Housing affordability in Ontario has eroded at a rate not seen in half a century over the course of the COVID-19 pandemic, a new report suggests, while home prices skyrocketed by 44 per cent across Doug Ford’s premiership.

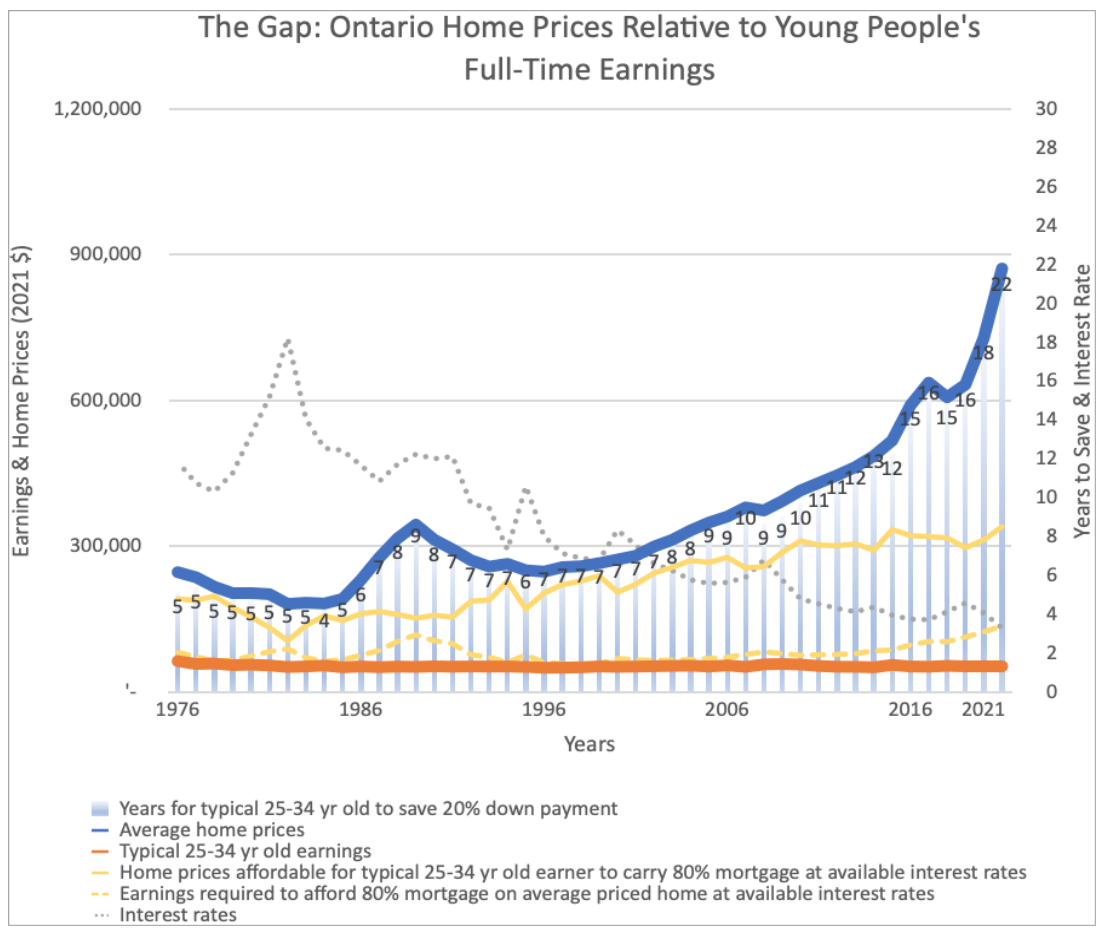

The new report by Generation Squeeze found that with current home prices, a new homebuyer would have to work full-time for nearly 22 years to save up enough money for a 20 per cent down payment on a home — up from 15 years in late 2019.

“Ontario has just completely lost control of housing,” said Paul Kershaw, an associate professor at the University of British Columbia and the founder of Generation Squeeze, which studies housing affordability and standard of living across Canada.

