Despite rents in Hamilton going up year over year, a recent report suggests renting may still be a cheaper month-to-month option than buying a home amid ongoing Bank of Canada (BoC) interest hikes.

Analysts from online real estate agency Zoocasa say that even though home prices have dropped in many Canadian cities in the latter half of 2022, interest-rate hikes over the same period have bumped up average mortgage payments in some Ontario locales.

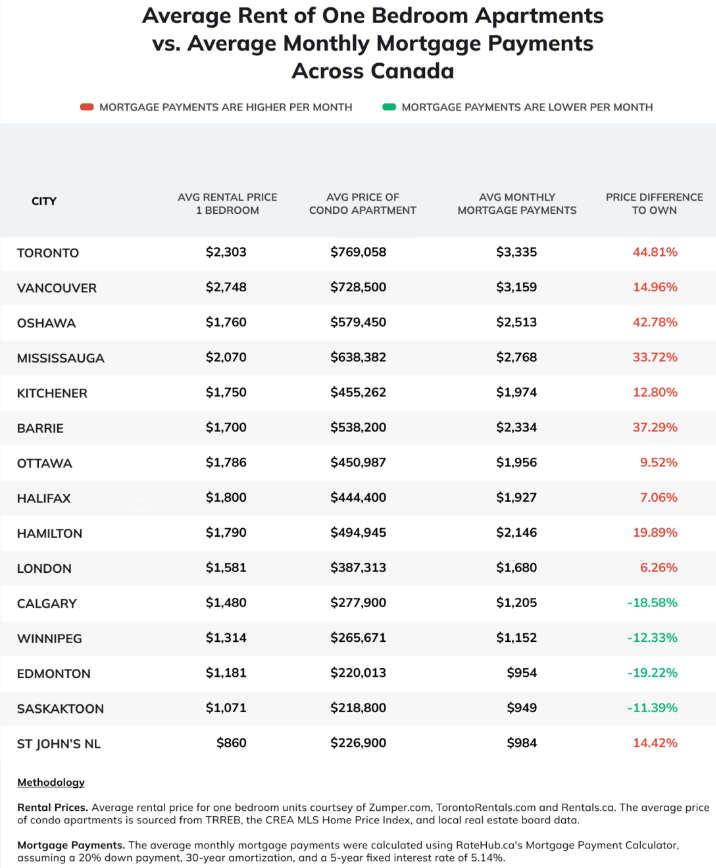

Hamilton is one example in Zoocasa’s mid-August study, revealing that the average of $1,790 a month for a single-bedroom rental was less than a monthly mortgage payment of around $2,146 for a unit roughly the same size.

Patti Cosgarea, Zoocasa’s spokesperson and content marketing manager, told Global News those numbers likely were “very different” from early June, when the BoC’s benchmark interest rate was at 1.5 per cent.

By July, when rates had increased a whole percentage point to 2.5 per cent, Cosgarea says the average monthly mortgage payment in 10 Ontario markets had moved ahead of the average monthly cost of rent.

The BoC has raised rates six times since March, with the most recent increase of 50 basis points announced on Wednesday. The bank’s key interest rate is currently 3.75 per cent, up from only 0.25 per cent in March.

“The interest rate increases, they’re really affecting what people are paying a month for their mortgages,” Cosgarea said.

“Hamilton rents are coming up as well, month over month, but the Bank of Canada increases are growing faster.”

She went on to say investors are also choosing condos, a favourite rental type, as a primary investment due to their affordability relative to larger properties.

“And number two, rental prices keep coming up. So if you’re an investor that’s looking to get a renter in the door, it’s a really sound investment right now,” Cosgarea said.

“So those two are kind of working together to make both the rental market and the home buying market quite unaffordable in general right now for a lot of Canadians.”

In the August report, Toronto was tops in terms of monthly mortgage payments outpacing monthly rents, with an average one-bedroom 45 per cent higher in cost.

London was a little more reasonable, with the average mortgage for a single-bedroom property only about six per cent higher than renting a space the same size.

More cost-effective choices would be found out of the province, particularly in Edmonton where the average price of a single-bedroom condo was $220,013, which translates to approximately $954 a month in mortgage payments.

As of last August, the average monthly cost of rent in the Alberta city was $1,181.

Rent for one-bedroom in Hamilton up 8.4 %, year over year

September reports from Rentals.ca and Zumper.com, which track rental listings across Canada, recorded either month-over-month drops or a flattening of prices for single-bedroom units, suggesting would-be home sellers have opted to list properties for rent rather than sell them.

It’s believed rising interest rates continue to soften the number of potential home buyers on the market, now likely holding off for an economic rebound.

However, year-over-year rental listings were up over $100 per month in Hamilton.

The average listing for a single-bedroom condominium or rental apartment rose about $140 in September, year over year, to $1,683 per month.

A two-bedroom dwelling was up by around $394 last month to $2,155 compared when September 2021.

Month over month, those prices generally remained the same in the city.

Average listings in the city at Zumper.com were comparable, checking in at $1,590 for a single-room dwelling while a two-bedroom was around $2,150.

Year over year, rents did increase in 34 of the 35 Canadian cities that Rentals.ca tracks with only Fort MacMurray recording an ever so slight decline in the price of a one-bedroom unit.

“Rent continues to increase significantly both nationally and in Canada’s largest municipalities, growing 15.4 per cent annually,” Bullpen Research president Ben Myers said in a September report.

“However, this data is slightly skewed because the average unit size for listings on Rentals.ca is larger in September (963 square feet) versus September 2021 (868 square feet).”

Myers goes on to say that a few new purpose-built rental apartments started lease-up programs in September, adding a lot of higher-priced supply to the market.

READ MORE: Hamilton-Burlington home sales up 11.7 per cent month-over-month

Across Canada, Vancouver’s averages continued to be tops at $2,590 for a one-bedroom unit and $3,707 for two-bedrooms in September, according to rentals.ca.

Zumper.com listed prices at $2,500 and $3,630 for one and two bedrooms, respectively, in the west coast city.

Toronto remains number two, with a single-bedroom setting a person back $2,474 per month and a two-bedroom at $3,361 per month for two, according to Rentals.ca.

London, Ont., continued to have the highest annual rent growth of the 35 Canadian cities, more than 38 per cent for both dwelling types, with the average listing for a one-bedroom checking in at $1,810 and two bedrooms at $2,184.

Nova Scotia was the province with the most notable increases, as average rents in September for both property types climbed from $1,810 per month to $2,453 per month, higher than Ontario.

The average rent for all dwelling types across Canada in September was $2,043 per month, an annual increase of 15.4 per cent.

Comments