Most Okanagan homeowners can expect to see moderate property value increases as 2021 assessment notices are in the mail.

There are 283,500 properties in the Okanagan and Thompson regions and home values have increased zero to 10 per cent in most communities, BC Assessment said.

The assessment notices will reflect market value as of July 1, 2020.

“For the Okanagan, the majority of homeowners can expect to see moderate value changes compared to last year,” says Tracy Wall, Okanagan area deputy assessor.

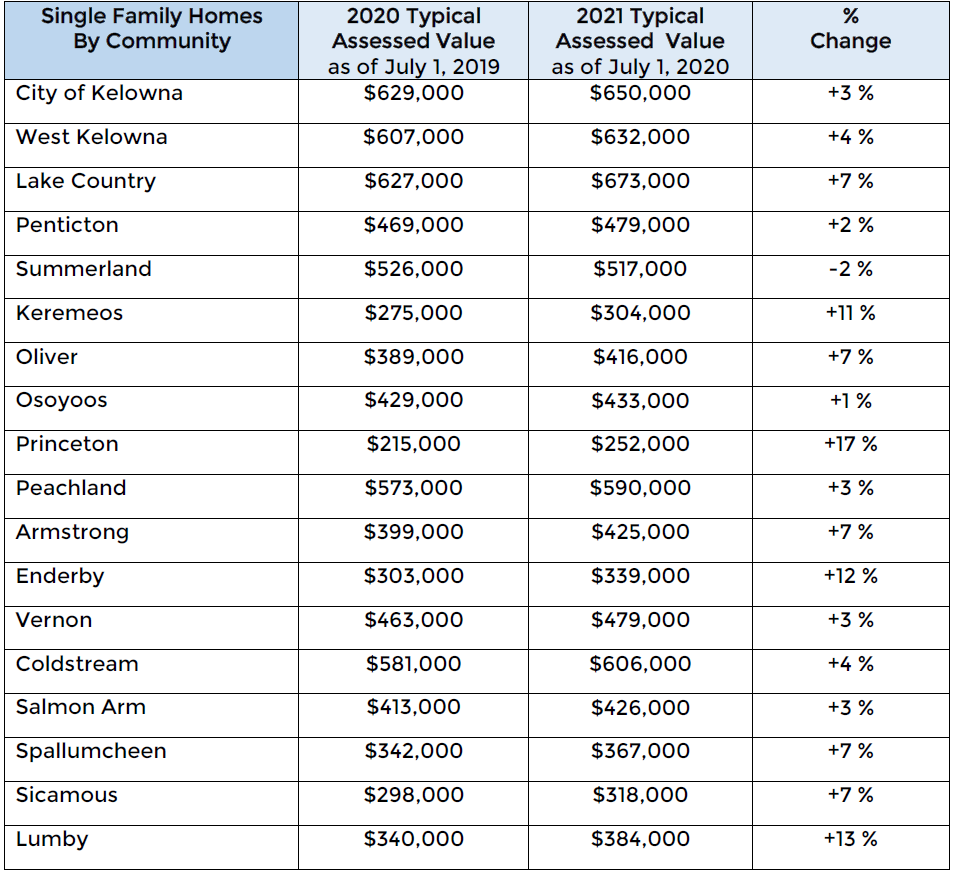

“Some of our smaller communities such as Keremeos, Princeton, Enderby, and Lumby are seeing notably higher increases in residential values compared to last year.”

The 2021 median assessed value for a single-family home in Kelowna is $650,000, up three per cent from July 2019.

In Penticton, a single-family home is assessed at $479,000 on average, which is up two per cent, while in Vernon, the median assessed value of a single-family home is $479,000, an increase of three per cent.

Wall said the COVID-19 pandemic did have an impact on the real estate market as buying and selling screeched to a halt in March, but rebounded by the summer.

“Last year was a very unusual year, as the market came to a slowdown in the early days of the COVID pandemic, through March it was practically at a standstill, and then what happened is it rebounded quite suddenly through the summer months,” Wall said.

“It took a while for some people to want to put their properties back on the market, but once they saw that the market was reacting normally, then they were more comfortable in listing and selling their homes.”

Get breaking National news

Smaller Okanagan communities did see larger jumps in property values, such as Princeton, where single-family home values soared by 17 per cent.

Wall said low mortgage rates make it more affordable to get into the real estate market and stay-at-home orders drove people to purchase property elsewhere in B.C.

“Many people are now working from home so they are finding that they don’t have to be in certain locations and they don’t want to be in locations where there are greater COVID-19 outbreaks like through the Lower Mainland,” she said.

“So I think a number of people that were able to purchase a home in a smaller community, that was possibly one of the reasons why the demand was a little bit greater this year.”

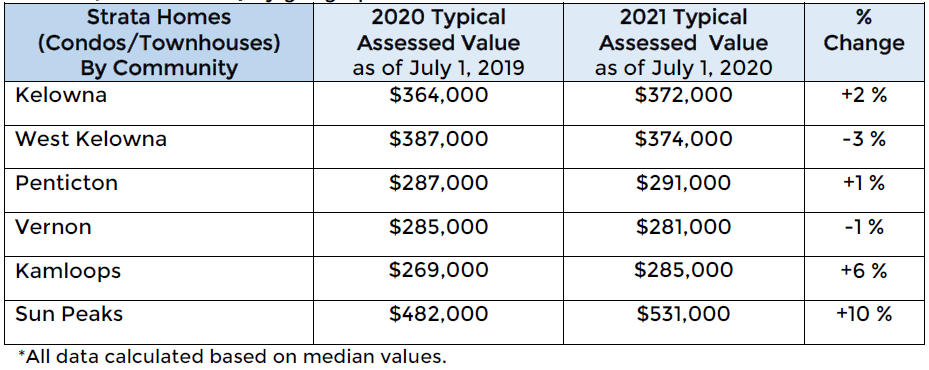

The condo and townhouse market also recorded moderate increases, although West Kelowna and Vernon strata homes saw an estimated drop in value by one to three per cent.

Overall, the Thompson Okanagan’s total assessments increased from $152.8 billion in 2020 to $159.3 billion this year.

A total of about $2.4 billion of the region’s updated assessments is from new construction, subdivisions and rezoning of properties.

Property owners who dispute their assessment value can file an appeal.

“Those who feel that their property assessment does not reflect market value as of July 1, 2020, or see incorrect information on their notice, should contact BC Assessment as indicated on their notice as soon as possible in January,” Wall said.

“If a property owner is still concerned about their assessment after speaking to one of our appraisers, they may submit a Notice of Complaint (Appeal) by February 1st, for an independent review by a Property Assessment Review Panel,” Wall added.

The Property Assessment Review Panels, independent of BC Assessment, are appointed annually by the provincial government, and typically meet between Feb. 1 and March 15 to hear formal complaints.

Property owners can contact BC Assessment toll-free at 1-866-valueBC (1-866-825-8322) or online at bcassessment.ca.

Comments

Want to discuss? Please read our Commenting Policy first.