The latest reading on the strength of the Canadian economy released Friday provided mostly good news but some not-so-good, as well.

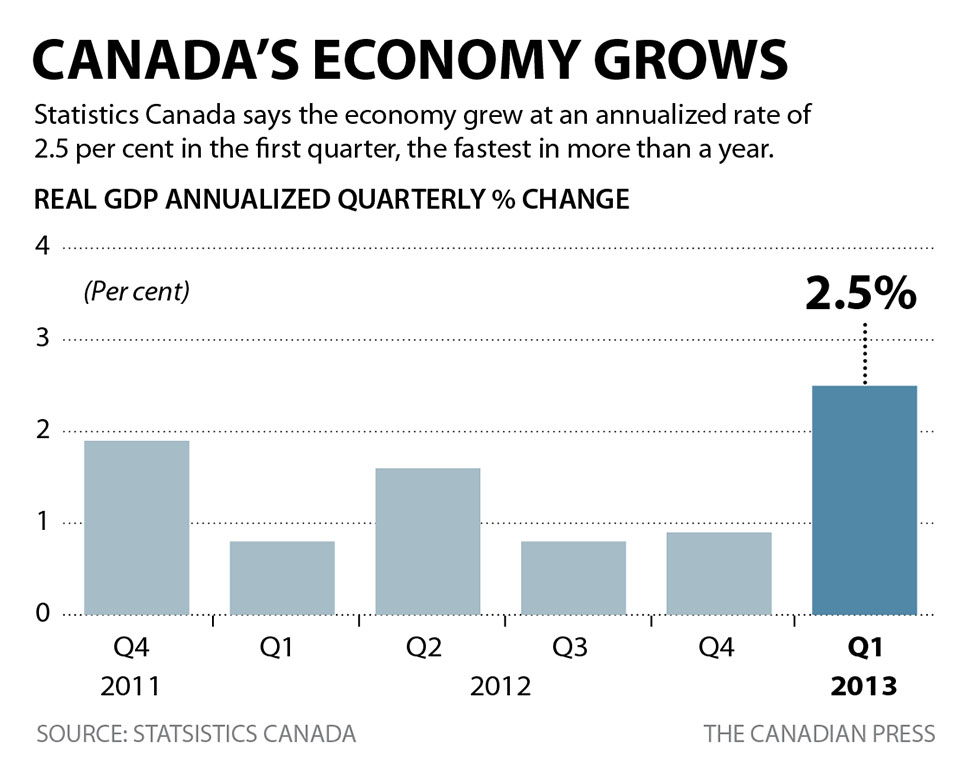

First the good. Statistics Canada says the economy grew at an annualized rate of 2.5 per cent in the first quarter – the fastest in more than a year, tempering concerns Canada’s economy had taken it’s foot off the pedal and was slowing down.

The reading beat already bullish private-sector estimates and was the fastest in six quarters, according to the government agency.

Statscan said exports were the largest contributor to growth in the quarter, a positive development for policymakers seeking to refocusing the economy on shipping exports abroad. The shift is meant to offset a slowdown in the real-estate market and consumer spending.

“The jump in exports more than made up for declining residential construction in the quarter and the slowing in consumer spending on goods and services,” Dawn Desjardins, an economist at Royal Bank of Canada, said.

As the economy in the United States – Canada’s largest trading partner – has gathered strength in recent months, economists expected 2013 to get off to a strong start with a consensus estimate of 2.3 per cent annualized growth — up from a meagre 0.6 per cent reported in the last quarter of 2012.

Get weekly money news

First quarter export volumes increased 1.5 per cent after a gain of 0.2 per cent in the fourth quarter of 2012 and declines in the previous three quarters.

“Today’s first quarter growth showed that Canada came out of its growth slump of the second half of last year. It also was a clear sign that the engines of growth in Canada are beginning to shift from domestic ones, like housing and consumer spending, to net exports,” economists at TD said. “We expect this trend to continue as U.S. growth strengthens in the second half of this year.”

But now the not-so-good news: domestic demand through the first three months was at its weakest since the first quarter of 2009 – or the depth of the recession.

A housing slowdown combined with a more cautious consumer more concerned with paying down debt than borrowing cheap credit is muting domestic demand, economists say.

Consumer spending was up a modest 0.9 per cent. “Consumption was held back,” TD noted.

After a decade-long bull run, the Canadian housing market continued through the first quarter a slowdown that began last year, with residential construction down 4.7 per cent.

“This outcome was largely as expected, after the first quarter’s 14 per cent decline in housing starts, and marks the third consecutive decline in residential investment, as Canada’s housing sector cools,” TD economist Leslie Preston said.

Comments