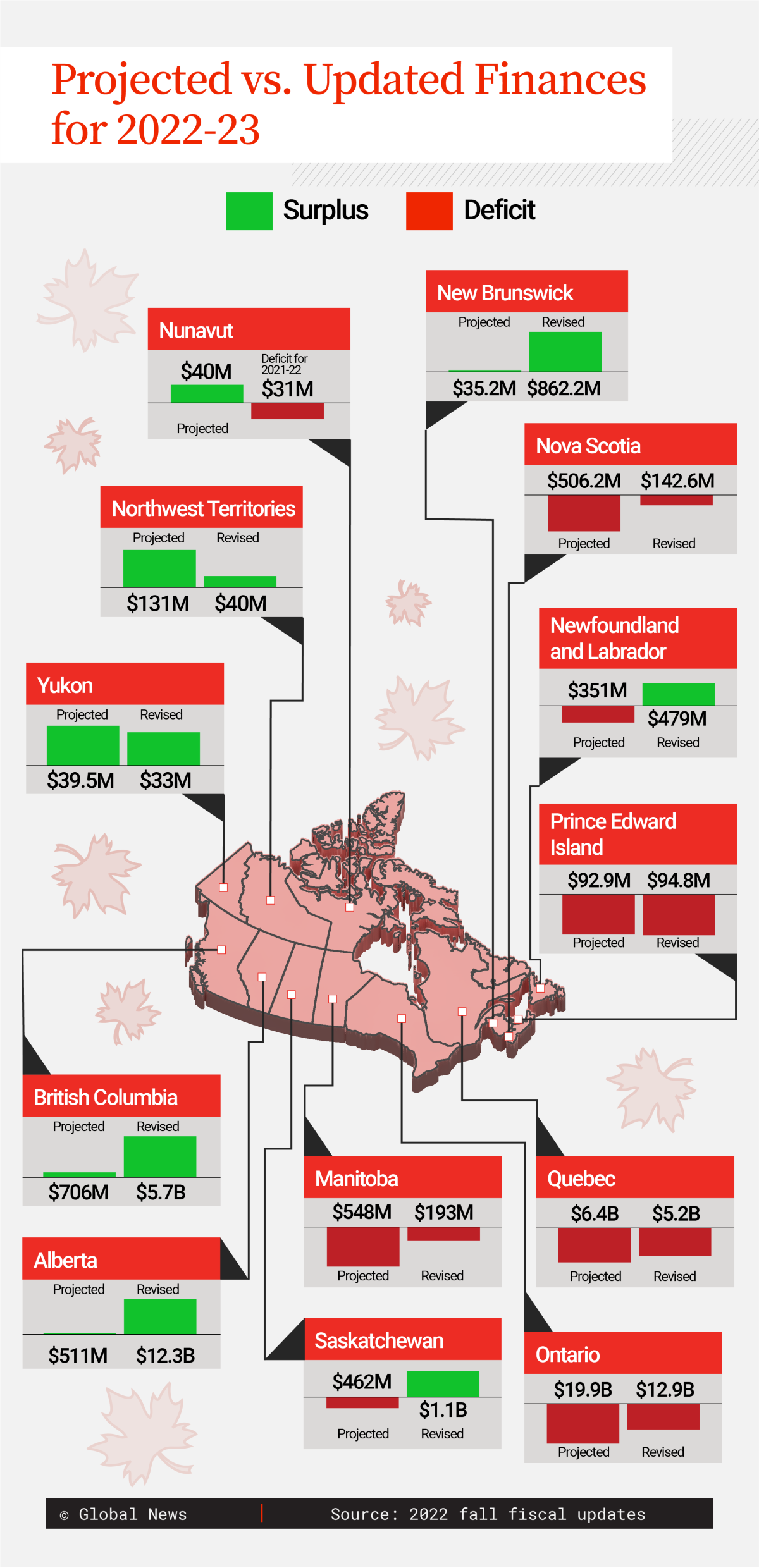

Here’s a snapshot of each province and territories’ finances for 2022-23, as of November or December 2022, when most governments provide updates to their operating budgets in their fiscal updates. New Brunswick’s surplus amount reflects a more recent update of it’s finances, released Wednesday.

