Canada’s central bank says businesses and consumers are increasingly believing that the pace of price increases will continue on its hot rate for longer.

The Bank of Canada said Monday its pair of quarterly surveys of businesses and consumers show respondents expect the annual rate of inflation to remain above the Bank of Canada’s two per cent target for the rest of the year.

Two-thirds of the firms that took part in the bank’s business outlook survey anticipate inflation to stay above three per cent over the next two years.

Respondents in the survey of consumer expectations expected inflation to remain above four per cent for the next two years, and 3.5 per cent five years out.

For consumers, inflation has become what the central bank describes as the most important economic issue, more so than taxes and jobs.

The consumer survey also suggests Canadians doubt policy-makers can easily rein in elevated inflation rates, with two-thirds of respondents saying it is more difficult now to control inflation than it was before the pandemic.

The survey of firms and consumers took place before the country saw a rapid rise in COVID-19 cases, which has resulted in new economic restrictions to slow the spread of the Omicron variant.

CIBC chief economist Avery Shenfeld wrote in a note that a similar survey done now would likely knock back some optimism firms expressed in late November, “but inflation expectations would no doubt remain elevated.”

The Bank of Canada is scheduled to make an announcement next week about its key policy rate and provide an updated economic outlook.

Senior bank officials have previously said they are keeping a close eye on expectations to see if Canadians start to believe that temporary issues driving inflation become permanent drivers of price growth.

In November, the annual rate of inflation hit 4.7 per cent and is expected to be the same, or a touch higher, when the December reading is released Wednesday.

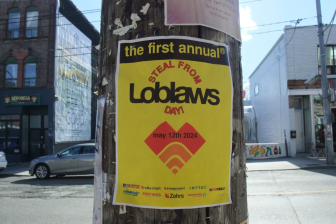

- Posters promoting ‘Steal From Loblaws Day’ are circulating. How did we get here?

- Canadian food banks are on the brink: ‘This is not a sustainable situation’

- Is home ownership only for the rich now? 80% say yes in new poll

- Investing tax refunds is low priority for Canadians amid high cost of living: poll

A key reason for the increase, and one flagged in each survey the central bank published Monday, is ongoing supply-chain issues.

Consumers told the bank they don’t expect to see supply chain issues to dissipate until the pandemic ends, the timing of which respondents were uncertain about.

Bank officials wrote that many respondents believe the pandemic will end, or COVID-19 will become endemic, within the next two years, while some expect it could last even longer.

Firms were similarly uncertain about when supply chain issues will be resolved, but many expect it will take more than a year at the very least.

Adding to inflation pressures are plans from a strong majority firms to raise wages at a faster rate over the next 12 months, pointing to the need to compete for talent amid growing labour shortages across regions and sectors.

The bank’s survey report noted that cost-of-living increases are also increasingly driving wage pressures.

Comments