“We’ve never seen anything like this before in any province at any time in the last 50 years.”

The report, citing Canadian Real Estate Association data, found the average price for a home in Ontario rose to $871,688 by 2021, up 44 per cent from the inflation-adjusted price in 2018 — the year Ford was sworn in as premier.

Meanwhile, wages have stagnated, particularly for the typical 25-to-34-year-old, which the report argues has led to “lost work” for those trying to save for a down payment.

Over the first two years of the pandemic, Kershaw says those young Ontario residents have lost the value of six years of work that would otherwise be put toward home ownership. During the same time, residents in British Columbia — where real estate prices have also skyrocketed — lost less than five.

“People in Ontario can no longer say, ‘At least we’re not as bad as B.C.’ It’s worse,” said Kershaw.

“And this also isn’t just a (Greater Toronto Area) problem either. This is Hamilton, Kitchener, Windsor, Ottawa — all of these places have seen the same stark increase.”

The report underlines how the erosion of housing affordability in Ontario has impacted young residents the most, going back even further than the pandemic or the arrival of Ford’s Progressive Conservatives in government.

Get weekly money news

Using Statistics Canada data, the report found that between 1977 and 2019, the value of all primary residences in the province has grown by nearly $1.09 trillion. Only three per cent of that additional wealth has gone to homeowners under 35, while two-thirds went to owners aged 55 and over.

The point, Kershaw says, is that older homeowners have benefitted from the rise in real estate values just as much as the industry has, while young prospective homebuyers are being left behind.

Yet so far in this year’s Ontario election, he says there’s been a lack of policies that could help tackle that disparity. That includes policies that would stall home values and allow wages to catch up, something 66 per cent of Ontario residents said they support in a recent Generation Squeeze poll.

“It’s not good politics to point out the many beneficiaries, including voters,” he said.

“If we’re not willing to point out the beneficiaries, then we’re not willing to really tackle what sustains our openness politically to having home prices leave earnings behind.”

There are signs the market is starting to cool. The Toronto Regional Real Estate Board last week reported the number of April sales in the market dropped by about 41 per cent from the same month last year and 27 per cent from March.

The average home price nationally also dipped for the first time in two years last month, according to the Canadian Real Estate Association.

A spokesperson for Ford’s Progressive Conservatives pointed to the government’s efforts to get new homes built, with 100,000 new homes starting construction and plans to build 1.5 million more over the next 10 years.

The party says it has also committed to following the recommendations laid out by the province’s Housing Affordability Task Force in its February report, which also focused on boosting supply.

But Kershaw says that will only solve part of the problem.

“It’s good that he’s talking about more supply, because it is needed,” he said. “But that’s been his singular focus, and he’s missing the broader reality that there’s a dozen other things that need to be done.”

The Ontario Liberals criticized Ford’s record on housing affordability in a statement, while also highlighting the party’s plan to build affordable homes for first-time buyers and end single-family zoning, among other policies. The party has also set a goal of 1.5 million new homes in 10 years.

“Ontario voters have a choice between the Ford Conservatives, who have introduced four plans but made no progress, and the Ontario Liberals, who will address this crisis once and for all,” press secretary Andrea Ernesaks said.

In her own statement, Ontario NDP candidate for University-Rosedale Jessica Bell took both the Conservatives and the Liberals to task for their mismanagement of housing over the past two decades in government.

The NDP plan is also focused on supply, echoing Ford’s promise for 1.5 million new homes over 10 years. In addition, the party is pledging home equity loans to help first-time buyers with a down payment.

Kershaw says no level of government is singularly responsible for the housing affordability crisis, but that provincial governments are uniquely positioned to shape policy over the real estate market.

Until home prices and values themselves are addressed, he says the plans being put forward by all major parties running in the election risk doing little to solve the issue.

“We have an opportunity for older generations to recognize that they have tolerated this relentless growing gap between home prices and earnings, where hard work is not paying off,” he said.

“We need political bravery to point that out.”

Comments

Want to discuss? Please read our Commenting Policy first.