- British Columbia – $5.7-billion surplus. Up from projected $706-million surplus. This is a $5-billion improvement.

- Alberta – $12.3-billion surplus. Up from projected $511-million surplus. This is an $11.8-billion improvement.

- Saskatchewan – $1.1-billion surplus. Up from projected $462-million deficit. This is a $1.6-billion improvement

- Manitoba – $193-million deficit. Down from projected $548-million deficit. This is a $355-million improvement.

- Ontario – $12.9-billion deficit. Down from a projected $19.9-billion deficit. This is a $7-billion improvement.

- Quebec – $5.2-billion deficit. Down from projected $6.4-billion deficit. This is a $1.2-billion improvement.

- New Brunswick – $826.2-million surplus. Up from projected $35.2-million surplus. This is a $709.2-million improvement.

- Nova Scotia – $142.6-million deficit. Down from a projected $506.2-million deficit. This is a $363.6-million improvement.

- Prince Edward Island – $94.8-million deficit. Up from projected $92.9-million deficit. This is an increase in spending of $1.9 million.

- Newfoundland and Labrador – $479-million surplus. Up from $351-million deficit. This is a $830-million improvement.

- Yukon – $33-million surplus. Down from projected $39.5-million surplus. This an increase in spending of $6.5 million.

- Northwest Territories – $40-million surplus. Down from projected $131-million surplus. This is an increase in spending of $91 million

- Nunavut – $40-million surplus projected for 2022-23. This is up from $31-million deficit last year.

In addition, last year, every province and one territory also ended their year with significantly higher gains and in better financial positions than they had projected — with audited financial statements showing them millions and, in some cases, billions of dollars better off than they expected to be by the end of the year.

For example, Alberta saw a whopping $22.2-billion improvement to its bottom line by the end of the 2021-22 fiscal year, going from a projected $18.2-billion deficit to a $3.9-billion surplus.

Get weekly health news

Ontario also went from having a large projected deficit to a small surplus by the end of the year, as did British Columbia and Nova Scotia, while Prince Edward Island went from a small deficit to a significant surplus in 2021-22.

Others either improved their deficits or surpluses significantly, with the exception of the Northwest Territories.

Where is some of this extra money going?

In response, many provincial governments have been using these cash windfalls to introduce new spending measures, including targeted tax breaks, increased spending in things like infrastructure and many have also sent special inflations payments to low- and modest-income citizens.

But other unbudgeted spending and financial measures have also emerged in the wake of unexpected improvements in provincial finances.

For example, on Wednesday, in announcing an even higher surplus than anticipated, New Brunswick heralded the creation of a news $300-million “New Brunswick Advantage Savings Fund,” which will set this amount aside to generate interest to be used for various as of yet unidentified measures.

Also, last week, British Columbia announced a new $1 billion fund for municipalities to “address their community’s unique infrastructure and amenities demands,” according to a government press release.

In addition, last year, ahead of the provincial election in Ontario, Premier Doug Ford announced he was scrapping driver’s licence renewal fees at a cost of around $1 billion.

And in November, the New Brunswick government announced a program that will reduce government revenues by $70 million for a tax cut that provides the greatest benefits to those who earn between about $142,500 and $162,000 a year — a wage that is about four times higher than the median Canadian income of $39,500, according to 2020 Statistics Canada data.

Trudeau called this out during a November visit to New Brunswick on a day health talks between provincial and territorial health ministers in Vancouver ended with no consensus while the premiers re-issued their demands for more federal money.

“I think citizens of provinces that see provincial governments saying that they don’t have any more money to invest in health care and therefore they need money from the federal government, while at the same time they turn around and give tax breaks to the wealthiest — those citizens can ask themselves some questions,” Trudeau told reporters in N.B. on Nov. 8, 2022.

