More than 400,000 property assessment notices for Edmontonians are in the mail.

Once Edmonton property owners receive their notices, they should check the accuracy by:

- Review the details

- Look at what makes up the assessed value of your property

- Compare your property’s value to similar properties in the neighbourhood

Assessments reflect the city’s estimate of the property’s market value — the amount that a property would have sold for in the open market — as of July 1, 2019.

“It’s a step in determining residents’ fair share of municipal property taxes and provincial education taxes for the current year,” the city said in a news release on Thursday.

The value of all assessed properties in Edmonton is $195 billion — $135 billion for 379,651 residential properties and $60 billion for 28,153 non-residential properties.

This year saw an overall assessment decrease of 0.1 per cent compared to 2019.

Get weekly money news

“It’s just symptomatic of what Alberta is experiencing as a whole,” Cate Watt, City of Edmonton assessment and taxation branch manager, explained.

“There is nothing in particular that I would point to, to say, ‘it’s this reason or that reason.’

“Alberta’s just going through some tougheconomic times right now and that has resulted in home values decreasing for the most part.”

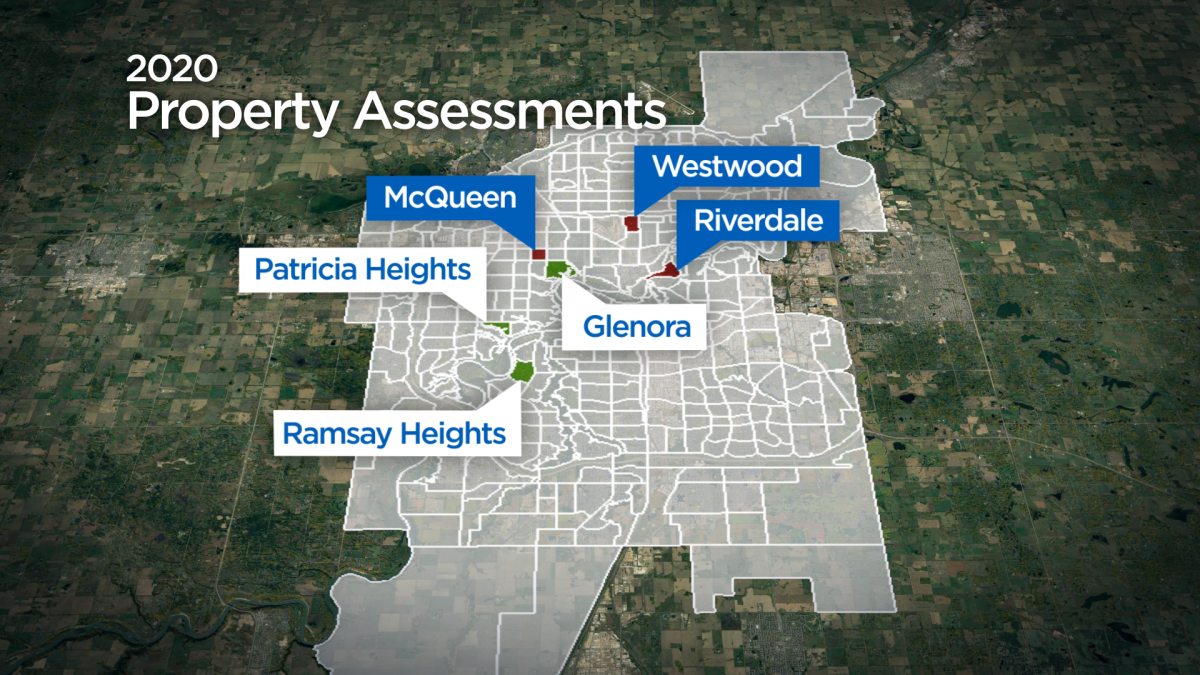

Anyone with questions about their assessment notice can call 311 or visit edmonton.ca/assessment for more information, including property-specific details, a neighbourhood map and estimator.

Actual property tax bills will be mailed out to owners in May.

Watch below: (From Feb. 6, 2020) Emily Mertz tells us about an Edmonton website that can help people with questions about their property tax assessments.

Comments

Want to discuss? Please read our Commenting Policy first.