Some of these more “discretionary” spending measures do raise questions at a time when the health-care system is facing significant pressures, says Mahmood Nanji, a fellow at the Lawrence National Centre for Policy and Management with Ivey Business School at Western University.

- ‘Alarming trend’ of more international students claiming asylum: minister

- NBC, CBS polls show Harris gaining ground as election focus shifts to Trump

- TD Bank moves to seize home of Russian-Canadian jailed for smuggling tech to Kremlin

- ‘We have a responsibility:’ Trudeau urges global leaders to support pact for future

“I think all provinces want to be perceived as being good fiscal managers… and a corollary to that also is the fact that when you have some surpluses or you have additional fiscal flexibility… it allows you to do other things, particularly programs you can get some credit for,” he said, pointing to the Ontario government’s elimination of licence fees.

“One can make the argument about whether that billion dollars should have been spent on health care as opposed to on giving somebody who owns a Land Rover a break.”

This “prickly” back and forth over whose job it is to fund health care and how much they invest is not new, says Gerald Baier, associate professor of political science at the University of British Columbia.

But when provinces are making tax cuts or increasing spending in other areas, it does show they could be investing more of their own provincial revenues into health care — a reality that likely played a role in the quick, albeit reluctant, acceptance of Ottawa’s funding offer by the premiers, he said.

“Provinces still have quite a bit of fiscal room right now, and so I think it put them in a weaker bargaining position, perhaps, because I think they were trying to make the case to the Canadian public that the federal government wasn’t paying its fair share.”

Why provinces aren't investing more of their surpluses into health care

But while most provinces and territories are doing better financially, some of this cash windfall is temporary, as it is linked to inflation, Baier noted.

“This extra money is probably a blip and it’s not something you can look at and expect to have in five or 10 years,” he said.

That’s why, given that health-care costs generally outpace inflation, looking at a long-term funding deal is a smart decision to ensure sustainability in the way health systems and staffing levels are funded and maintained, he said.

However, a number of provincial premiers are headed to elections in the next year, which could also be playing a factor in why they are not willing to invest more of their potentially temporary surpluses into the “money pit” that is the health-care system, Baier added.

“You can put $1 billion into almost any province’s health-care system and not notice it much in terms of benefits,” he said.

“So, I think the temptation for a lot of premiers, especially if they’re facing an election, is to find more direct benefits, even though some investment in the health-care system could deal with some of the things that are really motivating people.”

But with health care now taking up 50 per cent or more of provincial budgets, there is only so much fiscal capacity that provinces have when it comes to increasing their share of health investments while also facing higher demands in many other areas, said Nanji, who was also a former associate deputy minister of finance in the Ontario government.

He also noted that the deal being offered by the federal government is significant, despite the lukewarm reception it has received from premiers.

“There’s a lot of new money in here, more so than any previous administration has provided over the last few decades since, in fact, Paul Martin created this notion of creating 10-year agreements.”

Ottawa’s proposed financial package includes a number of elements, including $25 billion in new money for 10-year bilateral deals to be negotiated with the provinces and a $17-billion increase to the annual Canada Health Transfer, which includes an “escalator,” or guaranteed minimum increase, of five per cent over five years — up from the current three-per-cent escalator.

“It’s a much higher escalator than what the Harper administration provided, so there’s a lot of money here,” Nanji said.

“And as the prime minister has said, and I think other observers and experts have said, money’s not going to solve the problem here. We’ve got a number of big challenges.”

Ultimately, when it comes to provinces pulling their financial weight in health spending, the real question will be whether they will continue investing at the same rate when new federal billions start rolling in, Nanji added.

They could be tempted to divert some of the money they’ve already been investing and replace it with the new federal money, he said.

“I know that it was certainly one of the things that the federal government had indicated is that, by virtue of this new deal, they didn’t want the provinces actually to actually reduce their contribution. So let’s hope that the provinces don’t do that.”

Comments